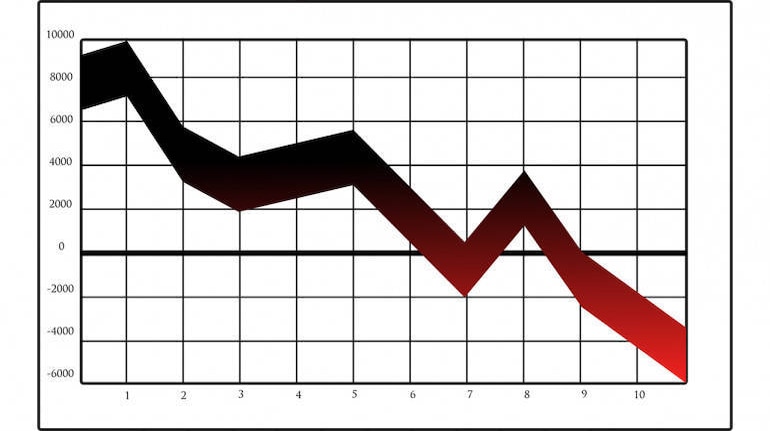

Divis Laboratories' share price plunged below Rs 3,000 on February 3, falling more than 13 percent after a significant deterioration in quarterly earnings.

At 2.35 pm, the stock was trading at Rs 2,803 on the NSE, the lowest level since August 7, 2020.

The active pharmaceutical ingredients manufacturer recorded a consolidated profit of Rs 306.8 crore in the December quarter of FY23, falling 66 percent on-year and 38 percent sequentially, impacted by lower topline as well as disappointing operating performance.

Consolidated revenue from operations at Rs 1,708 crore was down 31.5 percent compared to the year-ago period, Divis Labs said in an exchange filing. The sequential decline in topline was 8 percent.

On the operating front, EBITDA (earnings before interest, tax, depreciation and amortisation) tanked 63 percent year-on-year to Rs 408.3 crore for the December FY23 quarter and the sequential decline was 34 percent.

The operating profit margin came in at 23.90 percent, down more than 2,000 basis points from the year-ago period and falling nearly 1,000 basis points on a sequential basis.

Click Here To Read All Budget Related News

Technical View

Technically, the stock has formed a large bearish candlestick pattern on the daily charts with robust volumes, making lower highs lower lows formation for second straight session. It has seen a sharp breakout of the long horizontal support trendline adjoining lows of March 19, 2021 and November 14, 2022, indicating nervousness among participants.

After a sharp dip, the stock has been trying hard to hold the big gap-up area created between August 7 and August 10, 2020 (after solid earnings performance for the June FY21 quarter).

Generally, technical analysts say any breakdown of a big gap-up area can attract more selling pressure, which needs to be closely watched going ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.