Tata Consumer Products is expected to report 4.7 percent year-on-year decline in consolidated net profit for the quarter ended December 2022. Revenue is set to rise a modest 7 percent YoY on the back of weakness in tea business. The company will report its Q3 numbers on February 2.

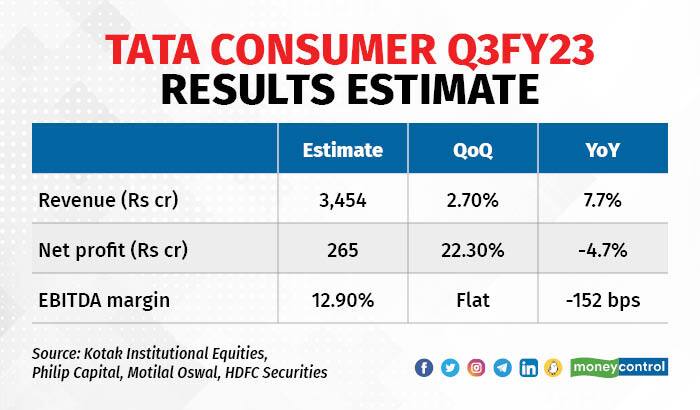

As per a poll of brokerages conducted by Moneycontrol, the company is set to report post-tax profit of Rs 265 crore on a revenue of Rs 3454 crore. EBITDA (earnings before interest, taxes, depreciation and amortization) margins might contract over 150 basis points from the year-ago period.

One basis is one-hundredth of a percentage point.

The tea business has been a laggard and analysts at Nuvama Institutional Equities as well as Kotak Institutional Equities expect a 4 percent YoY dip in volume of this segment.

“This is primarily due to consumers cutting down on consumption with lower-end population facing headwinds and TCPL’s business being more indexed to North and East India, which suffered a deficit in rainfall,” said Nuvama Equities.

Meanwhile, margins as expected to contract on account of inflationary pressure in UK Tea and US Coffee businesses.

The strength will come from India foods business, believe analysts. The Street is expecting 26-27 percent revenue growth in the segment, coupled with 3 percent volume growth YoY. NourishCo is seen continuing its strong performance with KIE estimating 67 percent YoY growth in revenue to Rs 120 crore.

The company was in limelight in November when the Street was anticipating that it will acquire Bisleri. While there has been no further update on that front, a key concern was that Tata-group will be straddled with debt if it acquires the water business for Rs 7000 crore.

So apart from comments on the international business and Starbucks, the Street will also be monitoring the company’s cash level as well.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.