“There is always a bull market and a bear market going on simultaneously in the world at every given point in time”, Paul Tudor Jones.

In my lifetime of investing, broking, reading, travelling, meeting people and countless other activities where things happen to you, there is nothing deeper, more meaningful and impactful & life-changing that has happened to me than coming across this line when I was in my late twenties.

Please read the line above in italics and bold again.

It has taken me living through countless bull & bear markets to appreciate the power of this exceptional piece of wisdom - first imparted to me by the legendary Paul Tudor Jones.

You are lucky if you can appreciate within twenty years, the power of something that’s told to you in your twenties. You are beyond wise if it takes less than ten. And if you get it immediately… then you are the modern-day version of the Great Buddha himself.

Even today, as I am getting sucked into the macro noise of rising interest rates, profligate fiscal spending, rising costs of literally everything & every pundit telling me that the deepest recession of our lives is coming next (on this they could be right or they could be wrong - I don’t know and I don’t care) … I momentarily forget what Paul Tudor Jones taught me.You can’t help it.

We are all human after all. We all get sucked into what’s hitting the headlines today. We lose perspective. Which is why the line above is pure Gold. It forces you to think the other way when the prevailing narrative is so one-sided as it has become now.

It is hard to be bullish and bearish at the same time. It’s hard enough being either one as we know! But as the dictum above reminds me, this is how the world of markets functions.

At 53, I live my life in the markets using the above dictum. So today, as the world is seemingly falling apart in front of our eyes, I will reflect on what I think is the most ferocious bull market underway in one part of the world.

Indian GDP & Apple

Given my long-term affinity to India, I am glad to see that the India that I grew up in, to the one today - is vastly different. I was 22 years old when India had its back against the wall facing a gigantic Balance of Payments crisis. GDP was like $280 billion and the market cap of the equity market was less than that.

Twenty years later, the Indian GDP was $1.8 trillion. Thirty years later (from 1992), GDP is now $3.5 trillion and the market cap of the equity market has kept pace. I’ll come back to this in a second. Hold the thought.

A quick detour to Apple.

Apple was listed in 1980. For the first twenty years since its listing, it made no returns for shareholders (it was doing well till the dotcom crash happened). In 1992, it had a market cap of $5.2 billion and in 2002, the market cap was $4.2 billion.

Apple was growing up for those 22 years.

It effectively went nowhere in that time. And then, the story kicked off. If you were invested in Apple during that time, you could have so easily abandoned it, just before the big gains started to come through.

And now the bigger killer point.

It took 38 years for Apple to become a Trillion-Dollar company. Within two years after that, it was at $2 trillion (in August 2020). It then took just another two years to become a $3 trillion Dollar company.Think about this for a minute again. It is mind-blowing.The takeaway is this: When things take off, the curve becomes exponential.

Now coming back to India.

It has taken a long … a long, long time for Indian GDP to hit $3.5 trillion. But given the power of compounding and the fact that India is a full-grown adult now (like Apple, it too was growing up between 1992 and 2012), it will take less than a decade to double GDP to $7 trillion.

And there is literally no force on the planet that can stop this from happening. The risk to my forecast is that this doubling in GDP happens even faster than a decade.

Stock Returns and GDP growth

There is tons of research to back the claim that the fastest periods of CAGR (Compound Annual Growth Rate) in equity returns happen when the GDP of a country doubles from around the $3 trillion mark.

The best case in point: US GDP was $3 trillion in 1982. In 2000, it was $10 trillion. We all know what happened to equity returns for the next two decades there. It created the Fidelities and Peter Lynch’s of the world. US equity Indices went up 10x.

The next big Fidelities & Peter Lynchs are going to come from India. And India’s fundamentals are far superior to that of the US today as well as to that of the US in 1982.

One statistic I absolutely love: Household debt as a percent of GDP in the US in 1982 was 45 percent. Today, US household debt as a percent of GDP is 65 percent (in the UK it is 88 percent, Japan it is 68 percent & China is 64 percent).

Today, India’s household debt as a percent of GDP is 14 percent. And with the GDP at $3.5 trillion, the headroom to grow is massive.

India’s best days of growth lie right ahead.

Bajaj Finance

There is a stock listed in this corner of the world and it is called Bajaj Finance.

I believe that Bajaj Finance is the next Apple.Its current market is $59 billion. By the end of this decade, it should be up (conservatively speaking) 10x from here. And Bajaj Finance is what I call a ferocious bull market (every Indian who trades in India has figured this out) that the world hasn’t yet woken up to.

