Amid the quick commerce boom post-pandemic, the demand for dark stores is being driven by Tier 1 and Tier 2 cities with a requirement of about 24 million sq ft (msf) of space in 2023 in India, as per data gathered from a JLL and Miebach Consulting joint research, accessed by Moneycontrol. The requirement is expected to grow at a steady 12 percent CAGR to 37.6 msf till 2027.

Chandranath Dey, India Head of Operation & BD, Logistics & Industrial at JLL, said, "While India started late on its dark store journey, the growth rate has already caught up with its organised counterparts in the Asia Pacific, like Shanghai and Tokyo, and is on the verge of transitioning. Consolidation of dark stores is eminent to counter compliance and operational risks."

This is exemplified by quick commerce companies like Swiggy Instamart, which announced on September 10 that it plans to expand to Tier 2 and Tier 3 markets by increasing its dark store network. "Our expansion into these new locations allows even more people to experience the ease of having thousands of products delivered in just 10 minutes," Amitesh Jha, CEO of Swiggy Instamart said.

Similarly, Blinkit in its financial report for the first quarter of FY25, said it is planning to more than double its dark store network to 2000 by FY26 from about 639 at the end of June 2024.

On the other hand, e-commerce has redefined how India shops. COVID-19 has compressed delivery timelines to as low as 30 minutes, ensuring zero compromises in product quality. However, the concept of "market at fingertips" means a massive and complex supply chain leading to exponential growth of dark stores across the country.

Here's a deep dive into what a dark store is and how it is evolving.

A dark store is a small warehousing urban distribution centre exclusively for online shopping with an area ranging between 3,000 to 8,000 sq ft located close to densely packed residential areas to meet quick delivery requirements, Srinivas N, Managing Director, Industrial and Logistics, Savills India said.

Dark stores stock a variety of products and operate around the clock. This enables quick access to inventory, reduces transportation costs, has a quick turn-around time, and improves last-mile delivery capabilities.

However, unlike warehousing, dark stores maintain a limited inventory, often with products having a shelf life of less than 24 hours. In contrast, warehouses store a wide variety of materials in bulk quantities, without the same time constraints on product freshness or expiration.

"The current requirements from quick commerce necessitate dark store spaces of 5,000 square feet or larger. The evolution of quick commerce has managed to establish a firm foothold in the market, which indicates a likely increase in the number of these larger stores moving forward," Abhishek Bhutani, Managing Director, Ahmedabad and Logistics & Industrials, Cushman & Wakefield said.

Where are dark stores usually located?A 2021 study by JLL showed that in the e-commerce sector, about 10-15 percent of total kilometres travelled in urban areas contributed to 47 percent of total transportation costs.

This brought dark stores closer to the dense residential areas to ensure efficient and timely delivery. However, real estate costs in urban locations cannot meet retail rental expectations. Therefore, dark stores are usually located in smaller commercial building basements, parking spaces, and defunct facilities in the bylanes or alleyways.

Additionally, these stores are not visited by customers. So, low-cost space is most functional for a dark store.

