Increasing education costs is an area of significant concern for many parents. Education costs have risen much faster than many parents would have anticipated. For example, an MBA in a premier college in India would have cost you roughly Rs 10 lakh -12 lakh in 2013. Today, enrolling in the same college or institute will mean shelling out Rs 22 lakh -25 lakh.

Industry estimates suggest that education inflation in India was around 11-12 percent over the last decade vis-à-vis six percent of Consumer Price Inflation (CPI) during the same period. And this phenomenon will continue in the future as well. As demand increases, the prices will increase sharply. That is precisely the reason why a ‘college fund’ is necessary.

But what is a college fund? As the name suggests, it is an amount kept aside specifically for higher education - to accumulate the money to fund higher education.

But how do you create a college fund? This is the step-by-step guide:

Step 1: Determine how much it costs to pursue the desired course today.

To project how much a course would cost in the future, you should know the present cost. So, decide on the course you wish your child to pursue and find out how much it costs today.

Step 2: Ascertain the time in hand to arrange for these expenses

You need to know when you will be required to incur the expenditure to forecast the future cost, hence determine how much time you have.

Step 3: Project the estimated cost using expected inflation.

Generally, higher education costs have increased at a CAGR of 10-11 percent. Assuming the same trend would continue, we should compute the expected cost when the child enters college. This would be your target amount.

Also read | Education funding: Not just bank FDs, there are other ways tooStep 4: Compute investment amount required to reach the target amount

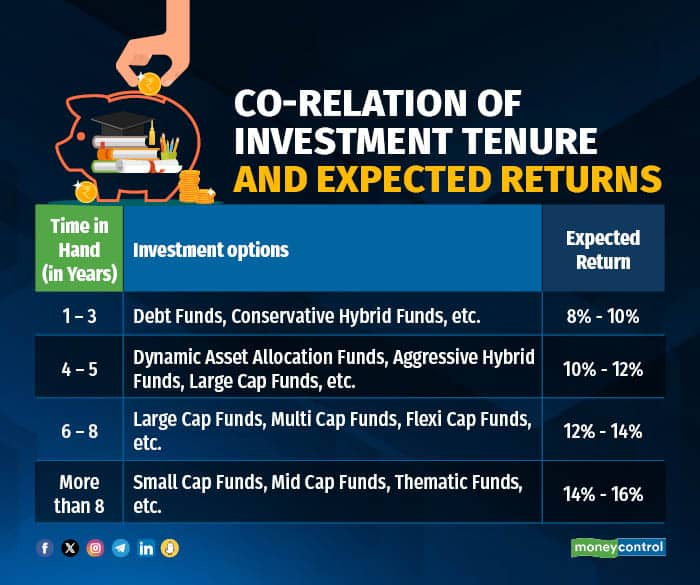

The earlier you start, the more time you have and, hence, higher risk appetite. Thus, regular smaller investments will work for you because of the power of compounding. But as the time in hand reduces, your risk-taking ability reduces; hence, you need to save more money to reach your goal. A simple rule in finance tells us that the higher the risk appetite, the higher the expected return.

You can use the SIP calculator to find out the monthly investment required to reach the target amount.

Step 5: Invest and monitor the investments regularly

Now, the question remains: where to invest? The answer depends on the time on hand. The longer the period, the higher the risk appetite; hence, equity funds can be considered. As the time in hand reduces, the risk appetite reduces; hence, less risky funds should be considered (see graphic).

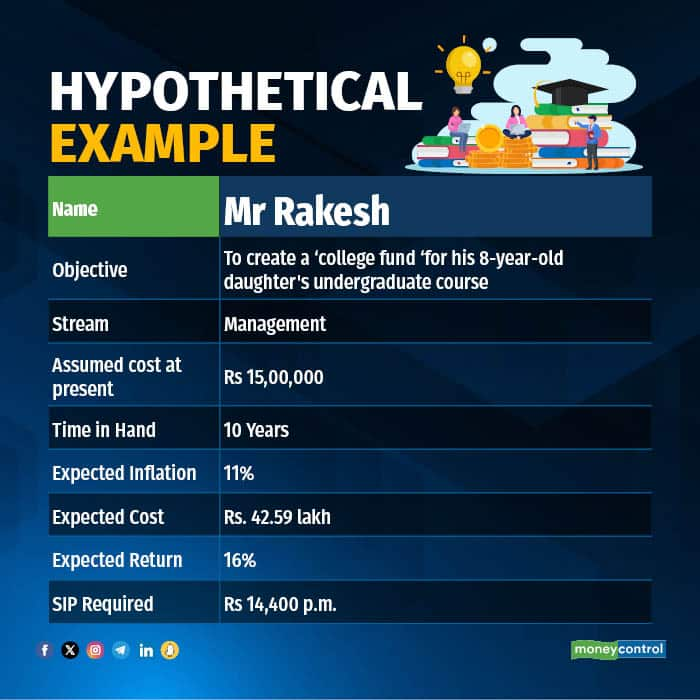

Let us understand the above process through a hypothetical example (see graphic).

So, Rakesh will be required to invest Rs 14,400 monthly to reach the target amount in 10 years. Since the time horizon is long, he should consider high-risk equity funds to reach the goal.

Investing in a portfolio of funds with suitable expected returns would be appropriate rather than investing in a single fund to achieve diversification and reduce risk. Also, investments should be monitored and rebalanced periodically. As you get closer to your goal, you need to reallocate the investments from high-risk to low-risk instruments as the risk-taking ability reduces.

In a nutshell, as the cost of higher education continues to rise rapidly, the importance of establishing a dedicated college fund cannot be overstated. It is better to bear the tiny pinch of keeping money aside today than to regret the missed opportunity in the future.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.