Sectoral and thematic funds may well have grown in popularity but they face cyclical challenges and investors should be careful of not falling into a trap due to FOMO (fear of missing out), says Deepak Ramaraju, Senior Fund Manager, Shriram AMC.

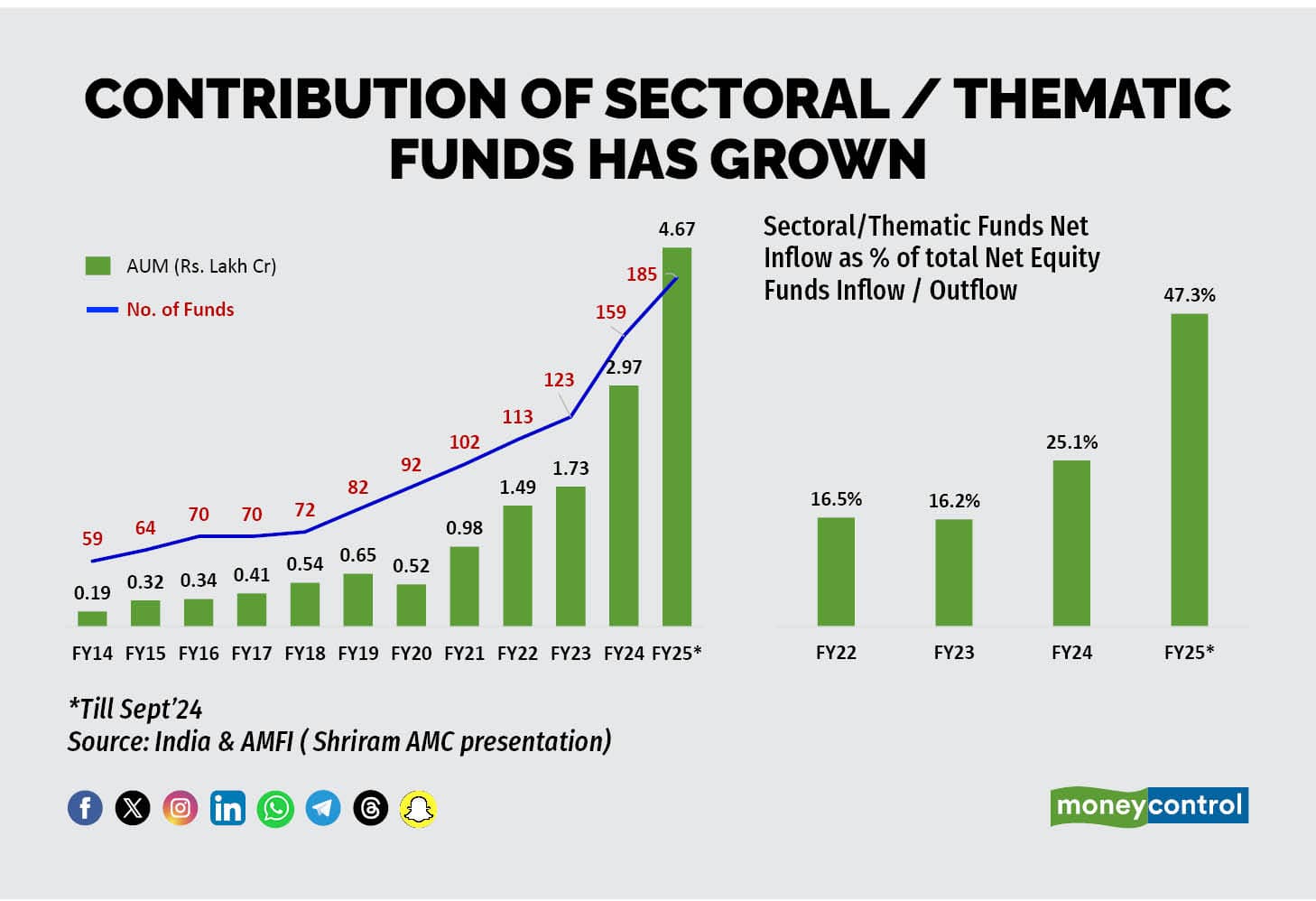

“If you look at the entire industry outlook, thematics and sector funds have grown massively – we are talking about a 20x increase in value and 3x growth in fund offerings over the last decade, but every sector or theme has its own cycles,” he says. As a result, many investors tend to get into a sector trap due to FOMO (fear of missing out), he adds.

To overcome this challenge, an ideal approach would be to adopt a multi-sector rotation approach, said Ramaraju, who was speaking at the launch of Multi Sector Rotation Fund. To explain why they see this as an ideal approach, Ramaraju cites the example of the IT sector.

