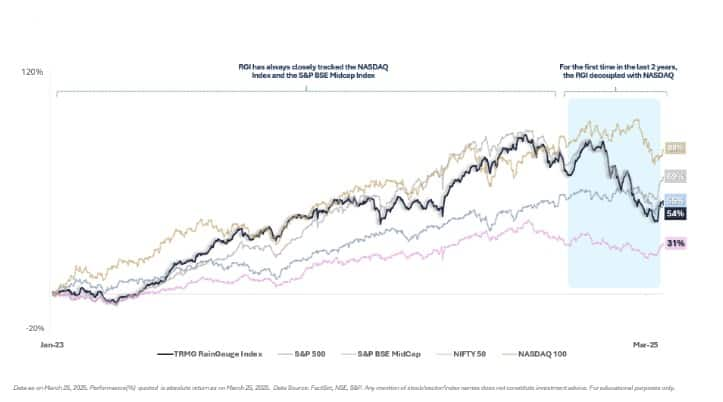

The RainGauge Index (RGI) dipped into bear market territory for the first time.

What's also noteworthy is that as the US and Indian markets seemed to go their separate ways, the RGI also broke its two-year link with the NASDAQ. Performance-wise, it pretty much mirrored the S&P BSE Mid Cap Index in Q3.

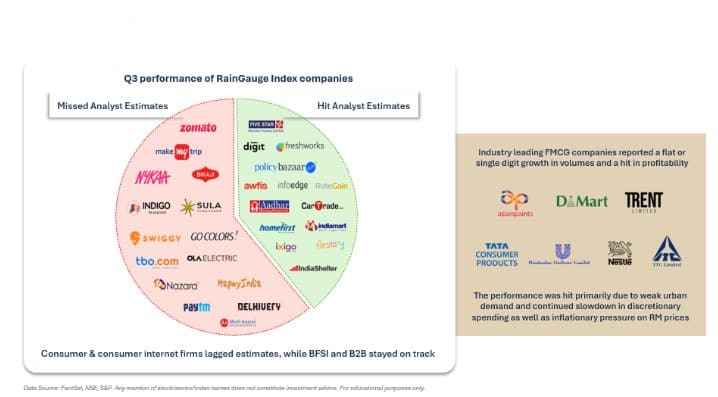

Based on our analysis, before the tariffs were announced in March’25, of the Q3 FY25 results for RGI companies, a few things stand out:

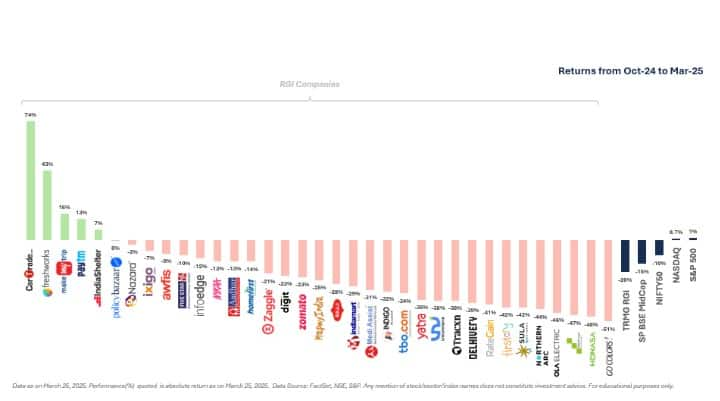

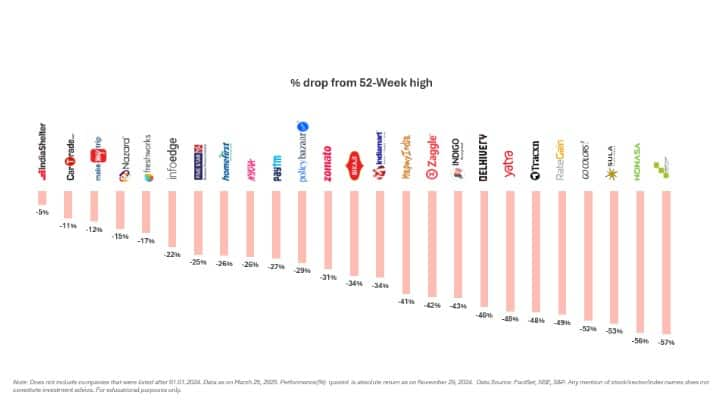

First off, the index as a whole underperformed all the major headline indices. We saw a pretty widespread drop of 20 percent across the RGI over the six months leading to March '25 (before the impact of tariff announcements), with only 5 out of 38 companies managing to stay in the green. For most RGI stocks, they've fallen 20 percent++ from their 52-week highs.

The reason for this underperformance?

Currently, RGI is a consumption heavy index. With urban consumption slowing down and affecting performance of even the big FMCG players on the country – the RGI took a hit as well. ~60 perent, of the companies in the index missed their estimates this quarter, and these were largely in the consumer and consumer internet space. This is quite different from our main market indices, which are heavily influenced by financials, IT services, and industrials.

Adding to that, another factor likely contributing to the RGI's volatility is the higher free-float market capitalization of its constituents. On average, the promoter-holding for RGI companies is around 30 percent. Compare that to the Midcap index, which is closer to 55 percent, and the Nifty at about 41 percent, and it suggests our companies have a higher free-float and hence are more sensitive to market swings.

Given the broader market correction in India, and the RGI’s performance, it's fair to say that the initial group of venture-backed IPOs has now navigated all market cycles. And the big takeaway from all these cycles? The market values consistent performance over just the perception of consistency.

The complete report can be downloaded from: RainGauge — The Rainmaker Group

Kashyap Chanchani is the Managing Partner at The Rainmaker Group and Dhwani Mehta is his colleague. The firm advises mid-late stage private, venture-backed companies on fundraising.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.