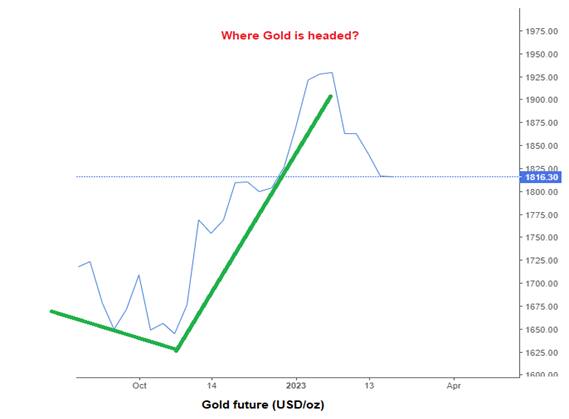

Five months ago, I had highlighted the likelihood of a trading opportunity emerging in gold. The opportunity did present itself, though not exactly in the manner I had anticipated. Nonetheless, the gold prices rallied about 19 percent in USD terms; from a low of $1,630/oz in early November to a high of $1,950/oz in early February.

Since peaking out in early February, the gold prices have corrected about 7 percent in USD terms. It would therefore be pertinent to ask what traders and investors should be doing with their gold positions.

It has been my long standing view that gold is no longer an investment asset. The view is even strengthening with each passing year. I believe that it is highly unlikely that gold will stage a comeback as a widely accepted medium of exchange (gold standard); and it will be gradually phased out as a store of value as better digital options emerge.

In this context, the latest report of the World Gold Council (WGC) presents some interesting data that needs to be noted.

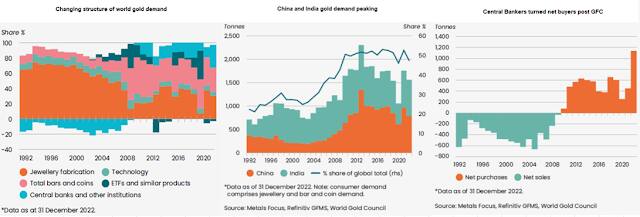

Demand structure of gold demand is changing

WGC highlights some important changes in the demand structure of gold in the past three decades.

It is therefore clearly evident that the demand for gold for social security, vanity and social status purposes is on the decline structurally.

Share of India and China in global gold demand peaking

India and China had emerged as major growth drivers for global gold demand during the 1990s and 2000s. The combined share of China and India in global gold demand had increased from 20 percent in 1992 to 55 percent in 2008. After the 2010 global financial crisis (GFC), this share stagnated and declined to less than 50 percent post Covid.

Central banks major buyers since GFC

In the post-GFC period central banks have been a major driver of the global gold demand. The banks which were net sellers of gold in the 1992-2008 period, turned net buyers of yellow metal, buying close to ~1200tonne in 2022. Apparently, the unprecedented money printing prompted the global central bankers to diversify their reserves away from USD and EUR.

The major surge in central banks’ gold buying was also driven by the demand by central Asian and East European bankers for the fear of NATO sanctions.

Now since most central bankers are pursuing a policy of quantitative tightening and inflationary expectations are well anchored in medium term; the bond yields are expected to stay higher for longer; the sanctions on Russia and allies have failed to show the desired impact; global consumers continue to remain under severe cost of living stress; demographic indicators continue to deteriorate in the developed world and showing signs of population peaking in China; there are few demand driver for gold to sustain the current prices.

The short-term trading opportunity in gold is therefore over in my view. The medium and long term outlook for gold continues to remain weak.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.