Buzzing Stocks: RIL, HCL Tech, Cyient, Suven Pharma and others in the news today

Stocks to Watch: Check out the companies making headlines before the opening bell today.

1/15

Results on April 21: Reliance Industries is going to be in focus ahead of its quarterly and full year earnings on April 21. Aditya Birla Money, Hindustan Zinc, Tejas Networks, Bheema Cements, Metalyst Forgings, Rajratan Global Wire, and Wendt (India) will also release their quarterly earnings scorecard on the same day.

2/15

Results on April 22: ICICI Bank will be in action ahead of its quarterly and full year numbers on April 22. Along with that, Yes Bank, Macrotech Developers, CE Info Systems, Star Housing Finance, and Nath Bio-Genes (India) will also be announcing their numbers on the same day.

3/15

HCL Technologies: The IT services company has reported lower-than-expected earnings for Q4FY23 with profit falling 2.8% QoQ to Rs 3,983 crore and revenue declining 0.4% to Rs 26,606 crore. On the operating front, EBIT fell 7.5% sequentially to Rs 4,836 crore with margin down by 140 bps to 18.2% for the quarter. Revenue in dollar terms declined 0.3% and topline in constant currency terms was down 1.2% QoQ, but IT attrition rate dropped sequentially to 19.5% from 21.7%.

4/15

Cyient: The engineering and technology solutions company has recorded a 4.6% sequential growth in consolidated profit at Rs 163.2 crore for quarter ended March FY23 on strong topline and operating numbers. Revenue for the quarter at Rs 1,751.4 crore grew by 8.2% and dollar revenue at $213 million increased by 8.1%, with constant currency revenue growth at 6.6% QoQ.

5/15

Siemens: Company as part of a consortium along with Rail Vikas Nigam, has received two separate orders from Gujarat Metro Rail Corporation (GMRCL). Siemens' share in orders is Rs 678 crore. The orders are for Surat Metro Phase 1 and Ahmedabad Metro Phase 2.

6/15

Suven Pharmaceuticals: The Competition Commission of India (CCI) has approved the acquisition of up to 76.10% of the voting share capital of Suven Pharmaceuticals by Berhyanda. Berhyanda is the wholly owned subsidiary of Berhyanda Midco, i.e. in turn the wholly owned subsidiary of Jusmiral Midco.

7/15

Sterling & Wilson Renewable Energy: The company has posted net loss at Rs 417.45 crore for quarter ended March FY23, widening from loss of Rs 126.3 crore in same period last year, as consolidated revenue plunged 91.7% YoY to Rs 88.4 crore and EBITDA loss increased to Rs 352.12 crore from Rs 124.24 crore in same period.

8/15

Laxmi Organic Industries: The chemical manufacturing company said the board has approved the borrowing of funds up to Rs 2,000 crore.

9/15

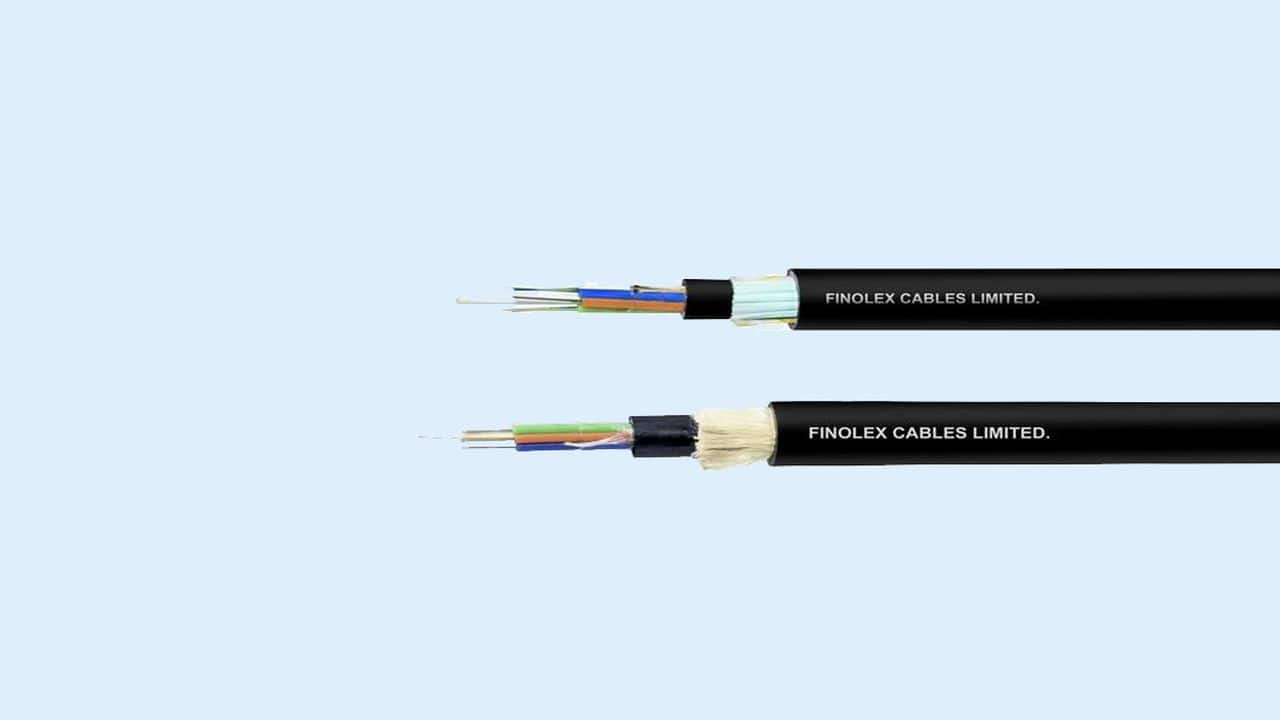

Finolex Cables: The electrical and telecommunication cables manufacturer would set up a plant at Urse facility in Pune to produce optical fibre preforms as well as expand on its fibre draw capacity. The plant with an initial capacity of 100 tons of preforms, is being set up at a cost of Rs 290 crore, and would be funded entirely out of internal accruals.

10/15

PNB Housing Finance: Nippon India Mutual Fund has bought 5 lakh equity shares or around 0.3% stake in the housing finance company via open market transactions at an average price of Rs 133 per share. Goldman Sachs Investments Mauritius I Limited was the seller in this deal.

11/15

Vodafone Idea: The board of directors has appointed Kumar Mangalam Birla as Non-Executive Director of Vodafone Idea with effect from April 20. Krishna Kishore Maheshwari has resigned as a Non-Executive Director from the board with effect from April 19, citing personal reasons.

12/15

India Grid Trust: International Finance Corporation (IFC) has subscribed to a listed NCD issuance of IndiGrid aggregating to Rs 1,140 crore. With a total tenure of 18 years, the NCD were priced at a competitive rate that is fixed for a long tenure. IndiGrid plans to utilize this debt for funding its upcoming refinancing opportunities in FY24.

13/15

HDFC Life Insurance Company: The company (including Exide Life Insurance) recorded 83% growth in premium for March YoY and 16% growth in financial year gone by. The retail APE growth was 118% in March YoY, reports CNBC-TV18.

14/15

ICICI Prudential Life Insurance Company: The company registered a 31% YoY growth in premium for March and 13 percent growth in FY23 premium compared to FY22. The growth in retail APE for March was 59% YoY, reports CNBC-TV18.

15/15

SBI Life Insurance Company: The insurance company has recorded a 23% year-on-year increase in premium for March and 16% growth in premium for FY23 over FY22. The growth in retail APE for March was 12% YoY.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!