Over the past decade, Mirae Asset Investment Managers (India) (Mirae AMC) has been a name to reckon with, on the back of its equity schemes’ performance. Neelesh Surana, the fund house’s chief investment officer (CIO), equities, is largely responsible for giving a consistently solid performance over the years. Surana oversees over Rs 94,000 crore of investor assets. Two of Mirae India AMC’s frontline equity schemes, Mirae Asset Emerging Bluechip and Mirae Asset Large Cap, are among the 20 largest equity funds in the Rs 37 lakh crore Indian mutual fund industry.

In September last year, the fund house touched the Rs 1 lakh crore mark in assets under management (AUM) across equity and debt.

Surana’s investment style is to look for quality businesses, hold on to them and ride their growth. He doesn’t shy away from contrarian bets, as long as the fundamentals of the business are strong. Prior to joining Mirae, Surana worked in the portfolio management services (PMS) industry. He was a senior portfolio manager at ASK Investment Managers.

Surana has demonstrated his stock-picking ability across several market cycles and since joining Mirae MF, he has put in place a strong investment process at the fund house.

In an interaction with Moneycontrol, he tells us how investors should invest their Rs 10 lakh today.

How should investors approach markets at this point of time?In the current environment, if someone is underweight on their equity portion based on the asset allocation, they should move towards equal-weight (rebalance portfolio towards their original equity allocation). They can do so by starting additional SIPs (systematic investment plans). The existing SIPs should definitely continue. Equity investments should be done with the money you are willing to keep aside for three-five years.

We have a positive view on the markets. We believe the Indian economy and corporates will withstand the current risks of oil prices rising again or if interest rates were to rise higher than market expectations.

So investors who do not have a proper asset allocation, they should first revisit their portfolio and construct a proper model. Those who already have an asset allocation model should also revisit it because the falling market would have brought down their equity allocation to an extent.

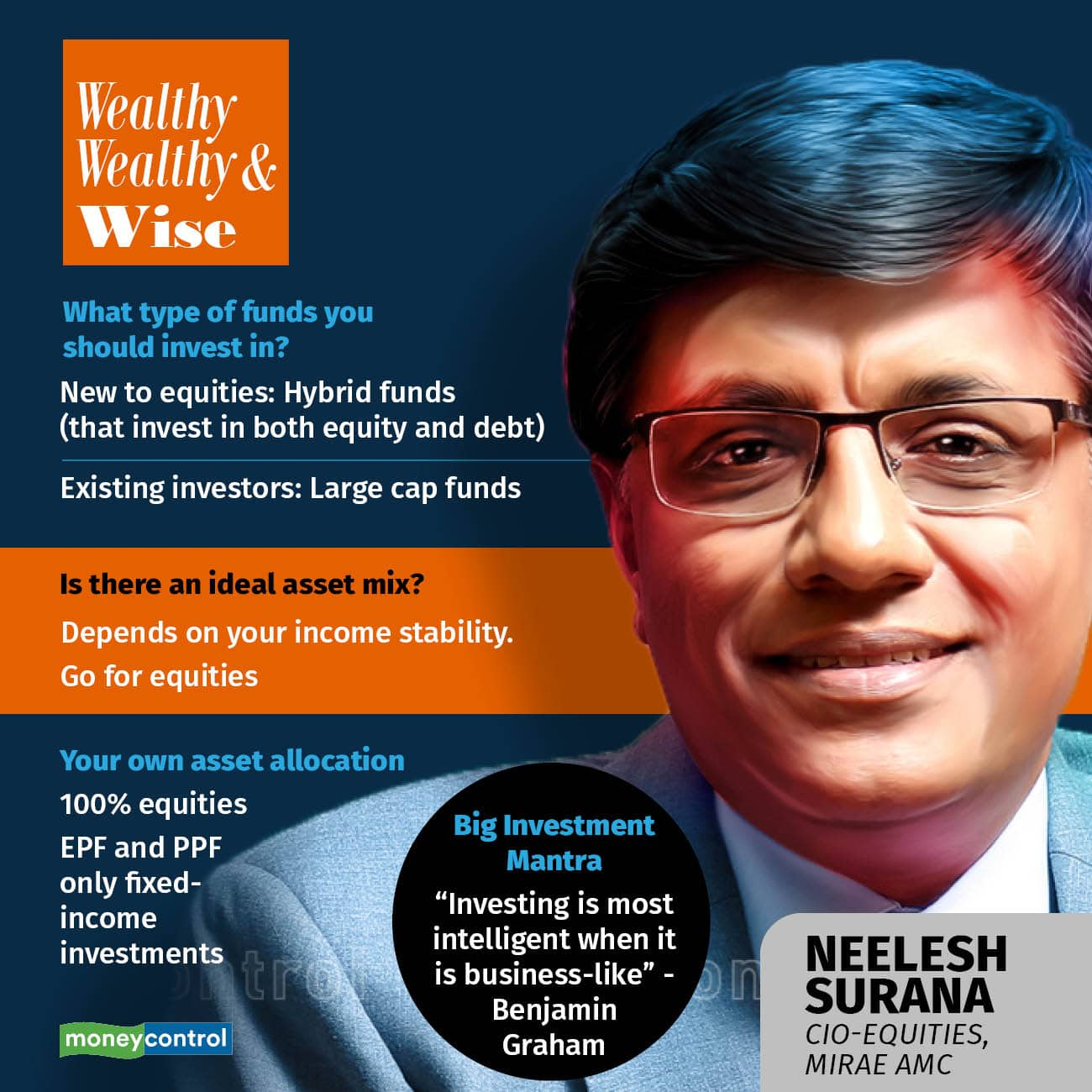

Hybrids (funds that invest in both equity and debt) are usually a good starting point for any investor who is new to equities. Equity savings funds (which have about 40 percent in equities, with the rest in arbitrage and debt) are an excellent product as they come with low volatility and offer higher returns than fixed income funds.

For seasoned investors, there are multiple choices. Of the equity portfolio, at least 70 percent should be towards large-caps in the current market environment. We think that large-caps are better positioned as they are also growing and showing stability in a difficult environment. Large-sized companies will do well as strong companies get stronger and weak ones in the same sector get marginalised.

This depends on the source and stability of income. For example, a rental income is different from income coming from a steady job. The only thing I would say is that equities will generate the best risk-adjusted returns over 5-10 years, i.e., adjusted for volatility. We have seen the Sensex going from 100 to 60,000, 600 times over 42 years. And I see a very exciting next two decades for Indian equities. We would expect 13-15 percent returns for equities, the highest among all asset classes.

Keeping that in mind and if you have enough money that you can set aside for the next three years, maximum allocation to equities is advisable. But again it is a complex decision as someone may have regular income and someone not.

Which sectors are you bullish on?We are positive on leading banking names, healthcare, autos and auto ancillaries, provided the latter are benefiting from the growth of electric vehicles or are agnostic to it. Further, in consumer discretionary, we are positive on building materials, consumer goods, etc.

What is your investment mantra?To quote Benjamin Graham, the father of value investing, “Investing is most intelligent when it is businesslike.” This is a simple yet very powerful phrase. It shows that when you are investing in stocks or investing in an equity fund, your time horizon and mindset should be like as if you are running a business. It should not get influenced by short-term noise related to macroeconomic indicators and news flow. This also means it is important to look for stable businesses that can withstand multiple headwinds, and yet grow earnings.

How do you invest your money?My personal investment approach should not be something that readers should try and copy. I invest 100 percent in equity funds (obviously of Mirae AMC). The only fixed-income investments I have are EPF (Employees’ Provident Fund) and PPF (Public Provident Fund).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.