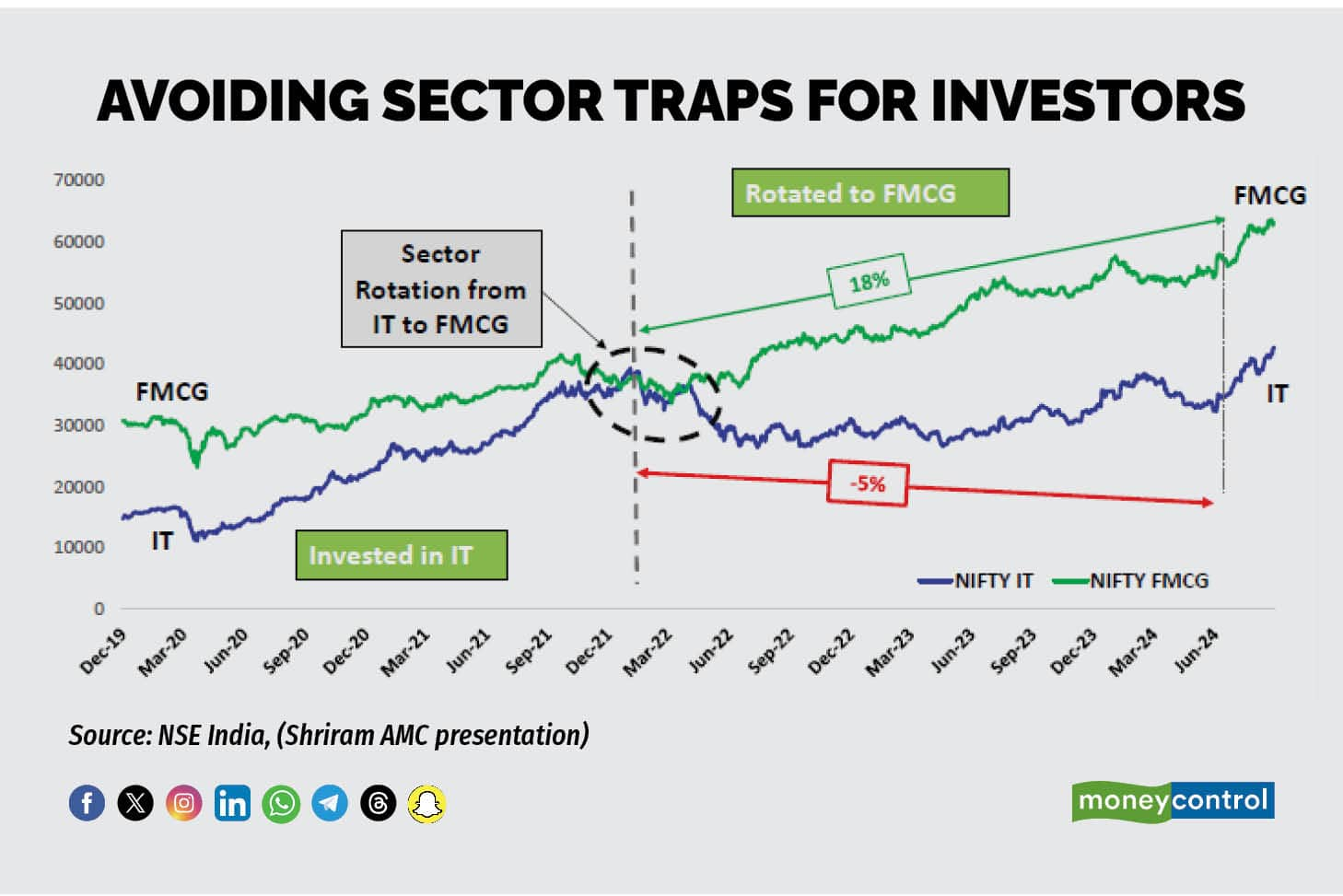

“If you look at IT sector performance pre-Covid, (the stock) it rallied from 6000 to 12,000 at that point of time. Ideally, if any investor had invested at the right point of time and they exited at the right point of time, the returns would have been phenomenally good. But ideally it doesn't happen,” he said adding that many of the investors will have an inertia; they will continue to stay invested in that.

“The returns over a period of time will also diminish for them because of the sector cycles. After consolidation, again the next phase of growth comes for every sector. But the investors will wait for longer term to make that kind of returns. Ideally, if an investor had entered and exited IT at the right time, they would have earned phenomenal returns. But in reality, inertia keeps them invested, and they lose gains when the sector cools,” he explained.

Meanwhile, the Multi Sector Rotation Fund, as per Ramraraju, would help prevent these challenges by diversification across a select set of three to six sectors.

“Staying invested in one single sector is always a risk. Imagine if the US government changes H1B visa policies; the entire IT sector could be impacted. By diversifying across multiple sectors, investors reduce such risks without over-diversifying and diluting returns,” he says adding that timing plays a crucial role in the fund’s strategy. “We’ve found that picking the top five sectors yields significant alpha,” he said.

How does it work?

The fund employs a two-step quant model, first identifying trending sectors, then selecting high-performing stocks within those sectors.

To optimise returns, Ramaraju explained that they developed custom indices for 19 sectors, beyond the 13 standard NSE sector indices. “Our quant model ranks sectors in descending order by trend, and we overlay this with fundamental analysis to understand macro and sector-specific factors,” he said. “Once we are convinced of a sector’s position, we create a portfolio of 3-6 sectors, checking trends monthly,” said Ramaraju.

The fund also aims to eliminate the need for investors to time the market. “Timing the entry and exit for individual sectors can be challenging. We manage the rotation, so they don’t get caught in sector traps, and, more importantly, they avoid capital gains taxes associated with moving between sectors.”

According to the management, the back-tested results demonstrate the fund’s potential. “The model achieved a 17x return over the last 10 years, compared to a 4x return for the benchmark,” said Ramaraju.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!