Even as government remains hopeful after increasing the axle load limit by 25 percent, transport industry’s experts and players remain on the back foot regarding the move. While experts feel that overloading will continue, industry players expect the “life of roads” to decrease.

“Overloading is done to the extent of 15-20 tonne… So any relaxation of two to three tonne will not stop overloading… It’s just that the person will have to pay a varied fine amount now…,” said S.P Singh, senior fellow, Indian Foundation of Transport Research and Training (IFTRT), an autonomous research body.

Singh said that the move would only change the amount of penalty being paid by transporters but will not curb overloading in any manner.

Union ministry of road transport and highways, on July 16th 2018, increased the maximum cap of axle load limit by 20 to 25 percent cross various categories to keep the limit “at par with international standards”.

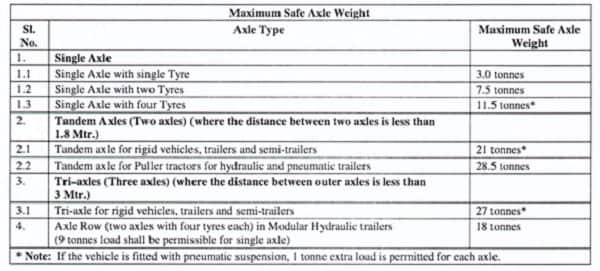

Gross vehicle weight (GVW) of a two-axle truck was increased to 18.5 tonne from 16.2 tonne and GVW for a three-axle truck was increased to 28.5 tonne from 25 tonne. For a five-axle truck, the vehicle weight was increased from 37 tonne to 43.5 tonne.

“The GVW shall not exceed the total permissible safe axle weight as above and in no case shall exceed (i) 49 tonne in case of rigid vehicles; and (ii) 55 tonne in case of semi-articulated trailers and truck-trailers except modular hydraulic trailers,” the advisory issued by the ministry said.

The amendment has been made after 35 years. The last amendments were made in 1983 which were implemented in 1988.

“At present nothing more than the government notification is available…Neither any detailed information is available in the market place nor does anyone know how it is going to affect our transportation industry as whole,” said Areef Patel, executive vice chairman, Patel Integrated Logistics.

“As on date only those utilising the optimum capacity will get the benefit from the decision”.

Patel said that the decision will have mixed impact across various industry.

“The areas of hard core transportation segment like iron and steel, coal, cement and agriculture… All these industries can earn very good benefit and their profit margin will increase substantially… In addition, select transport segments that operate on a volumetric basis like consumer durables, car carriers et cetera would not be impacted by the increased axle load as their load carrying capability is constrained by loading deck… They were already facing capacity constraints on current axle weight,” he said.

‘Freight Tariffs to remain unchanged’Analysts said that there may be no impact on freight tariff as costs may not go down as anticipated.

“Axle load was first increased in 1988 by almost 25 percent…But it hardly had any impact on either the demand for vehicles or on freight tariff,” said an industry analyst, on condition of anonymity.

Singh said that the Centre has “not taken” any “revolutionary step” and that freight tariffs shall remain unchanged.

“It’s not a revolutionary step… There are a lot of factors affecting freight tariffs like fuel prices, vehicular demand, axle load, toll amount etc…,” said Singh adding that logistics is a very “small component” of transport sector.

“Truck is not the only source of logistics… It’s one of the components… Making trucks as the face of logistics sector is not correct… There are a number of things that have to be taken into account… Change in one component will not affect the sector…” he said.

Others, however, remain bullish on the sector.

Also read: New rules for increased truck load capacity to be implemented immediately: Nitin Gadkari

“The freight tariff rates will definitely get affected but in positive manner. This may result in a big boost to logistics and transportation industry and likely to reduce cost of goods transportation,” said Harpreet Singh Malhotra, chairman and managing director, Tiger Logistics India. “This will have implications for commodity prices, road traffic and safety, besides truck sales and freight rates as per industry stakeholders”.

“Freight rates will also come down, although not immediately, but subsequently in a short period of time,” he said.

