Benchmark indices continued its winning streak as markets hit a fresh record high in the month of July supported by a gush of liquidity from domestic mutual funds.

The total category wise AUM or assets under management of the mutual fund industry increased by 5.3 percent or by Rs 1 Lakh crore to Rs 19.96 lakh crore in July 2017. On a YoY basis, total AUM of Mutual Fund Increased by 31.5 percent, IDBI Capital said in a report.

AUM of Equity Fund increased by 6.5 percent or by Rs 3414 crore to Rs 5.59 Lakh crore in July 2017 over June 2017. On YoY basis AUM of Equity Fund increased by 39.3 percent, it said.

The assets of ELSS increased by 6 percent or by Rs 3,964 crore to Rs 70,047 crore, meanwhile Equity Fund registered all time highest net inflow of Rs 12,037 Cr and ELSS Fund saw a net inflow of Rs 690 crore. Thus, total equity funds witnessed net inflow of Rs 12,727 crore.

Equities as an asset class generated more interest last month as benchmark indices hit fresh record highs. But, there was also plenty of stock specific action.

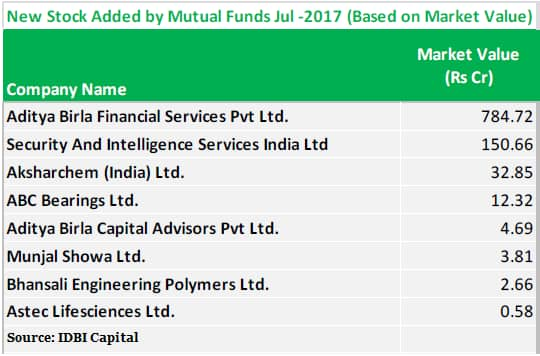

Fund managers added 8 stocks for the first time in their portfolio which include names like Aditya Birla Financial Services aggregative up to a market value of Rs 784 crore, said the IDBI Capital report.

Another stock which fund managers rushed to buy was recently listed IPO of Security and Intelligence Services India (SIS) for an aggregate market value of Rs 150 crore.

SIS which listed on bourses earlier this month listed at Rs 879 on the National Stock Exchange (NSE), an 8 percent premium against its initial public offer (IPO) price of Rs 815 per share.

Other stocks which caught fancy of fund managers include names like Aksharchem India, ABC Bearings, Aditya Birla Capital Advisors, Munjal Showa, Bhansali Engineering, and Astec Lifesciences.

Domestic mutual funds turned out to be net buyers in equity in July 2017. Mutual Funds were net buyers of equities in 21 trading session worth Rs 11,799 crore, as against net buying of Rs 9,106 Cr in June 2017.

The foreign institutional investors (FIIs) were net buyers in equity in July 2017. FII were net buyers in equities in 21 trading session worth Rs 2,488 crore, as against net buying of Rs. 3,939 crore in June 2017.

9 stocks from which some fund managers exited:Some fund managers preferred to book profits in small and midcap names in the month of July after a huge rally seen so far in the year 2017.

Some fund managers dumped Meghmani Organics from their portfolio, an investment aggregating up to Rs 4.8 crore, followed by Walchandnagar Industries, Shipping Corporation of India, Puravankara, Surya Roshni, PPAP Automative, DS Kulkarni, and Asian Hotels.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.