Tejas Khoday

"I need a favour. Can you take a look at my father's portfolio and tell me why the returns were poor, what's wrong with it?" bemoaned a friend from earlier times, whom I met over a quick lunch. I was in a hurry to get back to the office. Weekdays were busy and stock markets were roaring, after the recent crash in March. Traded volumes were shooting through the roof and new & younger clients were jumping into the market by the dozen.

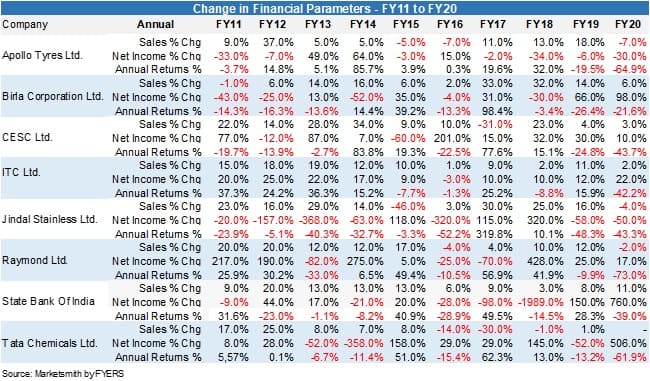

At a first look, the portfolio seemed diversified and consisted of well-known companies like Apollo Tyres, Raymond, CESC, Jindal Stainless, Tata Chemicals, Birla Corporation, State Bank of India, ITC and a few others, bought almost 10 years ago, probably in the aftermath of the global financial crisis. A cursory research of the top 8 holdings revealed considerable under performance, while financial parameters looked cheap and offered value. Little more granular look at the sales and profitability over the last 10 years showed inconsistent performance, marked by pitiable returns. A case of value investing not yielding the desired returns.

The concept of value investing versus one that is considered to be outperforming the market, generally comes from the fundamental stock analysis. When it comes to comparing the two fundamental approaches of stock market investing – Growth and Value – any results that can be seen, must be evaluated in terms of time horizon and the amount of volatility.

As I pondered on the returns, a thought flashed through my mind. Was value investing style slowly dying? A tried, tested and a proven method of investing, practised over many decades by many famed investors, was gradually losing its ability to deliver noteworthy returns. The reasons for the same seem to be many.

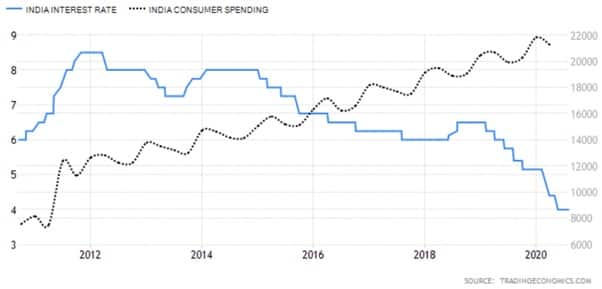

Since the global financial crisis, to boost economic growth, most countries pumped in copious amounts of liquidity. With interest rates diving south and ease of capital availability, entrepreneurs paved the way for new market segments of products and services. Boosted by high consumption demand and pricing power, the growth of these modernistic companies took off and so did the participation of the retail investors.

Armed with prospects of high growth, split-second information reach, large doses of capital infusion began to push the new age companies to stratospheric valuations. The stock prices continued to rocket northwards, and retail as well as institutional investors shed the time proven principles of staying invested for a long period of time. Old economy sectors and stocks – infrastructure, construction, public sector companies, metals & mining - started witnessing dwindling traded volumes, clearly highlighting the shift to consumer discretionary, fintech, FMCG and other consumption focussed sectors. Seth Klarman’s words, "The single greatest edge an investor can have is a long-term orientation" seem to be slowly fading away. Economy was disconnected from the stock market was an accepted fact in most investment circles, but by how much and for how long, were the points of debate.

It is a wakeup call for those who believe in old-style value investing and this caution comes from none other than the Professor of Finance at Stern School of Business at New York University (NYU), Aswath Damodaran, often referred to as the 'Dean of Valuation'. In a recent interview he did say "I think book value has completely lost its meaning. Value investing is not just buying low price to earnings or price to book stocks". It has become much more than that – was a mutual feeling.

Reflecting more on this statement, it is clear now. Value investing has lost out to growth investing over the last decade. Investors preferred growth opportunities and embellished their portfolios with stocks that were able to deliver high growth, continuously. Dividends weren't a priority like earlier times; capital appreciation appeared to be the only measure, a feeling which would not be appreciated by many. Any lapse in the quarterly performance was not taken too kindly and the impact expressed immediately on the market price, as witnessed recently in stocks which were more than priced to perfection, even bordering on super valuations (E.g. Nestle, Bajaj Finance, Asian Paints). Can companies continue to deliver superlative financial performance, quarter-after-quarter, forever? Definitely not possible and the streak is bound to meet a speed bump sometime in the future.

Similar thoughts would surely be on the minds of many value investors and growth investors. The need to balance the risk of capital loss by a self-incorporated margin of safety to the portfolio, while aiming for good capital appreciation, yearly dividends leaves us with the only option – Blended Investing.

In a steady state economic scenario, value investing brings the comfort of holding good stocks at a fair value, low volatility and a predictable earnings growth. In a lower interest rate environment, growth investing offers the possibility of extremely high earnings albeit with a higher volatility. As economic cycles alternate from time to time, a portfolio of value and growth stocks could reduce the risk, smoothening the volatility and thereby ensuring better returns.

As I sit down to pen down my thoughts in reply, I make a mental note of absolute certainties. Extremities in investing need to be toned down. A diversified portfolio is a must and cannot be avoided. Both, capital appreciation and dividends are desired, probably in a more measured manner that matches the risk profile and prevailing economic scenario. If an octogenarian and widely successful value investor like Warren Buffett can course-correct his investment style to match the evolving economic situation and opportunities, we surely can do too. Value investing is not dead; it is just blending into a new environment, and investors are yet to realize it.

The author is Co-Founder & CEO at FYERS.Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.