personal-finance

Coming soon: Higher NPS fund management charges

Jul 06, 03:07

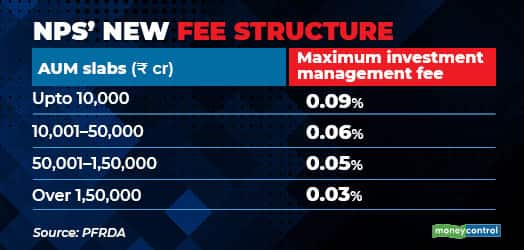

Investment management charges for National Pension System (NPS) funds are set to rise. At present, it is just one basis point, making it one of the cheapest investment avenues in India. PFRDA, the body that oversees NPS, has come up with four charge slabs linked to assets under management (AUM), as part of its invitation for applications from prospective sponsors for managing pension assets. The maximum fee levied can go up to 0.09% while the floor is fixed at 0.03%. The charge structure does not include brokerage, custodian fees and taxes. For equity transactions, pension funds can charge a maximum brokerage of 0.03%. Despite the hike, NPS will continue to be cheaper than even direct mutual funds.