Facebook’s $5.7 billion investment in Reliance Jio has virtually catapulted the social network to the top leagues of technology investors in India overnight, a title generally reserved for Japan’s SoftBank, which has invested over $10 billion in the country across a dozen startups including Flipkart, Ola and Oyo.

The Jio-Facebook deal is the largest investment for a minority stake by a technology company anywhere in the world and the largest FDI in the technology sector in India. A somewhat distant second is SoftBank’s $2.5 billion investment in online retailer Flipkart.

This also marks Facebook’s third direct investment in India, after it backed social commerce firm Meesho and online learning firm Unacademy in the past year, although in much smaller deal sizes of between $20-30 million.

Catch our entire coverage on the Facebook-Jio deal here“This investment really shakes up the league tables. SoftBank’s recent poor track record was somewhat ending their hegemony, but even then no one else had that cheque-size writing ability,” said an investment banker advising consumer internet firms, requesting anonymity.

However, the banker also warned that a deal of this scale by Facebook should be seen as the exception rather than the norm.

“While the comparisons to SoftBank are obvious, does Facebook look at itself that way, comparing itself to SoftBank? I highly doubt it. Because their investment thesis is quite different,” he added.

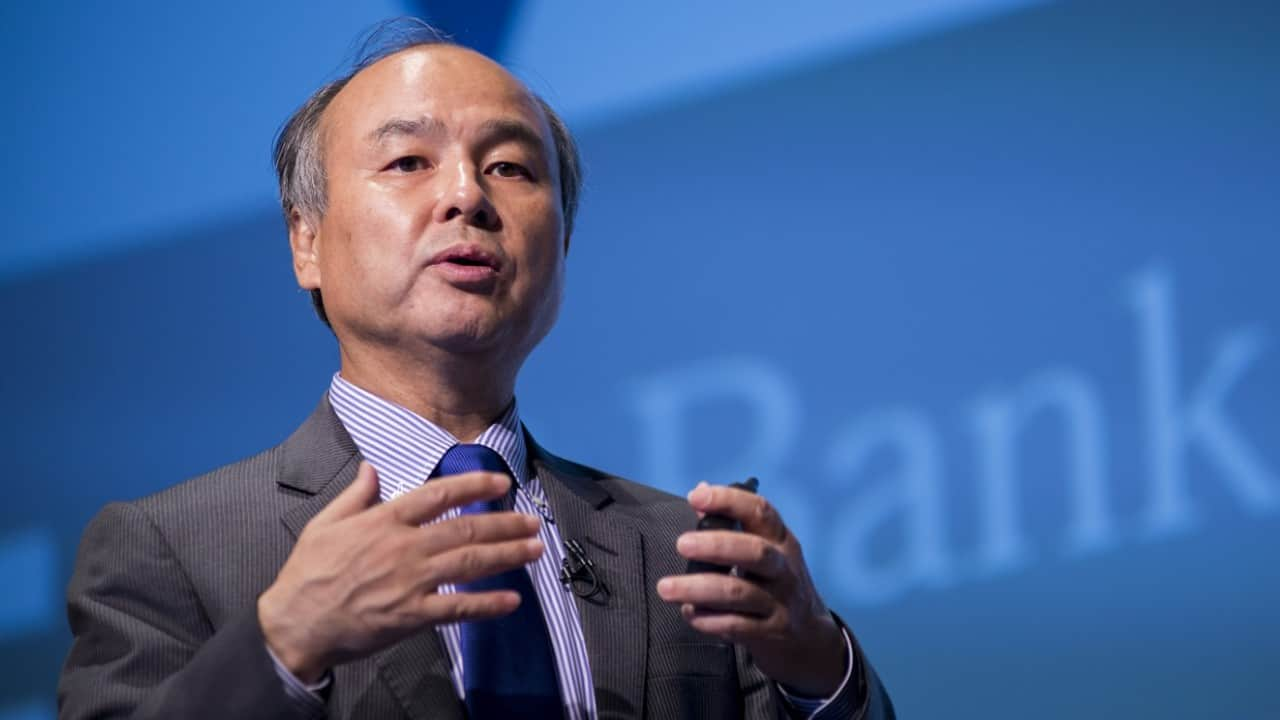

SoftBank Group Corp. founder, Chairman and CEO Masayoshi Son announces his group earnings during a press conference in Tokyo, Japan, 7 August 2017. SoftBank Group Corp. announced its consolidated earnings results for the 1st quarter (April - June, 2017) of the fiscal year ending March 31, 2018.

SoftBank Group Corp. founder, Chairman and CEO Masayoshi Son announces his group earnings during a press conference in Tokyo, Japan, 7 August 2017. SoftBank Group Corp. announced its consolidated earnings results for the 1st quarter (April - June, 2017) of the fiscal year ending March 31, 2018.Despite both firms investing in technology companies, Facebook has a decidedly strategic angle to all its investments globally in India. For instance its portfolio companies Unacademy and Meesho use Facebook, WhatsApp and Instagram extensively to sell and market their products, providing a customer base as well.

SoftBank on the other hand, invests from its Vision Fund, a $100 billion first-of-its-kind vehicle meant to seek financial returns, and like most funds invests across sub-sectors, countries and seeks exits in a certain period.

Facebook has also leap-frogged search giant Google in its India investment strategy.

According to people close to Google, the Mountain View, California-based firm is very interested in Indian startups and technology, but has a different approach.

It mainly ties up with companies it sees as a fit, rather than become a shareholder in it. However it made its first direct Indian investment in hyperlocal delivery firm Dunzo in 2018.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.Catch our entire coverage on the Facebook-Jio Deal here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.