Indore Municipal Corporation (IMC) has launched India’s first public issue of municipal bonds intending to raise up to Rs 244 crore to fund a solar power project. This would be the first time a municipal body is targeting individual investors in India.

The base issue size is Rs 122 crore with an option to retain an oversubscription of up to Rs 122 crore, aggregating up to a limit of Rs 244 crore.

The issue will remain open for subscription during February 10-14. This is also a green bond as the proceeds will be used to fund a 60 MW captive solar photovoltaic power plant at the villages of Samraj and Ashukhedi in Madhya Pradesh’s Khargone district.

Also read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemes

Here’s what you need to know before investing in these municipal bonds (MC).

About muni bonds

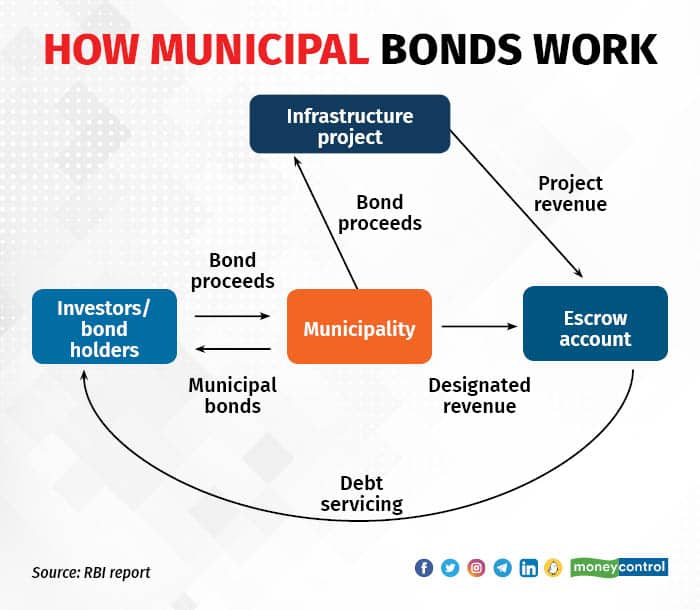

Municipalities are now allowed to issue bonds to raise money to fund public infrastructure, such as roads, water supply and sewerage.

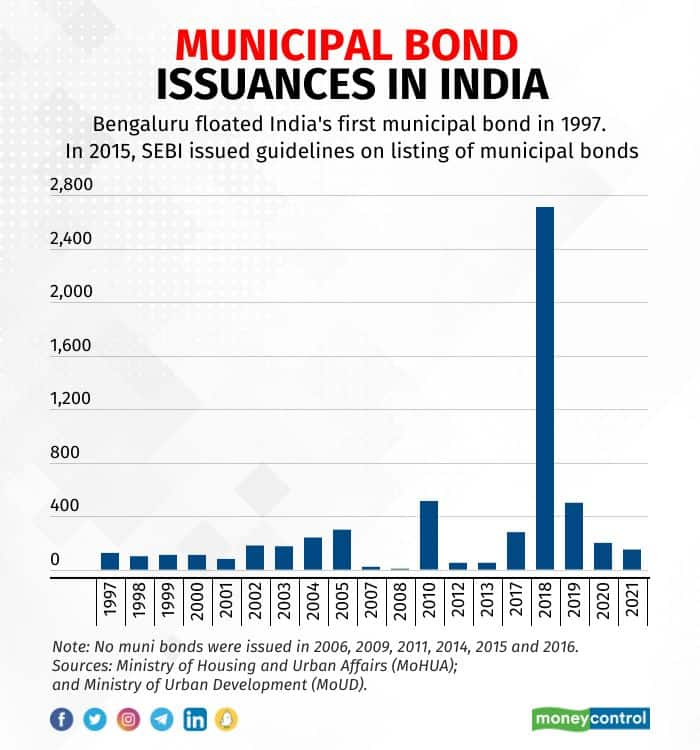

Although IMC is the first to target individual/retail investors, municipal bonds have hit the street before but catering only to institutional investors. Bengaluru MC floated municipal bonds for the first time in India in 1997, followed by Ahmedabad MC in 1998.

