The finance minister presented her fifth and the last full-fledged budget of the Modi 2.0 government. The proposals have provided tax relief to both middle-class and the high-net worth taxpayers.

Here is a brief look at some of the important personal income-tax changes proposed in the Budget presented before Parliament on February 1, 2023:

New Tax Regime (NTR) gets a boost

The Finance Minister has announced the following changes in NTR to make it more appealing.

Individuals having income up to Rs 7 lakhs under NTR is proposed to be exempted through a tax rebate from the erstwhile threshold of INR 5 lakhs. This leads to a tax saving of INR 33,800.

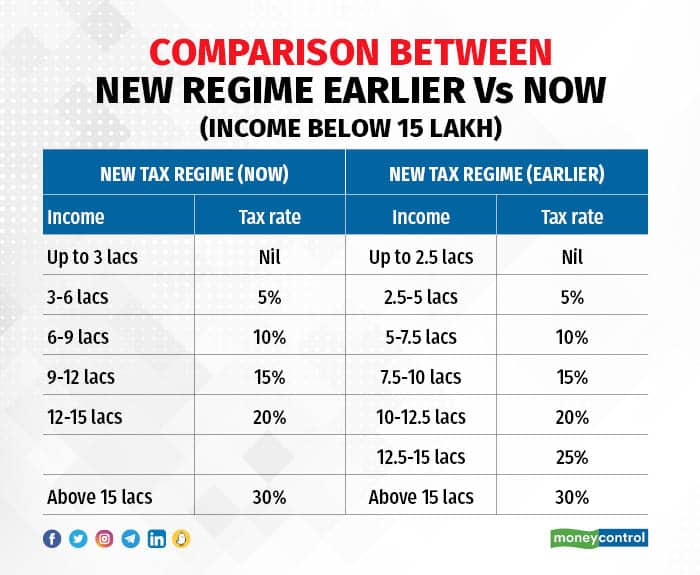

Under the NTR, hike in basic exemption limit from Rs 2.50 lakh to Rs 3 lakh. Also, subsequent income slabs have been proposed to be amended as follow:

A standard deduction of Rs 50,000 from salary/pension and a prescribed deduction on family pension income is proposed to be allowed under NTR.

Aforesaid proposed change in slab rate and standard deduction under NTR will result in a tax saving of Rs 54,600 for the salaried taxpayers having an income of Rs 15.5 lakhs

The highest surcharge rate reduced from 37 percent to 25 percent under NTR. This will reduce the effective tax rate for individuals in the highest tax slab from 42.744 per cent to 39 per cent.

NTR will now be the default tax regime. Nonetheless, taxpayers can opt for the old tax regime depending upon their individual situation and subject to certain conditions.

Proposals that affect your money box

Leave encashment limit increased: The tax exemption limit on leave encashment for non-government employees has been proposed to be increased from Rs 3 lakh to Rs 5 lakh, subject to further notification.

Deduction from long-term capital gains under sections 54 and 54F has been proposed to be capped to Rs 10 crore on reinvestment of capital gains/sale proceeds in immovable residential property.

Any proceeds from a life Insurance policy issued on or after 1 April 2023 [other than Unit Linked Insurance Plan (ULIP) and Keyman Insurance] having an annual premium exceeding Rs 5 lakh in any year during the term of the policy, is proposed to be taxable net of premium paid, except in case of death of insured person.

The interest payments on the housing loan claimed as a deduction while computing the Income from the house property are proposed not to be considered as part of the cost of acquisition, for computing capital gains at the time of transfer of such house property.

The conversion of the physical gold into Electronic Gold Receipt (EGR) or conversion of EGR into Gold is proposed to not be considered as “transfer” of assets. Hence, no capital gains would arise on such a conversion. At the time of sale of such converted asset, for the purposes of computing the capital gains, the period of holding and cost of acquisition of the original asset (Gold/ EGR) is proposed to be considered.

The budget has proposed to provide relief to middle-class taxpayers having total income up to Rs 7 lakhs wherein they would not be required to pay any income tax under NTR.

Individual taxpayers having income more than Rs 5 crore may prefer NTR given the significant reduction in surcharge rate from 37 percent to 25 percent resulting in a reduction in the marginal tax rate to 39 percent from 42.744 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!