Silver is the second-best performer after crude oil in the commodity asset class shown in the table below and given returns of 52 percent during March 18-July 6, 2020.

In the same time frame, MCX Silver futures have given returns of 46.8 percent.

Investors have faith in this asset class in times of uncertainty and this is clearly evident in the returns the metal has given in such a short time-frame.

An alternative investment in a relatively volatile market and a proxy to gold is what defines the investment in this asset class. The movers and shakers for silver prices in the second half of 2020 will be a combination of heavy industrial use, investment demand and its strategic importance as a currency hedge during times of uncertainty.

Talking about uncertainty, the world is ravaged by the coronavirus pandemic that has shattered the global growth. The International Monetary Fund (IMF) has said in its recent update on (June 24, 2020) that the 2020 global output will shrink by 4.9 percent, compared with a 3 percent contraction predicted in April. The IMF views the current recession as the worst since the 1930s Great Depression, which saw global GDP shrink 10 percent, however, the $10 trillion in fiscal support and massive easing by central banks have, so far, prevented large-scale bankruptcies.

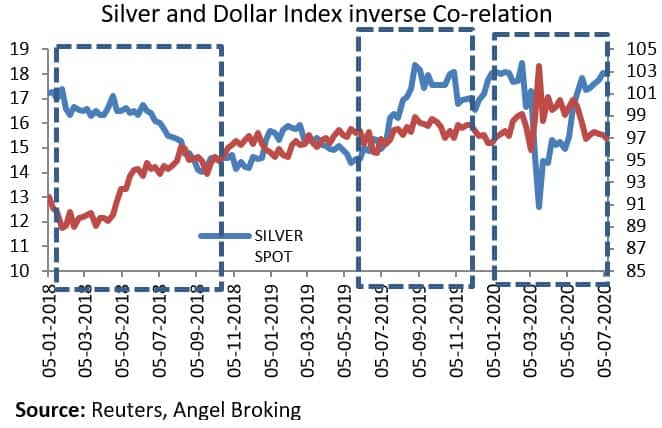

Strategic importance as a currency hedgeSilver price tends to perform poorly in times of stronger dollar and vice-a-versa. For instance, silver declined 8 percent from January 25, 2019 to May 31, 2019 as the dollar index rose 2.3 percent. A similar trend was seen in 2018 as visible in the chart alongside.

Similarly, the dollar index declined by 3.35 percent during April 3-July 3, 2020 while silver prices gained 17.5 percent.

In this scenario, the dollar plays a strategically important role in the price of silver. The impact of the pandemic has led all central banks to push in more liquidity and the US Federal Reserve's balance sheet has already increased from $4 trillion in March 2020 to around $6.976 trillion, up by around crossed $2.97 trillion.

This easy money push from the US Fed will lead to a weaker dollar in 2020, which is already the case.

Silver prices to riseThe annual size of the global silver market is around 23,000 tonnes. The US accounted for 3.6 percent of the global silver production in 2019 or around (980 tonnes) compared to Mexico and Peru, which produced 6,300 and 3,800 tonnes, respectively. It means that silver prices are a global phenomenon and market forces of supply and demand rather than any price manipulation.

Global silver investment jumped 12 percent in 2019 to 186.1 million ounces (Moz), making it the largest annual growth since 2015. Moreover, silver ETF holdings climbed to a record 1.13 billion ounces in 2019 and this trend has continued in 2020.

The way forward2020 has been ravaging for financial markets with a host of uncertainties ranging from Brexit, negative bond yields, global trade war, oil price crash and recently the coronavirus.

The actions of central banks will for sure led to easy liquidity across the globe and with US Fed increasing the size of the balance sheet and the dollar weakness will continue to be help prices.

Rising investment demand, as witnessed in 2019 and a similar trend in 2020, will ensure that silver prices will rise further. Spot silver in the international markets CMP ($18 per ounce) has the potential to move towards $21 per ounce by the end of 2020. On the MCX, silver prices may move towards Rs 57,000 in the same timeframe.

(The author is AVP-Research - Non Agri Commodities and Currencies at Angel Broking.)Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.