Municipal bond issuances came to a sudden halt after 2005 with the launch of the Jawaharlal Nehru National Urban Renewal Mission.

To revive municipal bonds, the capital markets regulator Securities and Exchange Board of India (SEBI) came up with guidelines for issuing and listing municipal bonds in 2015.

Also read | Sebi launches information database on municipal bonds

Notably, the Indore MC became the first municipal corporation to list on the National Stock Exchange of India (NSE) in 2018 while Ghaziabad MC became the first municipal corporation to issue green bonds in India in 2021.

According to a Reserve Bank of India’s (RBI) report on municipal finances issued in November, the coupon rates offered by the MCs are generally higher than the government bonds of similar maturity, even though they are rated as adequately safe with low credit risk.

Also read | Listing municipal bonds can pave way for developing secondary market: RBI

How they differ

Government Securities (G-secs) and State Development Loans (SDLs) are issued by the Centre and state governments, respectively, to fund fiscal deficits, while a municipal bond is a bond issued by a city, town, or state to raise money for public projects.

G-secs and SDLs are sovereign guaranteed but muni bonds may or may not come with a sovereign guarantee and their ratings depend on the corporation’s balance sheet and its financials.

In terms of interest payout, India's benchmark bond yields (10-year bond yields) are hovering around 7.30-7.35 percent for the past few days.

On the other hand, the bonds of Lucknow MC (issued in December 2020) have a coupon rate of 8.5 percent, while the bonds of Ghaziabad MC (issued in April 2021) have a coupon rate of 8.1 percent.

What do Indore muni bonds offer?

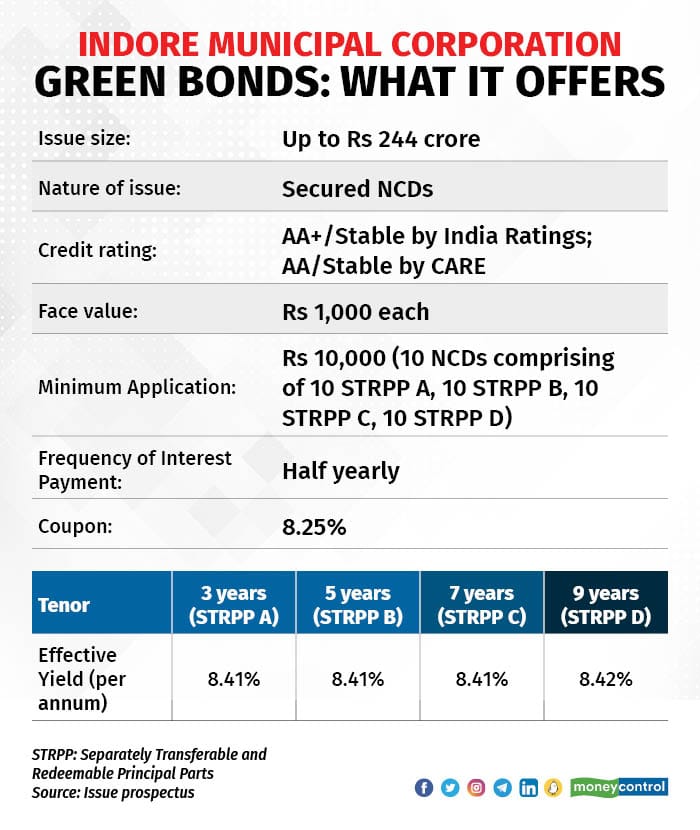

Indore MC’s public issue of rated, listed, taxable, secured, redeemable and non-convertible green municipal bonds have a face value of Rs 1,000 each and a minimum application of Rs 10,000.

Each bond comprises four separately, transferable and redeemable principal parts (STRPP) with each STRPP having a face value of Rs 250.

The green bonds have a tenor of three years (STRPP A), five years (STRPP B), seven years (STRPP C) and nine years (STRPP D).

Note that investors will have exposure to all four tenors in each non-convertible debenture (NCD).

