The currency in circulation declined during the Diwali week, a busy shopping period, for the first time in 20 years, this year, a report said, an indication of the growing preference for digital payments.

The report, authored by Soumya Kanti Ghosh, chief economist of SBI Research, credited structural transformation due to technological innovations for the shift in the Indian payment system.

The success of the digital journey was primarily due to the relentless push by the government to formalise and digitalize the economy, the report said. "Further, the interoperable payments systems like UPI, Wallets & PPIs have made it simple and cheaper to transfer money digitally, even for those who don’t have bank accounts," it said.

Source: SBI Research

Source: SBI Research

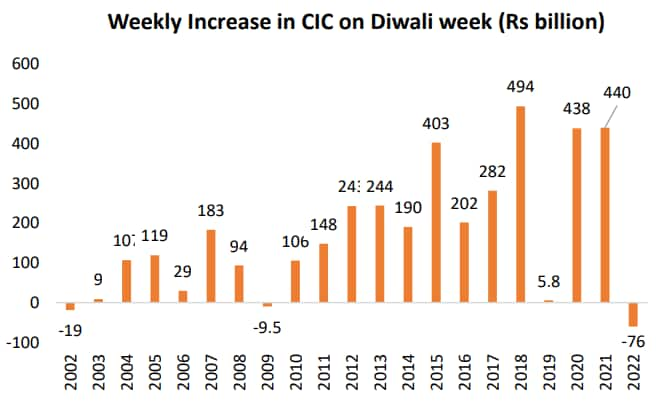

Cash transactions declined by Rs 76 billion in 2022 as against a growth of Rs 440 billion in 2021 and Rs 438 billion in 2020, weekly data gathered by SBI Research showed.

This is the first time after 2002 that currency in circulation declined during the Diwali week, as a marginal decline of Rs 9.5 billion in 2009 was largely due to the economic slowdown, the report said..

"Over the years, the Indian cash lead economy now has changed to smart-phone lead payment economy. A lower currency in circulation also is akin to a CRR cut for the banking system, as it results in less leakage of deposits and it will impact monetary transmission positively," the report said.

The latest retail digital transactions data revealed that National Electronic Fund Transfer (NEFT) held a 55 percent share in value terms, with most transactions done either at a branch or through internet banking.

Smartphones transactions through UPI, IMPS and e-wallet had a share of around 16 percent, 12 percent and 1 percent, respectively, the report said. Small retail payments done through UPI or e-wallets accounted for around 11-12 percent of the payments industry.

The share of currency in circulation in payment systems has been declining from 88 percent in FY16 to 20 percent in FY22 and is estimated to go down further to 11.15 percent in FY27, the report said.

"Consequently, the digital transactions share is continuously increasing from 11.26 percent in FY16 to 80.4 percent in FY22 and is expected to touch 88 percent in FY27," it said.

The rise in digital payments is a win-win for the Reserve Bank of India and the government, as it results in the saving of seignorage costs and also a less- cash economy, the report said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.