20 March, 2025 | 16:20 IST

Instant personal loans have become a popular solution for addressing financial needs, offering unsecured credit with minimal paperwork and fast approvals. Whether it’s a medical emergency, a home renovation or any other large spending, quick personal loans provide a hassle-free option to have funds during a cash crunch.

In India, you can secure instant personal loans through the websites or mobile apps of banks and non-banking financial companies (NBFCs). Additionally, digital platforms like Moneycontrol collaborate with top lenders to offer streamlined loan options. Through the Moneycontrol app and website you can access loan offers up to Rs 15 lakhs, offered in partnership with sixlenders. The app provides an entirely digital process, from application to disbursal.

While eligibility criteria for instant loans may vary depending on the lender, with a strong credit profile and a stable income you can conveniently get a personal loan from top lenders. Some instant digital lending platforms even offer pre-approved personal loans, making it possible for eligible users to receive funds almost instantly.

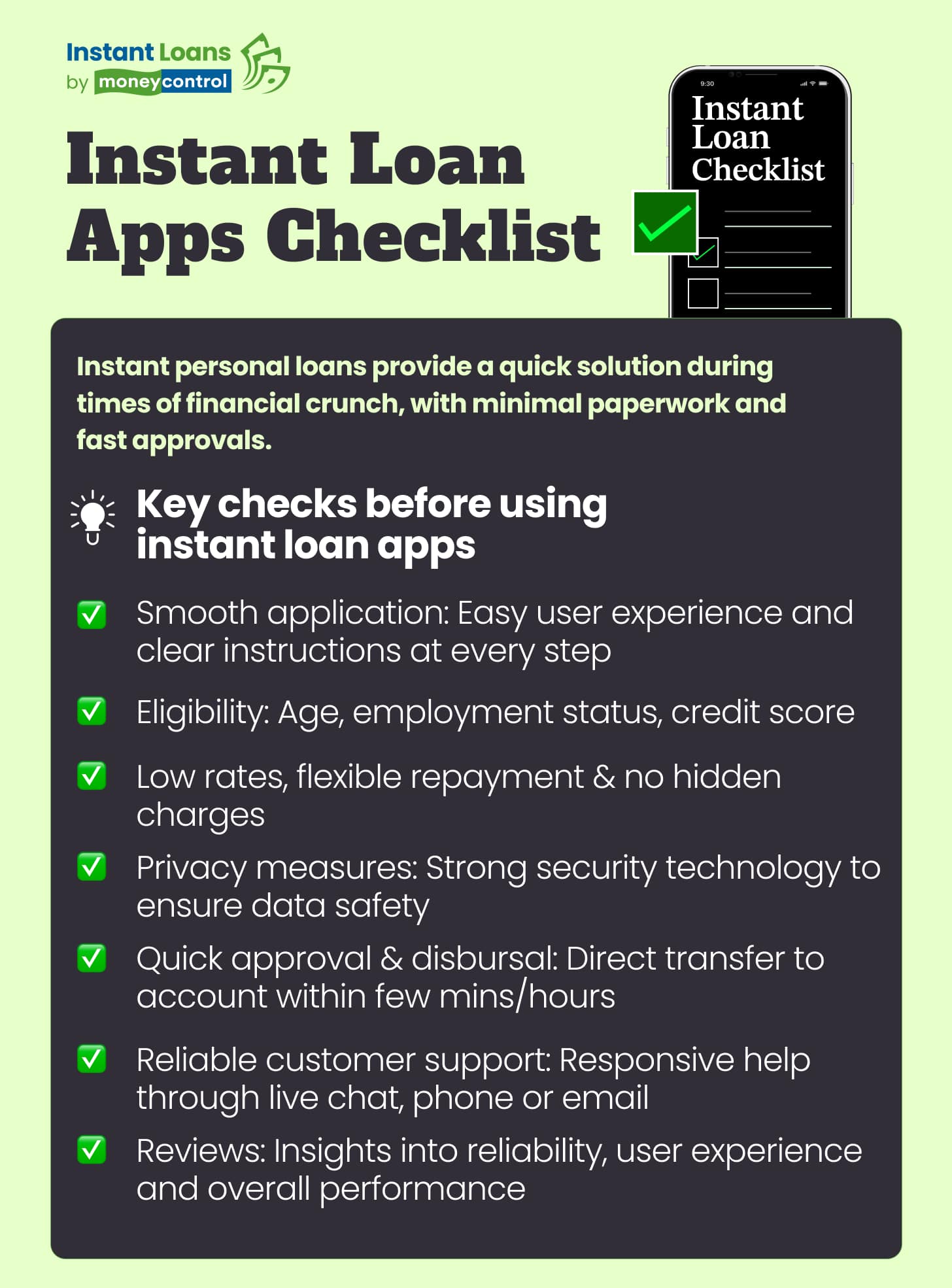

As the popularity of online personal loans grows, the number of instant loan apps available has surged, leaving borrowers spoilt for choice. However, selecting the right app requires careful consideration. Factors like user experience, transparency in fees, approval time and customer support, among others, are essential to ensure a smooth borrowing experience.

Let’s take a look at the important factors to consider before applying for an instant personal loan.

Table of Contents

Seamless application process

An ideal instant loan app should be easy to navigate, ensuring a hassle-free experience for users. Look for an app that simplifies the application process, offering clear instructions at every step. Apps that allow you to complete the entire process digitally without unnecessary delays could be helpful. The user-friendliness of the app plays a significant role in ensuring a smooth borrowing process.

Eligibility requirements

Understanding the eligibility criteria of an instant loan app is essential before applying. Different lending apps may have varying requirements, such as minimum and maximum age, employment status and credit score thresholds. While some cater exclusively to salaried individuals, others extend their services to non-salaried borrowers. Additionally, consider the maximum loan amount offered by the app and ensure it aligns with your financial needs. Evaluating these criteria can save time and prevent unnecessary rejections.

Competitive interest rates and fees

Interest rates and associated charges can vary significantly between lenders, making it crucial to compare your options. Even a slight difference in interest rates can lead to substantial cost variations over the loan term. Opt for an app that offers loans at competitive rates while being transparent about additional charges like processing fees, late payment penalties, or prepayment costs. Selecting an app with favourable terms ensures a cost-effective borrowing experience.

