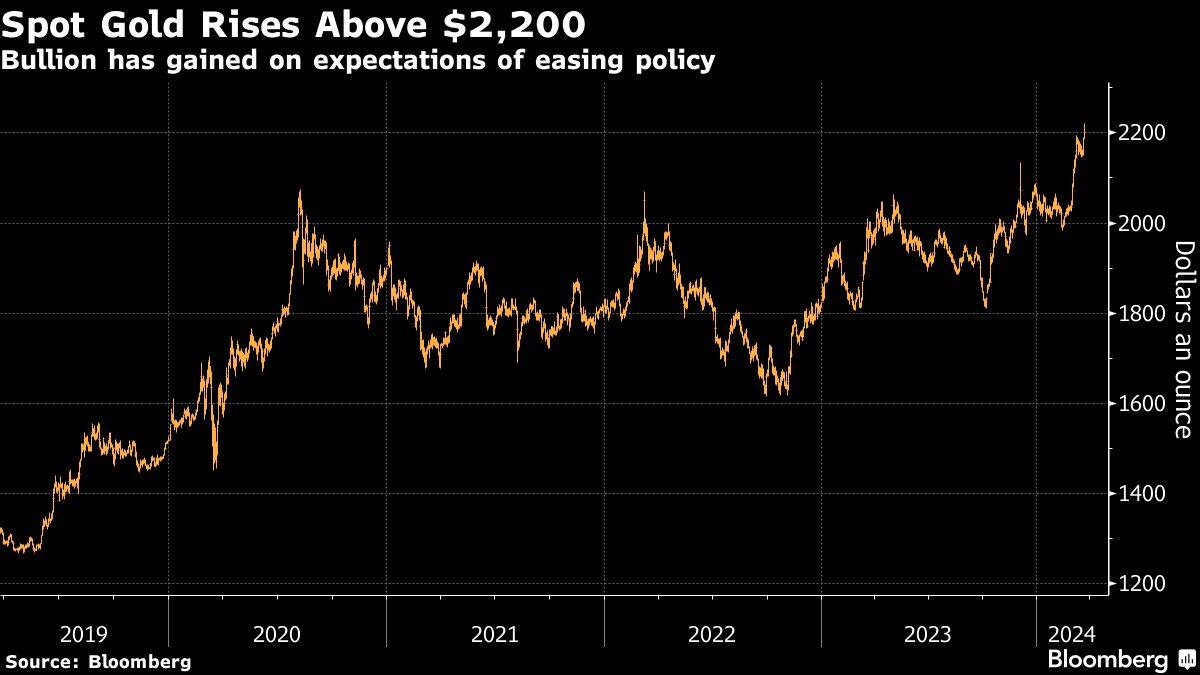

The spot price of gold jumped above $2,200 an ounce for the first time after the Federal Reserve maintained its outlook for three rate cuts this year. Fed’s outlook suggested that it isn’t alarmed by a recent uptick in inflation.

However, Dileep Narayanan, the head of treasury & banking at Malabar group of companies, believes the yellow metal might see some correction of around $100. “It is likely that it will come down to around $100 and then again go to the next level,” he said in an interview to moneycontrol.

Bullion advanced to a new record in early trading, before paring gains. The surge has been on since mid-February, backed by long-standing supports including heightened geopolitical risks and buying by central banks, led by China. Many experts were taken by surprise by the rapid ascent as there hasn’t been a clear catalyst.

In India too, the precious metal has been growing for the last fortnight, baring a few days. Geopolitical issues have boosted the price of different asset classes such as gold, which has seen prices jump from Rs 62,000 to Rs 67,000 this year itself.

The high prices have certainly made the industry take a more cautious approach. “The industry is definitely stocking up but it is also mindful about the current situation. However, we see a good festive season sale, especially during Akshaya Tritiya,” Narayanan said.

Market observers said the rally has been partially driven by expectations for looser monetary policy in the US, and that was reaffirmed by the Fed on Wednesday. US central bank’s chairman Jerome Powell said the Fed would like to see more evidence that prices are coming down, but “it’s still likely in most people’s view that we will achieve that confidence and there will be rate cuts,” he said.

“What we saw last night was the green light really for gold traders to come back in,” said Chris Weston, head of research for Pepperstone Group. “The Fed have said that right now they’re tolerant of the inflation that we’ve seen, they’re tolerant that the labour market strength is not going to be the impediment.”

The recent gains may have been triggered due to the speculation around the timing of the Fed’s long-anticipated pivot. The data showed that traders boosted their net long positions on gold last week by the most since 2019. UBS Group AG said that the metal will gain more when the US interest rates actually do come down, as bullion-backed exchange traded funds look likely to increase their holdings.

On the geopolitical front, Russia appears to be gaining the upper hand in its war in Ukraine, the Israel-Hamas conflict continues unabated and has led to a re-routing of global shipping, while the US presidential election at the end of the year could prove massively consequential for markets. These global issues are boosting gold’s allure as a haven asset.

Years-long property downturn and losses in China’s stock market have also pushed regular investors to stock up on coins, gold bars, and jewellery to protect their wealth apart from the central bank.

Spot gold rose 0.7% to $2,201.94 an ounce as of 9:40 a.m. in Singapore. The Bloomberg Dollar Spot Index declined 0.2%. Silver, platinum and palladium were all higher.

(With inputs from Bloomberg)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.