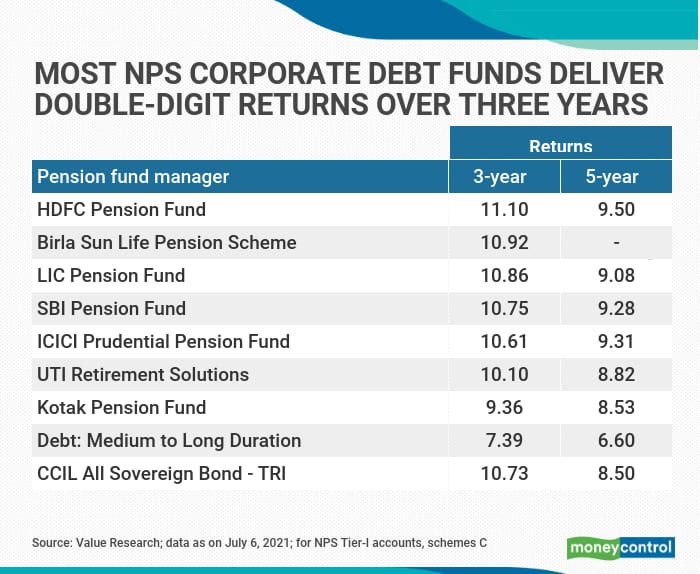

All National Pension System (NPS) fund managers’ corporate debt schemes (Tier I) have stolen a march over their mutual fund counterparts across three- as well as five-year time horizons (see table).

Four of the seven pension funds also managed to beat the benchmark CCIL All Sovereign Bond (total returns index) as of July 6, 2021, as per data from Value Research. HDFC Pension Fund and Aditya Birla Sun Life pension funds have been the top performers in this category over three years. The former has outperformed its pension fund peers, debt mutual funds as well as the benchmark over five years too.

NPS is amongst the most economical pension schemes in the world, despite the imminent rise in investment management charges. At the moment, the charges are around one basis point. The number of pension fund managers could also go up with the Pension Funds Regulatory and Development Authority’s (PFRDA) inviting applications from sponsors. It has created four charge slabs that will be linked to assets under management and the floor is set at 0.03 percent. The maximum cap on the charges is 0.09 percent. This structure does not include brokerage, custodian fees and taxes. The pension funds’ equity transactions will attract an additional brokerage of up to 0.03 percent.

Besides significantly lower fees, NPS also offers tax benefits for investing in these schemes. You claim deductions of up to Rs 1.5 lakh under section 80C, additional Rs 50,000 under 80CCD (1B) and up to 10 percent of your basic pay under section 80CCD (2). The latter tax exemption is available under the with-deductions regime as well as the new system introduced in the financial year 2020-21. However, tax on annuity income is a major dampener given that 40 percent of the NPS corpus at vesting has to mandatorily be utilised to buy annuities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.