For instance, through the Moneycontrol app you can apply for personal loans with interest rates starting as low as 12% per annum. You can also choose your tenure and the amount from the multiple offers provided through five lenders.

Flexible repayment options

Repayment flexibility is another critical factor to evaluate. Apps that allow borrowers to customise repayment terms based on their financial situation provide greater control over budgeting. A flexible repayment plan helps borrowers manage their loan repayments more effectively, reducing the likelihood of financial strain.

ALSO READ: Personal Loan Prepayment: Key points to consider before paying off your loan earlier

Privacy measures

With increasing instances of cybercrime and data breaches, safeguarding your personal and financial information is paramount. Instant loan apps require sensitive details during the application process, so it’s essential to verify their security measures. Choose apps that employ encryption or other advanced security technologies to protect your data. Additionally, reviewing the app’s privacy policy can provide clarity on how your information will be used and stored.

Quick approval and disbursal

One of the main advantages of instant loan apps is quick access to funds. Prioritise apps known for their speedy approval and disbursal processes. The best apps transfer the approved loan amount directly into your bank account within minutes or a few hours, ensuring you can address your financial needs promptly.

ALSO READ: How to get a quick personal loan: Your essential guide for instant loan approval

Reliable customer support

Dependable customer service is a hallmark of a trustworthy loan app. Opt for apps with responsive and helpful support teams that can assist you during the application process or address any issues that arise during repayment. Check whether the app offers multiple communication channels, such as live chat, phone support, or email, to ensure you can reach them conveniently when needed.

User ratings and reviews

Lastly, take the time to read user reviews and ratings for the loan app you’re considering. Feedback from other borrowers can provide valuable insights into the app’s reliability, user experience, and overall performance. High ratings and positive reviews indicate high reliability on the app, while negative reviews can help you avoid potential pitfalls.

Instant loan apps provide a convenient way for borrowers to access funds swiftly and with minimal hassle. Understanding the key features to look for in such apps can empower you to make an informed choice, ensuring a seamless borrowing experience.

To apply for an instant loan on Moneycontrol, follow these simple steps:

Share it in your circle

Table of Contents

Explore Top Lenders for Instant Loan upto

Get Instant Loan up to ₹50 Lakhs with Zero Paperwork from Top Lenders

100% Digital

100% Digital Quick Disbursal

Quick Disbursal Low Interest Rates

Low Interest Rates