Indian market rallied over 14 percent in April which many would have thought was the resumption of a bull market rally. But given the fact that we are just 2 months in the bear market, these swift rallies can be categorized as bear market rallies.

The Nifty50 is still down over 20 percent from January high, and with many states across India under lockdown, economic activity is virtually shut and that is likely to impact earnings of India Inc. for the June and September quarter.

The Nifty Mid-cap 100 was up 15.4 percent in Apr’20, as against the Nifty’s rise of 14.7 percent. In the last 12 months, mid-caps were down 23% as against Nifty’s decline of 16 percent.

Notably, over the last 5 years, mid-caps have underperformed by 15%. The Nifty Mid-cap100 P/E ratio now trades at 14.4x from 20.2x in Mar’19 while mid-caps are currently trading at 25% discount to large-caps, said a Motilal Oswal strategy report.

The statistics look compelling to investors who are looking for a better return, but the reality could be very different. Not all midcaps which are trading below their intrinsic value or are beaten down are top buys, caution experts.

“Along with growth shock, there is another challenge for Small and Midcaps equity. Credits are getting re-priced in this environment and it will also impact these companies’ ability to get funding,” Sameer Kaul, MD and CEO, TrustPlutus Wealth Managers (India) Pvt. Ltd told Moneycontrol.

“Unavailability of credit and uncertain growth environment will create too much risk for investment at this point in time. Hence, we suggest being cautious before investing in the Mid and Small-cap businesses,” he said.

Irrespective of the market cap of the company, investors should focus on key monitorable such as management pedigree, growth potential, uniqueness of the product, as well as operational efficiencies.

“One should be cautious in all caps I would say, as now only the most resilient will survive the onslaught of the undergoing economic crisis. Companies with a sound business model, along with the capability to adapt to such fast-changing dynamic business environments, will emerge stronger and richer,” Aamar Deo Singh, Head Advisory, Angel Broking Ltd told Moneycontrol.

“And even large caps resting on their past laurels could get hit. But true, one should do a thorough and in-depth analysis before investing in small and midcaps. Now, the quality of management of companies will also be put to test, and it will be interesting to see those who emerge from the current churn,” he said.

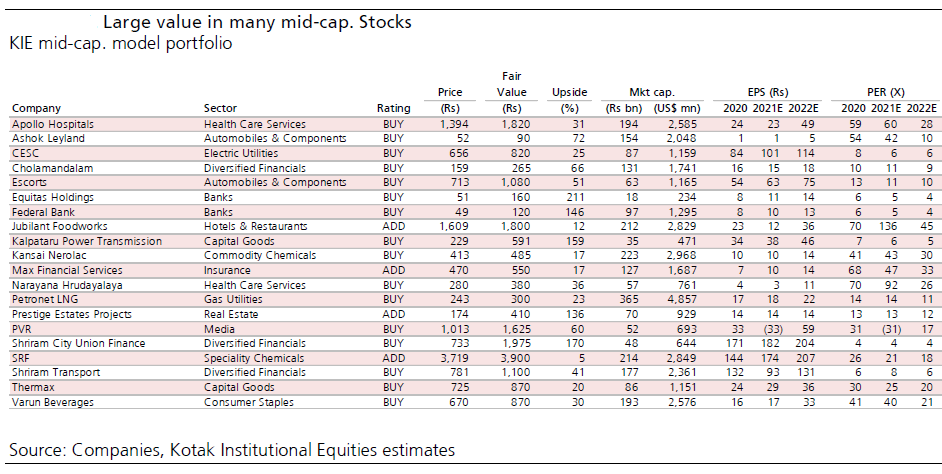

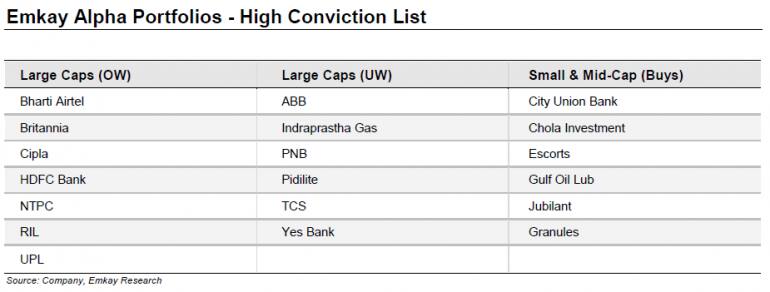

Experts advise investors to be selective while choosing midcaps. We have collated a list of midcaps from various brokerage firms that they are recommending amid COVID-19 fall:

Brokerage Firm: Kotak Securities

Brokerage Firm: Emkay Global

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.