The year 2023 has been a historic year for the markets; from 16,900 on Nifty 50 in March, we managed to scale up to 20,000 for the first time ever in September. As the move was characterised by bouts of volatility, investors were left scratching their heads "How to create alpha".

At Moneycontrol's Mutual Fund Summit, we address exactly that question. The theme for the CIO panel is: Where to find alpha: Simmering economy, sizzling small-caps, stretched valuations.

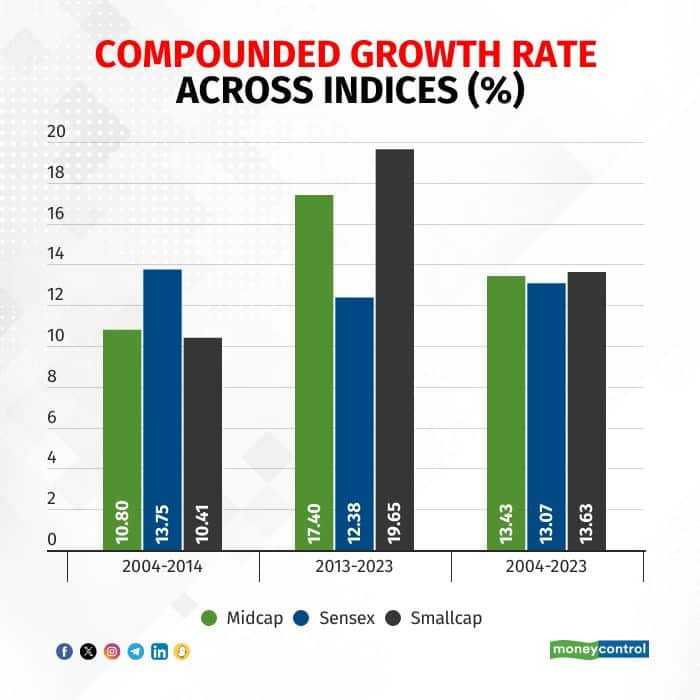

If we look at the last 10 years, then midcaps and smallcaps have outperformed largecaps by a big margin. But from a longer-term perspective, returns of largecap, midcap and smallcap indices converge. This begs the question: Is it worth investing in smallcaps? Is it worth the risk?