‘Immediate implementation a concern to be taken in stride’Analysts and players are divided over immediate implementation of the rule. While experts believe that immediate implementation could create instability in the industry, players say that the step should be taken in “positive manner” to contain “menace of overloading”.

“They have issued a statutory order instead of bringing out a draft notification inviting objections and suggestions… Normally, when an important notification has to come out, all the stakeholders are to be consulted. After that, draft notification is prepared which is put out in public for comments for a period of 40-45 days… Then, a month or so is taken to take the recommendations into consideration after which the notification is issued…” said Singh, adding “The problem is that the order was issued and applied immediately as a statutory order… Generally, a six months’ window is given to be prepared”.

Union road transport minister, Nitin Gadkari, had said that as the rules were out in public, they need to be implemented with immediate effect.

“I think it’s a positive sign for road transportation industry and every trucker should take this in a positive way. Truck overloading has been a menace in India resulting in deterioration of roads and increasing number of accidents. Freight overloading up to 100 percent is a common thing, various transporters are doing the same from last too many years...,” said Malhotra.

Patel said that transporters are yet to do their cost calculations regarding the impact of the move.

He said that none of the truck manufacturers had done any benchmarking on areas like what will be fuel average or tyre consumption in the future. Operators who have started the operations can arrive at real cost being spent and earned while rest of the calculations will be on assumptions.

‘Extra load to reduce road life’Industry players feel that the move could adversely impact the road life as extra weight will only add the burden. They feel that Centre needs to provide more clarifications on various ancillary issues.

“It would be better if government shall wait till BS VI vehicles come on ground actively. As an example, allowing more weight on same size of truck for containerised cargo movement won’t have an impact till the government notifies new sizes for containers,” said Malhotra.

He also said that the new rule could decrease the life of roads by one year.

“As we all know that previously built Indian roads are made keeping standard axle loads in mind. The new national and state highways along with expressways can be built by using new norms, but for the existing roads, the life will be reduced on average by one year,” he said.

Malhotra explained that if a road requires re-carpeting (laying of surface) in five years, new norms will reduce it to four years.

“Along with 25 percent axle weight increase, if the government grants permission to extend the chaise or container size to 26 feet from current 24 and 36 feet from 32 feet, it may help parcel operator to get some benefit out of the move,” said Patel.

The advisory issued by Centre put the onus on states to ensure stricter implementation of new rules.

“With the revised permissible weight for the transport vehicles, the state enforcement Authorities are requested to rigorously enforce the regulations and take strict action against overloading by goods vehicles on roads and ensure that such vehicles are stopped and made to unload the excess load before being allowed to proceed further, in addition to levy of penalties under section 194 of the Motor Vehicles Act, 1988,” the advisory by Centre noted.

Singh of IFTRT said that it would be better if Centre was the only enforcing body.

“As national highways are properties of the Centre and NH rules, 2013 empowers National Highways Authority of India (NHAI) not to allow overloaded vehicles on their assets… Why have they allowed these highways that carry 80 percent of freight traffic to run overloaded vehicles…?” asked Singh.

‘Prevention of Overloading at Toll Plaza on NH Sections- Amendment to Fee rules 2013’, empowers NHAI to charge 10 times the applicable fee (toll amount) from overloaded vehicles. It also empowers NHAI to remove the excess load before allowing the vehicle to go ahead.

The practice, however, is not being adopted by NHAI officials citing that “removal of excess load at toll plaza is not practical for safety or security of goods and also due to unavailability of space at toll plazas to off-load”.

Singh suggests that Centre should strictly stop overloaded vehicles at national highways, install weigh-in-motion sensors without human intervention to check weight, overloaded vehicles to be compounded and licence of driver and permit to drive the truck across the country should be revoked if overloading is done for the second time.

Overall, the industry has mixed emotions about the increase in axle load limit. Players are relying on improved construction quality and better technology at hand to contain overloading.

“As per our working experience, we hope that the additional 25 percent capacity may lead to negligible impact on diesel consumption and lead to a marginal increase in the area of tyre consumptions, minimum of 7 to 8 percent additional,” said Patel.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.