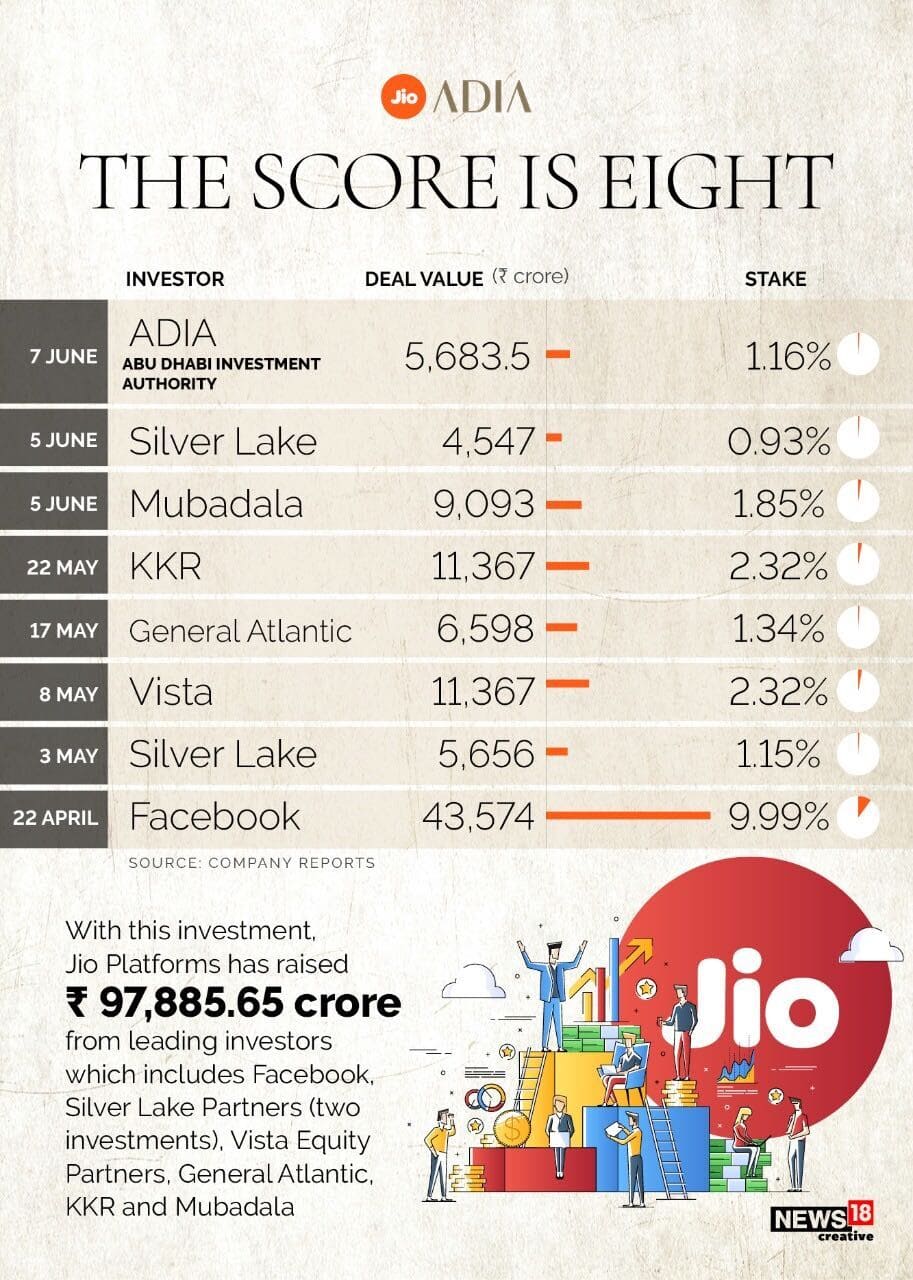

Reliance Industries Ltd's Jio Platforms got its latest investor in the form of Abu Dhabi Investment Authority (ADIA) on Sunday. One of the world’s biggest sovereign wealth funds, will pump Rs 5,683.5 crore into Jio Platforms.

The company is estimated to have assets of nearly $700 billion, has invested in 18 companies, according to data from Crunchbase.

ALSO READ: Reliance Jio: Abu Dhabi Investment Authority new investor in Jio Platforms as RIL unit raises total of nearly Rs 1 lakh croreThe fund has for years been spending money in Indian equities. Initially it acted as an anchor investor in several IPOs, and fixed income. In recent years, it widened its interest to assets such as infrastructure, real estate and private equities.

ADIA invested another $495 million in renewable energy firm Greenko Energy Holdings, which runs wind, solar and hydro projects, in 2019. ADIA was also a leading investor in Bandhan Bank’s IPO.

ADIA has been investing funds on behalf of the Abu Dhabi government since 1976 with a focus on long-term value creation. It manages a global investment portfolio that is diversified across more than two dozen asset classes and sub-categories, according to its website.

ADIA follows a strategy focused on long-term value creation. ADIA has invested in private equity since 1989 and has built a significant internal team of specialists with experience across asset products, geographies and sectors.

Through its extensive relationships across the industry, the Private Equities Department invests in private equity and credit products globally, often alongside external partners, and through externally managed primary and secondary funds.

ADIA’s philosophy is to build long-term, collaborative relationships with its partners and company management teams to maximise value and support the implementation of agreed strategies.

(Disclaimer: Reliance Industries Ltd., which also owns Jio, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!