Finance Minister Nirmala Sitharaman on Saturday presented Budget 2025 in the Parliament, her eighth consecutive Budget. She announced some major changes on the personal taxation front.

Let us look at some key amendments proposed around personal tax in the Budget 2025:

1. Tax rates under new tax regime

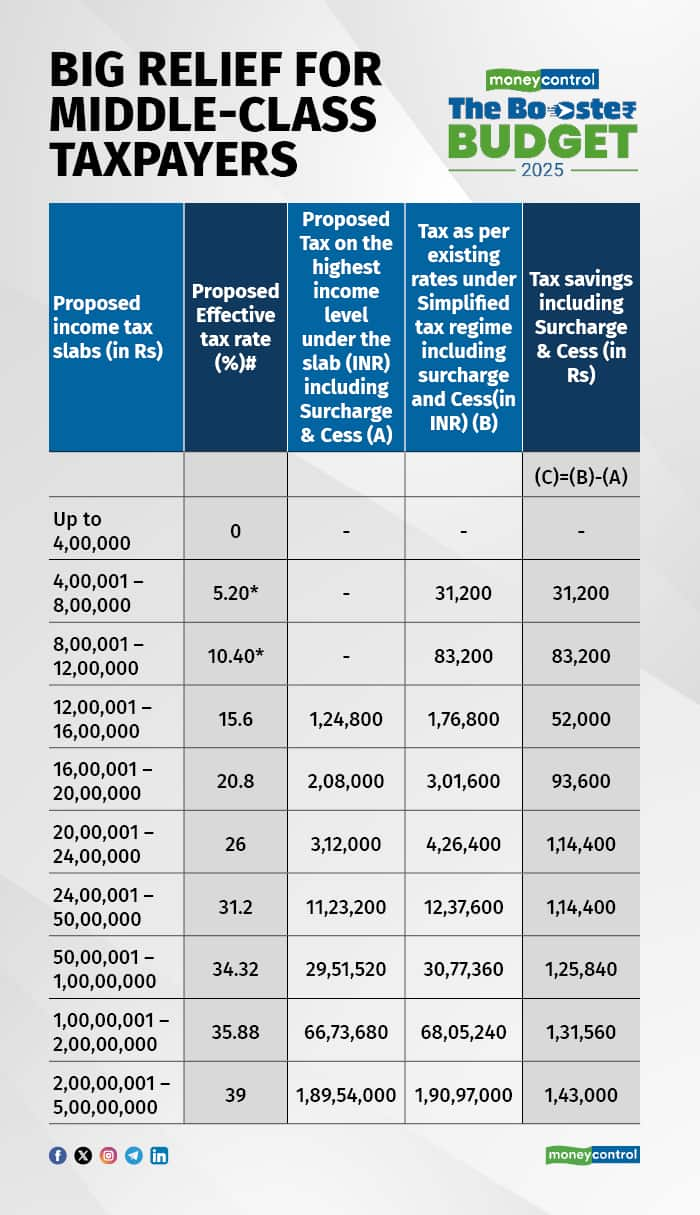

The Budget proposes to revise the tax rate structure under the new tax regime while keeping the rate structure under the old tax regime unchanged.

Here is the proposed revised tax rate along with a comparison with the tax rate structure as per the existing simplified tax regime and tax savings for a resident individual (not being a senior citizen).

In the above graphic, do note that the tax rebate is available for resident individuals whose total taxable income does not exceed Rs 12 lakh. Also, standard deduction of Rs 75,000 is available against salary. Hence, for salaried individuals, the tax liability under the proposed new tax regime for incomes up to Rs 12.75 lakh, is nil.

Also read: Big boost to the middle class: No tax on incomes up to Rs 12 lakh under the new regime, says FM

2. Extended timeline to file updated return

Currently, the timeline to file an updated return is 24 months from the end of the relevant assessment year. The Budget proposes to extend the time limit to file the updated return, to 48 months from the end of relevant Assessment Year (AY). Additional tax payable would be as follows:

| Period | Additional tax payable |

| After expiry of 24 months up to 36 months from the end of AY | 60% of aggregate tax and interest |

| After expiry of 36 months up to 48 months from the end of AY | 70% of aggregate tax and interest |

TDS provisions have various thresholds of amount of payment or amount of income paid to residents, beyond which tax is required be deducted. Budget has proposed to rationalise these thresholds as below:

| Incomes | Current threshold | Proposed threshold |

| Interest on securities (Section 193) | Nil | Rs 10,000 per year |

| Interest other than interest on securities (Section 194A) | When payer is bank, cooperative society and post office (i) Rs 50,000 for senior citizen (ii) Rs 40,000 in case of others. In other cases – Rs 5,000 | When payer is bank, cooperative society and post office (i) Rs 1,00,000 for senior citizen (ii) Rs 50,000 in case of others In other cases - Rs 10,000 |

| Dividend paid to an individual shareholder (Section 194), and income in respect of units of a mutual fund or specified company or undertaking (Section 194K). | Rs 5,000 per year | Rs 10,000 per year |

| Insurance commission (section 194D), and commission or brokerage (194H) | Rs 15,000 per year | Rs 20,000 per year |

| Rent (194I) | Rs 2,40,000 during the financial year | Rs 50,000 per month or part of a month |

| Fee for professional or technical services (194J) | Rs 30,000 per year | Rs 50,000 per year |

4. Rationalisation of TCS threshold

Currently, TCS is required to be collected on remittance made under the Liberalised Remittance Scheme, on an amount exceeding Rs 7 lakh per annum. This limit is proposed to be increased to Rs 10 lakh. Further, it is proposed that no TCS is required to be collected on the amount remitted abroad as a loan taken from specified financial institutions for education.

5. Annual value of the self-occupied property

Presently taxpayers can claim the annual value of self-occupied properties as NIL for 2 properties, provided the following conditions are satisfied:

- where the house property is occupied by the owner for the purposes of his residence; or

- where the owner cannot actually occupy it due to his employment, business, or profession carried on at any other place.

Considering the difficulties faced by taxpayers, it is proposed to do away with the above conditions for which the property cannot be occupied by the individual and extend the benefit in respect of property that cannot be occupied for any reason.

Overall, the Budget focuses on providing significant benefits to the middle class by reducing the tax rates and thereby increasing the take-home pay for individuals. It is clear that the Budget is aiming to further promote the adoption of the new regime. One will have to wait till next week for the New Tax Bill to be announced by the FM, to see what additional changes are proposed to be introduced.

(With inputs from Niji Arora, Director, Tarika Agarwal, Manager, and Ami Rathod, Deputy Manager with Deloitte Haskins & Sells LLP)

(Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!