Every year, World Health Day is observed on April 7.

This year’s theme was ‘Health for all’, which is relevant now more than ever as health concerns are no longer restricted to old age. With fast-changing lifestyles and increased stress levels, individuals across age groups are becoming susceptible to health hazards.

This is especially true for individuals in their 40s who often struggle to strike a balance between their professional and family responsibilities. This makes them vulnerable to higher stress, which, in turn, brings health concerns in the long run. This makes the 40s a crucial period to take stock of health and make decisions about the kind of health coverage required.

If you are in your 40s, while relooking at your existing health coverage, you should also consider upgrading the same to protect yourself and your loved ones from unexpected health issues and rising healthcare costs. Here is how you can do so.

Also read: World Health Day | Health insurance gets a face-lift: Companies roll out premium lock-in, unlimited sum insured, coverage for diabeticsImportance of adequate health cover and factors to considerAfter turning 40, the likelihood of lifestyle-related illnesses gradually increases. This age range is also when you may experience significant financial obligations, such as caring for elderly parents, repaying home loans, or supporting your children. The cost of hospitalisation is also on the rise with an increase in inflation. Thus, if you do not have adequate medical insurance, an unexpectedly large healthcare expense could severely disrupt your financial planning.

Additionally, as you get older, obtaining insurance becomes more challenging, particularly after reaching your 50s. This makes it crucial to upgrade your health coverage annually to match the increasing healthcare expenses.

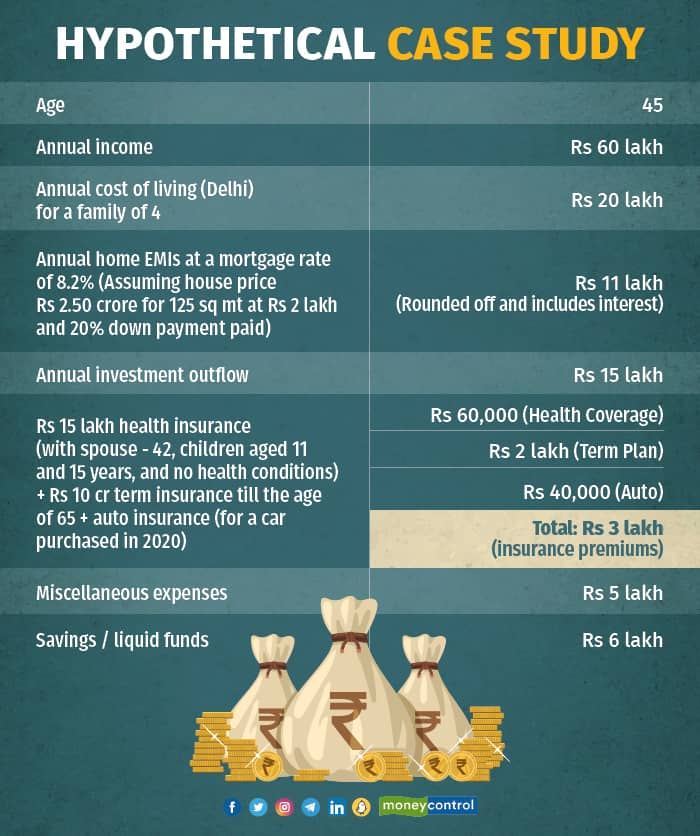

Also see: Moneycontrol SecureNow Health Insurance RatingsLet’s take a hypothetical case study for an individual named Shashi, in his 40s, who lives in Delhi with his wife and two kids.

Shashi has a health plan of Rs 15 lakh, which covers his wife and two children as well. He suffered a critical medical condition, the hospitalisation for which cost him Rs 25 lakh. His insurance is only going to cover Rs 15 lakh, which means he needs Rs 10 lakh more. Now, he needs to pay this from his savings/emergency fund or liquidate a part of his investments.

Both these options will substantially impact Shashi’s finances. With adequate coverage and a regular increase in health coverage over the years, this situation could have been easily avoided without Shashi needing to pay from the pocket.

Instead of the standard 10-15 percent coverage increase, you should consider raising your coverage between 30 percent and 40 percent in your 40s. Thus, it would not be an overstatement to say that you should increase your medical insurance coverage between the age of 40 and 50 years.

Also, when you are in your 40s, you need to pay comparatively less for a higher coverage than in your 50s. Thus, you should gradually increase your coverage and consider your spouse’s age and lifestyle, too, if it's joint coverage.

It is recommended to have a coverage of at least Rs 25 lakh-Rs 30 lakh, depending on your lifestyle, geographical location (higher coverage for metropolitan areas) and whether it is individual coverage or for your spouse or family members are also included.

How to decide on an upgrade and how to choose the best optionThere are various factors to be considered while upgrading your health coverage. They include health concerns, family’s medical history, hereditary conditions, lifestyle factors such as diet, exercise, and stress management, and future health goals and life changes you may plan to undertake.

Also, any lifestyle choices such as smoking or drinking can also impact the coverage amount you may require.

You should also educate yourself about the types of health coverage available. For example, you can increase the limit of your existing insurance policy at the time of renewal or you can purchase a fixed benefit cover, over and above your base insurance.

A fixed-benefit cover includes hospital expenses and critical illness costs and can be particularly beneficial if you haven't accumulated significant savings. This cover gives you a fixed payout, based on just diagnosis and can supplement the lost income you tend to face, especially when you get diagnosed with life-threatening diseases such as cancer or cardiac diseases.

You can also consider a super top-up cover that goes beyond your base insurance. For instance, if you have a base policy of Rs 15 lakh, you can revise the same to Rs 25-35 lakh, ensuring that your overall coverage is high. This coverage only activates if your claim amount exceeds Rs 15 lakh.

Also, purchasing a top-up cover is less expensive than the premium you may require to pay for increasing the regular policy value to that amount. It is advisable to get the super top-up coverage from the same insurance company as your regular insurance to facilitate coordination.

Ultimately, the decision on which type of upgrade you want– whether additional insurance or increasing the limit of your existing health insurance should be based on research, cost comparison, individual/group insurance, and the amount of upgrade. In case of doubt, it is advisable to get in touch with an expert and make an informed decision.

Also read: Want to increase your health insurance cover at low cost? Buy a top-up or super top-up policyConclusionThere is no doubt that health is wealth. While it is important to keep yourself fit and healthy, it is equally important to secure yourself and your family financially by having adequate health coverage in place.

Also read: The best insurance policy for a senior citizen: Personal policy or employer’s group policy?Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!