The green bonds, which are proposed to be listed on NSE, offer a coupon rate of 8.25 percent per annum payable half-yearly and come with an effective yield of 8.42 percent per annum.

Principal repayments will be made in four equal instalments of 25 per cent each for different tenors (3, 5, 7 and 9 years) of the total issue size for each STRPP.

The issue has been assigned a credit rating of AA+ with a stable outlook by India Ratings & Research and AA with a stable outlook by CARE Ratings.

Divyank Singh, IAS, Chief Executive Officer of Indore Municipal Corporation in a response to Moneycontrol’s queries said, “Higher demand is expected for this first public issue of the municipal bonds in India. The proposed issue is fully secured through escrow on revenue streams of IMC through waterfall mechanism.”

Singh added that four STRPPs independently tradable at the exchange will provide higher liquidity to investors.

How to apply?

As per SEBI operational circular, an eligible investor wanting to apply in the issue can make applications only through the ASBA process.

In ASBA, or Application Supported by Blocked Amount, an application contains an authorisation to block the application money in the bank account, for subscribing to an issue. If an investor is applying through ASBA, her application money will be debited from the bank account only if the application is selected for allotment.

You can apply through partner banks or registered stock brokers, registrar and transfer agents and depository participants, as well as stock exchanges.

Taxation of muni bonds

Unlike many western countries, there are no special tax benefits. Interest income is taxed as per your income tax slab rates. Further, the capital gains arising on the transfer of municipal bonds are not tax-exempt, while tax at source is deducted on interest as per the rate applicable under the IT Act.

What works?

Experts feel that the risk associated with muni bonds is minimal and Indore Municipal Corporation carries a rating of AA+, which is the second-highest credit rating.

According to Vikram Dalal, Founder and Managing Director, Synergee Capital Services, while the issue is not sovereign backed, it is implied that if there is any complication tomorrow, the Madhya Pradesh government will step in. “The corporation is also financially strong,” he said.

In terms of financials, the corporation’s revenue income for 2021-22 was Rs 1,739.95 crore compared with Rs 1,508.10 crore in the year-ago period and expenditure was Rs 1,107.88 crore in the financial year 2022, excluding interest and depreciation.

Also read | MC Explains: Indian municipalities and their finances

Further, the issue is offering an effective yield of up to 8.42 percent, which is good for a “sub-sovereign paper”.

What doesn’t work?

Despite being issued by a municipality, this is not an AAA-rated issue, unlike government security. To be sure, none of the municipal corporations in India is AAA-rated.

Further, the issue doesn’t have any sovereigns guarantee and the only entity responsible for the repayment of the debt is the municipal corporation itself.

The proposed project is subject to the risk of unanticipated delays in implementation and cost overruns.

Therefore, any such unanticipated delays in implementation and cost overruns of the project may have an adverse impact on the corporation’s operations, reputation and cash flows.

Also, the corporation’s financing agreements impose certain restrictions on its operations, and the failure to comply with operational and financial covenants may adversely affect its operations and reputation.

Experts feel that the instrument is a bit complicated because of the breakdown into four STRPPs in the bond issue.

“Each NCD will be split into four parts and each of the STRPPs will mature in three, five, seven and nine years. The investor doesn’t have an option when it comes to tenors and may find it difficult to keep track of the repayments in terms of taxation,” Dalal said.

What should investors do?

Financial experts say retail investors can subscribe to the issue.

Deepak Panjwani, Head-Debt Markets, GEPL Capital, said, “Investors can go for Indore Municipal Corporation’s public issue as the city is continuously receiving the Clean City of the Country Award for the last couple of years and their corporation is working on the right path. Further, payable semi-annually, the yield is 8.42 percent, and investors can access that as interest rates are very near to their peak and over a period of time the yields will fall.”

Dalal also said that investors can go for the issue. “For example, an investor having a corpus of Rs 100 earmarked for fixed income can invest up to 10 percent in the issue,” he said.

Note that only up to 25 per cent of the issue has been reserved for retail individual investors, and the allotment will be done on a first-come-first-serve basis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.