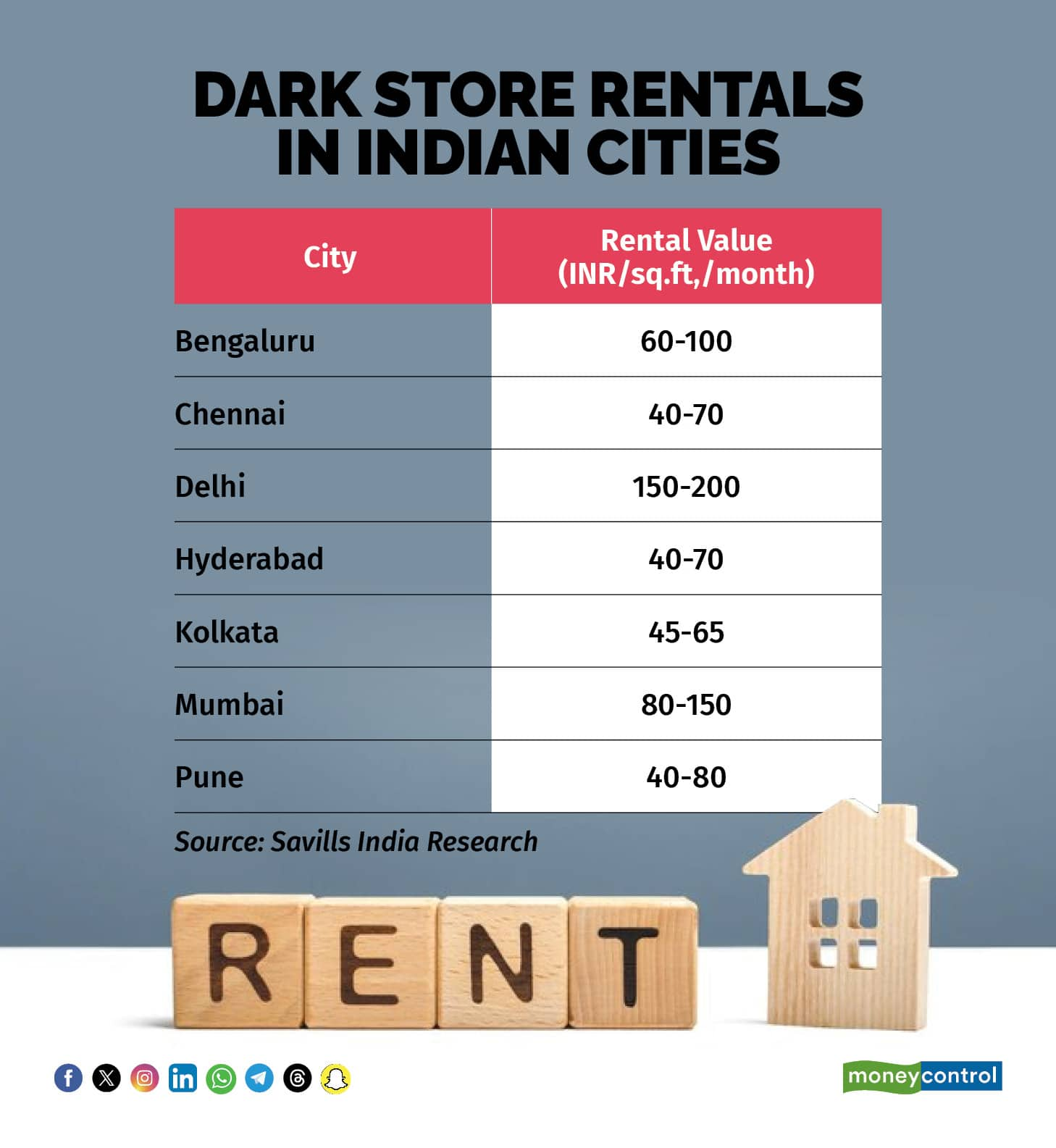

How much are the rentals?A dark store rental is typically lower than retail space due to its strategic position. Data from Savills India show that Delhi commands the highest rental of Rs 150-200 per sq ft. Mumbai comes second with Rs 80-150 per sq ft followed by Bengaluru at Rs 60-100 per sq ft.

Landlords typically rent out these buildings to dark store operators monthly, Srinivas said, with a 9–12-month lock-in period and a lease term of two to three years. The security deposit usually ranges from four to six months of rent. Tenants are responsible for maintaining the premises and paying the actual electricity and water tariffs.

Challenges to expanding dark storesBalbir Singh Khalsa, Executive Director - Industrial Capital Markets at Knight Frank, said across cities dark stores are growing at the rate of 40 percent every year. According to his estimates, Zepto has over 300-400 stores, Blinkit has over 600 and Flipkart is planning for about 100 dark stores.

However, despite such rapid growth of the dark store network, experts expect that only 10-15 percent of them are organised in compliance with local municipal laws.

One of the challenges, according to Anuj Kejriwal, CEO & MD of ANAROCK Retail, lies in the increasing cost of property ownership in areas essential for efficient business operations. In metropolises such as Bengaluru where rental prices are steep in central districts, finding reasonably priced yet strategically located premises poses a difficulty.

Additionally, ensuring the logistical smoothness required for prompt deliveries proves to be a challenge given urban problems like traffic congestion and regulatory barriers, especially within residential precincts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.