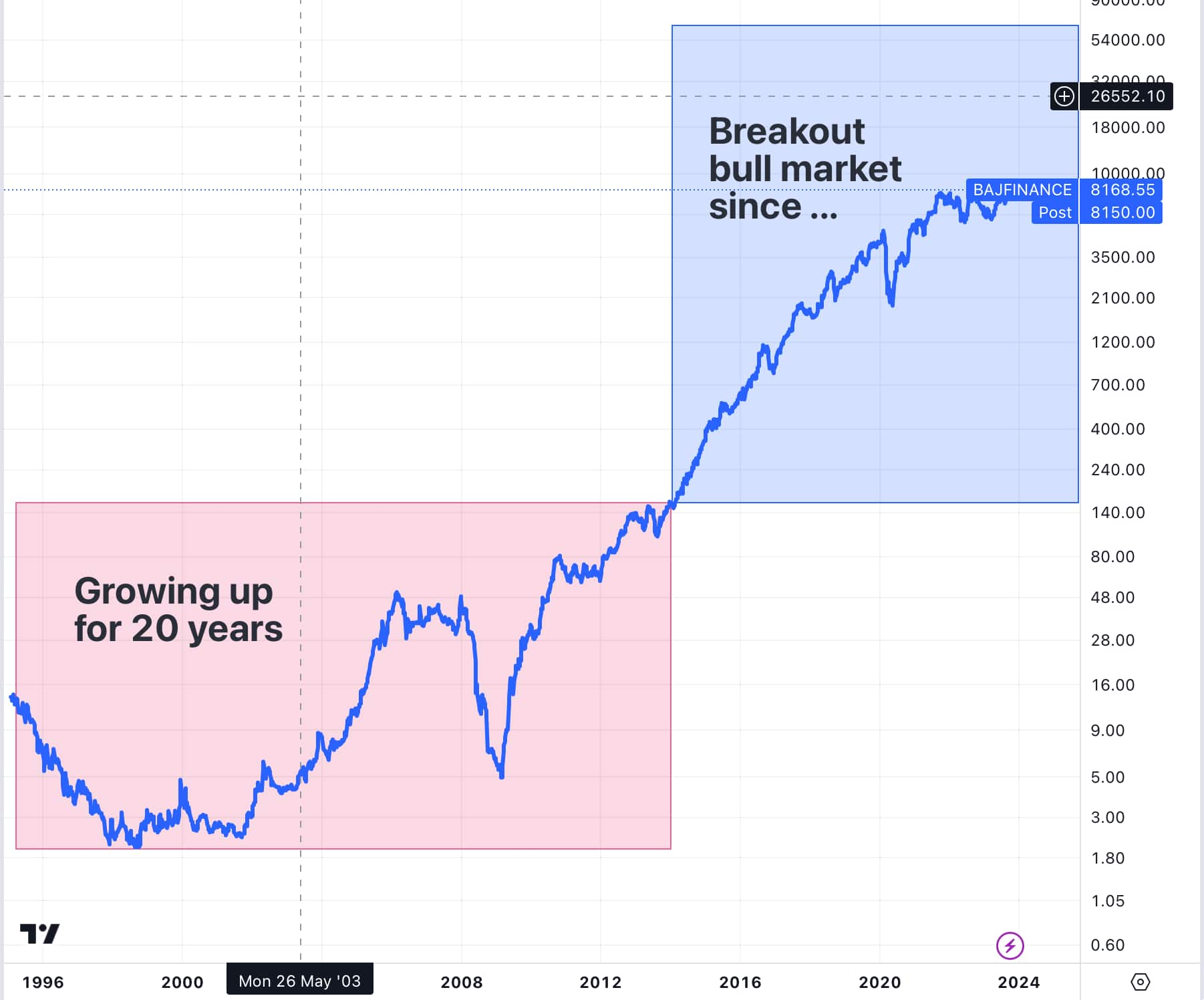

This is what it looks like:

For 20 years, it spent time growing up. Then from 2012 onwards, just like Apple, it has been on a strong trend.

As we sit today, the stock is printing a new all-time high on the Indian stock exchanges. While the world bleeds, Bajaj Finance is breaking into new high ground.

Paul Tudor Jones will smile when he reads this note today.

India can lead the world now

All global markets are reeling under sovereign debt crises. Households are stretched everywhere. Infrastructure is creaking in America, the UK and Europe. There are no leaders anywhere in government. Central banks are tapped out. Consumers are feeling the stress.

Not in India.

Households in India are more digitally savvy than anywhere else. Everyone uses a smartphone to run their business and also consume. The new-to-credit population is exploding. Infrastructure is growing at a rapid pace.

The desire to grow, to succeed and to work hard is something you see everywhere. If any of you are interested, come with me to India this December. I’ll take you around.Fortunes are going to get created here. This is a highly unleveraged economy (just like Apple has been through its entire history) where a Bajaj Finance literally prints money every day. This company exemplifies how great management, savvy technology, alert-to-consumer product and leverage intersects.

Final thought for this Friday

Can India take the world out of its malaise? Why not. Before the East India Company came to the Indian shores, 45 percent of the global GDP came out of India (read Dalrymple’s amazing book called Anarchy to understand and appreciate this time of global history).

India’s share of global GDP is going to grow faster than any other part of the world. And stock returns will reflect that.

I’m sick and tired of all the bearish noises everywhere. The time has come for the world to look elsewhere.

Let’s go to India …

This article first appeared on the Substack account of Ashwani Mathur. Ashwani has been a broker to large macro and equity long-short hedge funds for almost three decades.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.