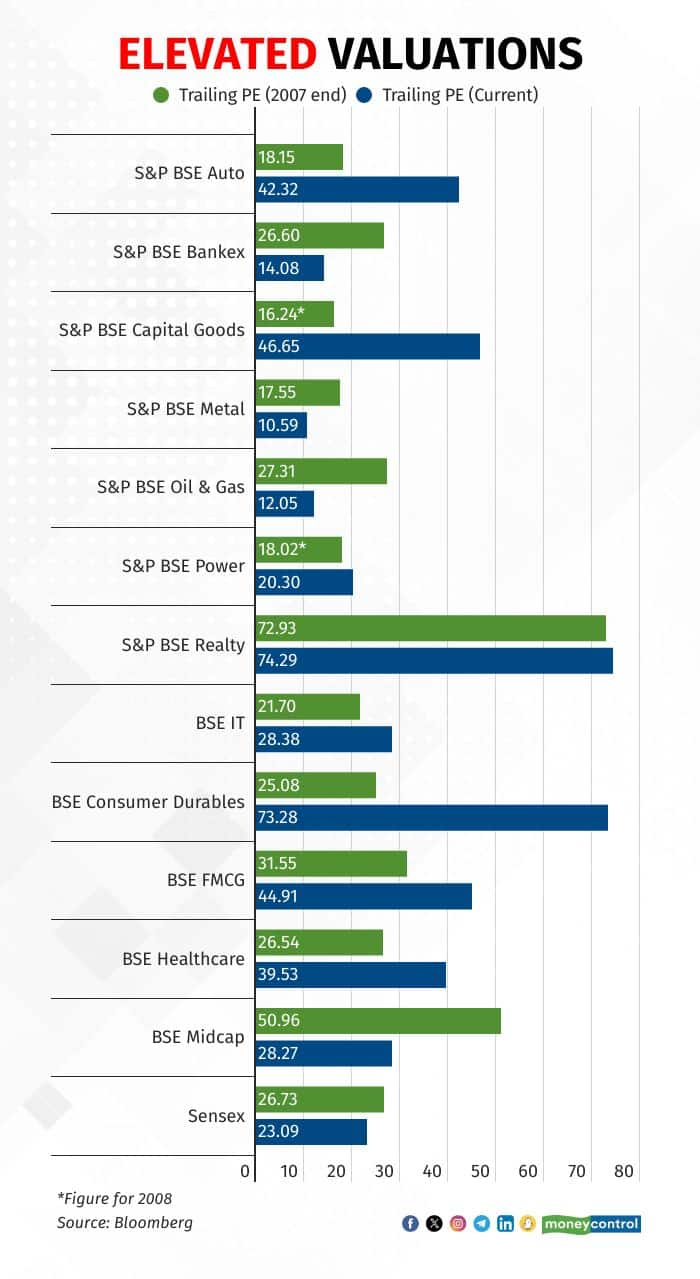

Data also shows an elevated price-to-earnings ratio for most sectors like autos, capital goods, and consumer durables compared to the 2007 market peak. In this context, which sectors hold potential?

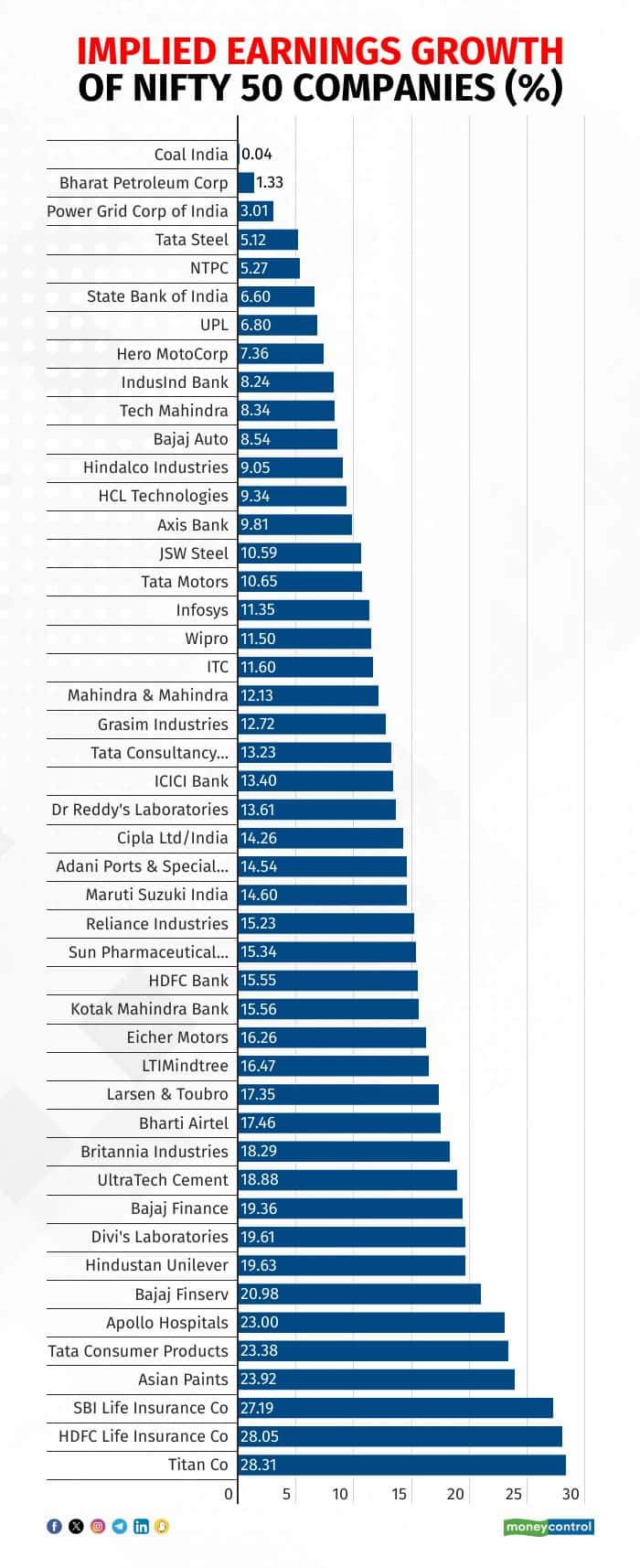

The implied growth rate shows that about 80 percent of Nifty companies will deliver less than 20 percent growth. So what are the best alpha-generation opportunities? What risks investors should be cognizant of?

N Mahalakshmi, Senior Consulting Editor sits down in conversation with Sandeep Tandon of Quant Mutual Fund, Ashish Gupta of Axis Asset Management, Umeshkumar Mehta of Samco Mutual Fund, Sailesh Raj Bhan of Nippon Life India Asset Management, I.V. Subramaniam of Quantum Advisors and Anup Maheshwari of 360 ONE Asset will discuss all this and more. Tune in.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.