Mid and smallcap shares are bearing the brunt of the selling fury lashing Dalal Street but there are signs that some investors are looking for bargains.

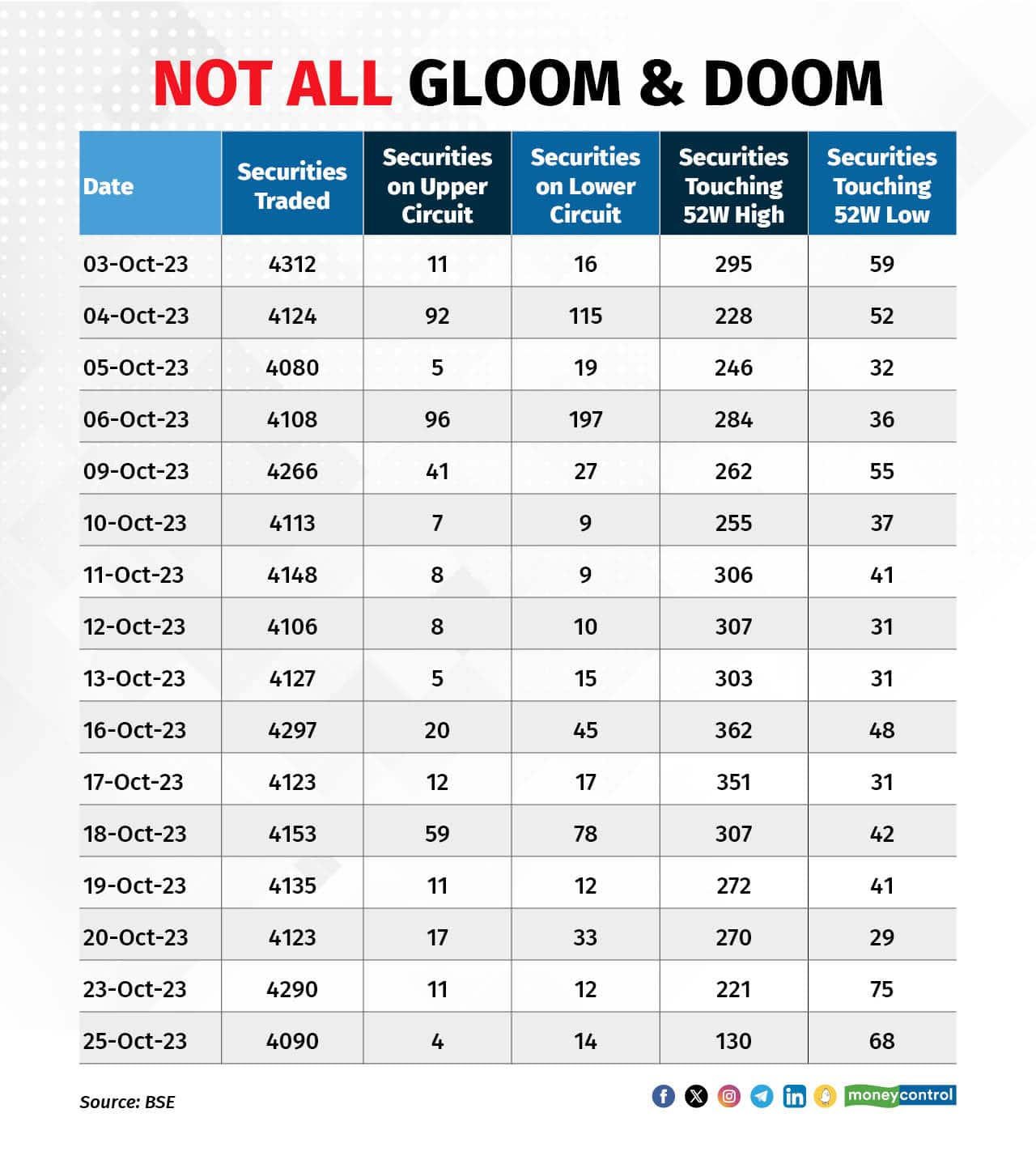

Given the intensity of selling pressure, plenty of stocks should have hit the lower end of the intra-day circuit filter but data sourced from BSE shows only 14 scrips hit lower circuit on October 25, out of 4,090 traded amid a sharp selloff.

When a stock hits the lower end of the intraday circuit filter, trading mostly comes to a halt because of lack of buyers. Technically, trading in shares can continue even when the price hits the lower end of the circuit filter but buyers usually defer purchases expecting stocks to fall even lower the following day.

If the stocks don’t hit the lower limit, it indicates that the shares being offered are getting absorbed by buyers.

Since October 17, BSE midcap and smallcap indices have lost over 6 percent. While the cut in broader markets has been deeper than largecaps, the number of stocks hitting lower circuit has been coming down. But, there is another number than bargain buyers should be mindful of.

The number of stocks hitting 52-week highs has fallen sharply, while those hitting 52-week lows has been rising. What this could possibly indicate is that the market may be losing momentum and pessimism could be on the rise, analysts said.

That said, the number of stocks hitting 52-week high are significantly higher than the stocks falling to 52-week low. Stocks like BSE, Medplus Health and recently-listed Plaza Wires have shown strength and gained over the past three trading sessions.

A dealer told Moneycontrol that smart money, marketspeak for institutional money, is using this opportune time to bottom pick stocks. "Jinke pass paisa hai, woh khareed rahe hain. Mere jaison ke paas nahi hai, toh hum sirf dekh rahe hai (those who have money are buying and those who don't, like me, can only watch)," he said.

According to Nirav Karkera of Fisdom, the panic-induced selling in markets is cleansing excessive valuations, particularly in the mid and small-cap sectors.

"Enhanced valuation propositions, coupled with promising long-term prospects and subsequently sustained buying interest by domestic retail and institutional investors seem to be arresting the slide in many high quality mid and smallcap counters," he said.

Over the past month, BSE midcap's one-year forward valuation has corrected from 28.86x to 27.79x. BSE smallcap's one-year forward valuation has come down from 24x to 23.39x.

Some fund managers also believe that this is a good time to deploy cash that they have been sitting on. "Largecaps may outperform now given the valuation difference and stable earnings growth profile but, correction also provides us an optimal time to pick stocks to add to our portfolio," Chandraprakash Padiyar, senior fund manager (equities), Tata Asset Management Company, had said earlier.

He believes the manufacturing sector has some stocks where "growth is coming at a reasonable price".

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!