By Tarun Jain & Shreyash Shah

In the run up to the Budget, a number of diverse groups have exhibited rancour against Dividend Distribution Tax (DDT), which has been in vogue in Indian Tax laws since 1997, albeit with a minor gap before its re-introduction in 2003 since when it has been continuously levied.

Setting the Context

It is well known that dividend is the return on equity, which is declared by a company, ordinarily, as a distribution of its profit. Dividend is statutorily regulated and required to be paid as per the Articles of Association and Company law to the shareholders. DDT is a specie of tax on dividends declared or distributed by an Indian Company. Some contentious issues relate to (a) whether payer or payee bears the brunt of tax on dividends, (b) rate of tax, (c) horizontal equity versus vertical equity, (d) whether the rate prescribed under the double tax treaty can be applied, and (e) whether credit can be granted to a non-resident in its home country, etc. However, there are complex economic and legal issues, each having varying dimensions.

To highlight one of the aspects, ordinarily, dividend is the income of the shareholder. Thus, the tax on dividend is generally at level of the shareholder receiving such dividend. This implies that, to illustrate, where the shareholder is as such not taxable (being below the tax threshold, etc), no tax is payable on dividend. Vice versa, an individual under the higher tax basket receiving dividend will pay higher tax. This progressive system of taxing dividend addresses horizontal equity consideration in tax policy. DDT, however, changes the very premise.

Section 115O of the Income Tax Act, 1961, which is the relevant statutory provision for levy of DDT, was first introduced in 1997, thereby shifting the tax liability from the shareholders to the domestic companies as additional tax on distributed dividend. When the concept of DDT was introduced, it seemed that this was directed to induce Indian companies to retain the bulk of their profits and plough them as re-investments. The rationale notwithstanding, many investors have made representations for abolishing DDT since it affects their return on investments. In fact, as per media reports, the Task force on Direct Tax Code (DTC) in its Report of October 2019 has recommended abolition of DDT to promote investment and also considered that there would hardly be any revenue loss since it will be offset by the taxes paid by the shareholders.

Let us understand the practical issues as to why DDT is perennially requested for being abolished and shifting back to the classic regime where dividend is taxed in the hands of the shareholder.

Impact of DDT on return for foreign shareholders vis-a vis Indian shareholders

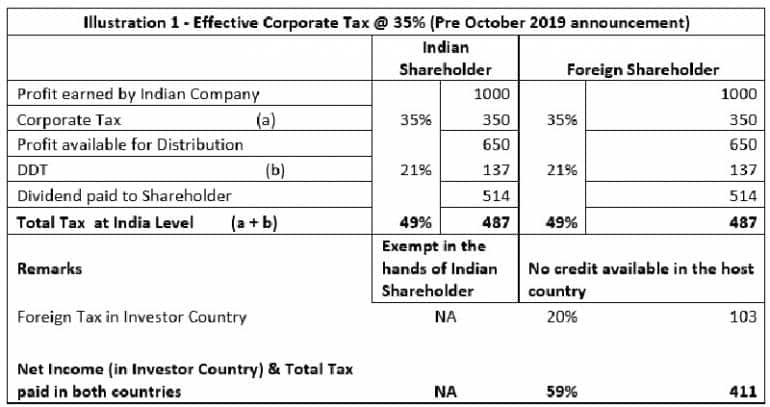

Let us take an illustration to demonstrate how DDT impacts foreign investors:

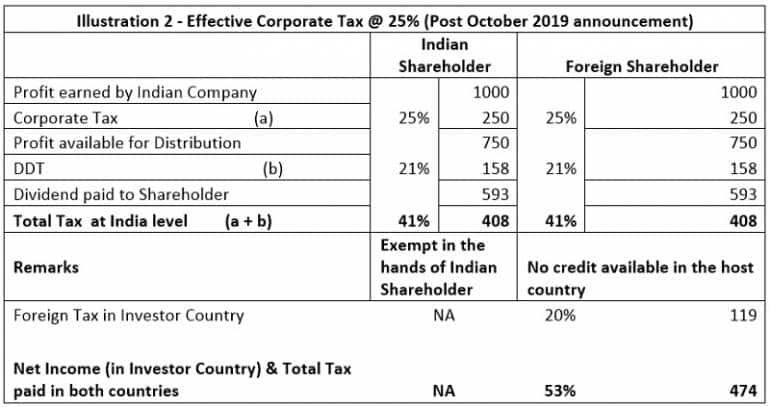

Up to September 2019, the cumulative effect of Corporate Income Tax and DDT implied roughly 49 percent tax for Indian shareholder versus and for foreign investor at India level. In other words, for every 1000 profit the foreign investor will effectively get only 510 and this too would be reduced to 411 in the event the tax rate in his host country is say 20 percent, for the sole reason that no credit of DDT available in the host country.From FY 2019-2020, the reduction in corporate tax rate has only reduced the tax incidence marginally to 8% for Indian and foreign share holder.Now, the foreign investor will only effectively get 474 instead of 411. No wonder, there is a louder cry by foreign investors that DDT interferes in their decision to invest in Indian equities and thus be abolished.Tax Dichotomy of treatment for return for debt versus equityThere is another way of examining DDT impact which is not evident unless a debt-equity analysis is undertaken. In this illustration:

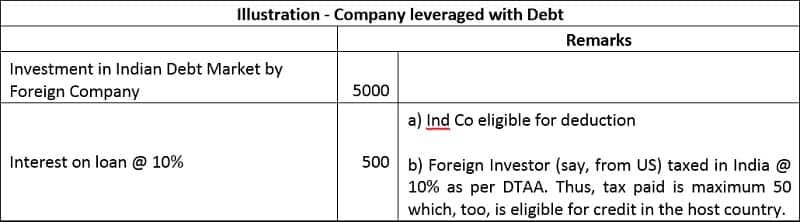

Up to September 2019, the cumulative effect of Corporate Income Tax and DDT implied roughly 49 percent tax for Indian shareholder versus and for foreign investor at India level. In other words, for every 1000 profit the foreign investor will effectively get only 510 and this too would be reduced to 411 in the event the tax rate in his host country is say 20 percent, for the sole reason that no credit of DDT available in the host country.From FY 2019-2020, the reduction in corporate tax rate has only reduced the tax incidence marginally to 8% for Indian and foreign share holder.Now, the foreign investor will only effectively get 474 instead of 411. No wonder, there is a louder cry by foreign investors that DDT interferes in their decision to invest in Indian equities and thus be abolished.Tax Dichotomy of treatment for return for debt versus equityThere is another way of examining DDT impact which is not evident unless a debt-equity analysis is undertaken. In this illustration:  This example shows that return for foreign investor in debt market is effectively with a tax of 10 percent only and there is virtually no tax in India (considering tax sparring available under the double tax treaty).This example is opposed to the foreign investor not infusing equity capital but lending money through debt market. Based on the segmental analysis, in economic return terms, at least DDT does influence corporate decision making on how to invest in Indian companies. In effect, DDT pushes investment in debt instead of equity. In the present scenario, levy of DDT is a disincentive for a foreign shareholding in terms of the return on investment as well as a disincentive for capital investment.Hence, it is hoped that the policy framers will revisit the justification of levy of DDT and the need for its continuity in the present Budget exercise.(Tarun Jain is Partner, BMR Legal Advocates and Shreyash Shah is Managing Associate)

This example shows that return for foreign investor in debt market is effectively with a tax of 10 percent only and there is virtually no tax in India (considering tax sparring available under the double tax treaty).This example is opposed to the foreign investor not infusing equity capital but lending money through debt market. Based on the segmental analysis, in economic return terms, at least DDT does influence corporate decision making on how to invest in Indian companies. In effect, DDT pushes investment in debt instead of equity. In the present scenario, levy of DDT is a disincentive for a foreign shareholding in terms of the return on investment as well as a disincentive for capital investment.Hence, it is hoped that the policy framers will revisit the justification of levy of DDT and the need for its continuity in the present Budget exercise.(Tarun Jain is Partner, BMR Legal Advocates and Shreyash Shah is Managing Associate)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!