Attacks launched by Yemen's Houthi group on commercial ships at the southern end of the Red Sea and the subsequent fallout on shipping via the Suez Canal are going to have little impact on India’s coal imports under prevailing prices, analysts told Moneycontrol.

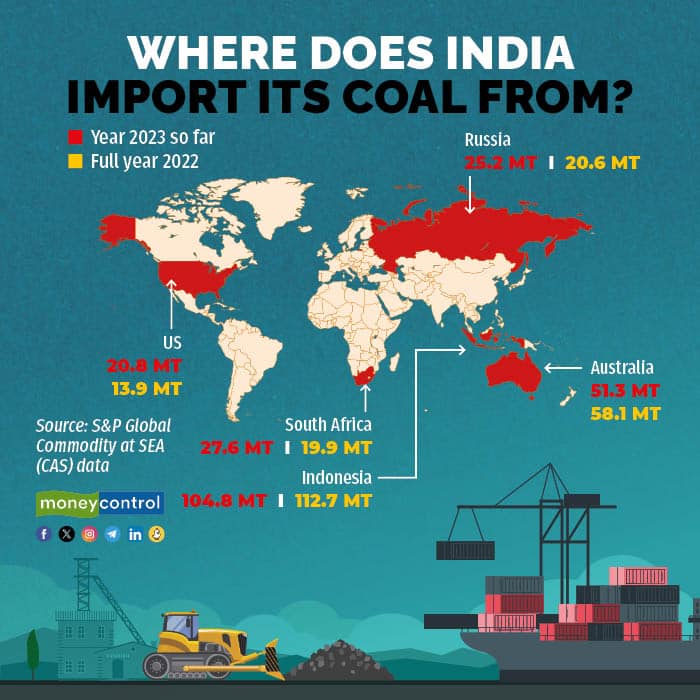

This is because the bulk of India’s coal needs are met by Indonesia and Australia, which are outside the affected sea routes. These two countries together have contributed to around 67 percent of India’s coal imports so far, according to S&P Global’s Commodity at Sea (CAS) data.

India's coal imports

India's coal importsThe rise in attacks on ships in the Red Sea by Houthi rebels have increased fears about a looming disruption in global supply chains. The Houthi attacks on the ships are a fallout of the Israeli military action on the Palestinians in Gaza since the war began on October 7, in which over 18,000 people, overwhelmingly Palestinians, have been killed.

The attacks have prompted several shipping companies to divert vessels, avoiding a route that would take them through Egypt's Suez Canal in the north and its link to the Mediterranean Sea. The rerouting adds significant cost and time to vessel journeys. Oil prices and war risk insurance premiums have spiked as a result.

As for coal imports to India being hit, Ritabrata Ghosh, vice president and sector head. corporate ratings, ICRA Limited, said the affected route accounts for 2-3 percent of the volume of global coal traded and, therefore, may not materially impact seaborne coal trade flows.

The Suez Canal crisis due to the geopolitical crisis in the neighbourhood poses low risk to India’s non-coking coal imports, said Miren Lodha, director (research), CRISIL Market Intelligence and Analytics. Most of India’s non-coking coal imports are fulfilled by Indonesia (58 percent average over fiscal 2023 and the first seven months of FY24), South Africa (12 percent) and Australia (8 percent).

“These coal varieties are shipped from within the Indian Ocean stretch limiting impact of the Suez route. Having said that, the logistical roadblock will impact India’s imports of about 20 million tonnes of non-coking coal combined from the US and Russia (average over fiscal 2023 the first seven months of FY24) which would be transported via the canal,” Lodha said.

However, this volume is only 14 percent of India’s total non-coking coal imports and, hence, is replaceable or players may reroute as an option if economical. The price impact from replacement of US and Russian non-coking coal, though minimal across Southeast Asian countries (cumulatively a larger set), would be a monitorable on pricing for Australian and Indonesian varieties, the natural substitutes, he said.

As per India’s current import policy, coal can be freely imported (under open general licence) by consumers themselves considering their needs based on their commercial consideration.

On the coking coal side, around half is procured from Australia. The impact may be more pronounced for this segment where around 25 percent combined on average is sourced from the US, Russia and Canada. “With a drought in Panama (severely hampering operations at the Panama Canal), the transit options are now limited for north American coking coal and an additional voyage of around 10-14 days will be there for the Cape of Good Hope route. As supply is already constrained, there is no substitute supplier available in global market for hard coking coal,” Lodha said.

Coking coal is imported by the steel sector mainly to bridge the gap between the requirement and indigenous availability and to improve the quality. Other sectors like power and cement, apart from coal traders, are importing non-coking coal.

Coal is essential for India’s power sector. To ensure power generation amid rapidly growing demand, the Ministry of Power on January 9 this year directed all central and state generating companies and independent power producers to import coal at 6 percent by weight through a transparent competitive procurement for blending. This mandate has now been extended till March 2024.

Pritish Raj, managing editor, Asia Thermal Coal, S&P Global Commodity, said the impact of the Red Sea issue should ideally be on Russian coal imports, but for some time sourcing from that country has not been quite attractive for Indian buyers. One, because of its losing price competitiveness to other origins and two, due to logistical challenges and rising freight arising from geopolitical tensions including the conflict in Ukraine and attendant sanctions risks.

Indian buyers are now preferring South African material the is priced cheaper by $6-7 per million tonne than Russian thermal coal.

“Moreover, now there's a risk of war insurance premiums increasing, which when clubbed with high freight rates doesn't make economic sense for Indian buyers,” Raj said.

In 2023, South Africa replaced Russia as the third biggest exporter, according to S&P Global data. “Some Indian consumers of Russian coal were even heard to have been pushing ahead their Russian coal contracts for forward months and looking for other-origin material,” Raj said.

On December 6, Minister for Power and New and Renewable Energy RK Singh, told the Rajya Sabha that despite the country reeling under a shortage of domestic coal, widespread power cuts and blackouts were averted in September 2022 with the government's mandate of using imported coal for blending at thermal power plants.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.