Senior citizens dependent on bank fixed deposits (FDs) for their monthly cashflows have had a tough time over the past year or so due to plunging interest rates. The interest rates on small-saving schemes too have declined sharply. This is because the Reserve Bank of India (RBI) has steadily cut repo rates. Banks have followed the same trajectory and gradually reduced the interest rates on fixed deposits across tenures.

Even so, there are some banks that offer attractive rates on three-year FDs for senior citizens.

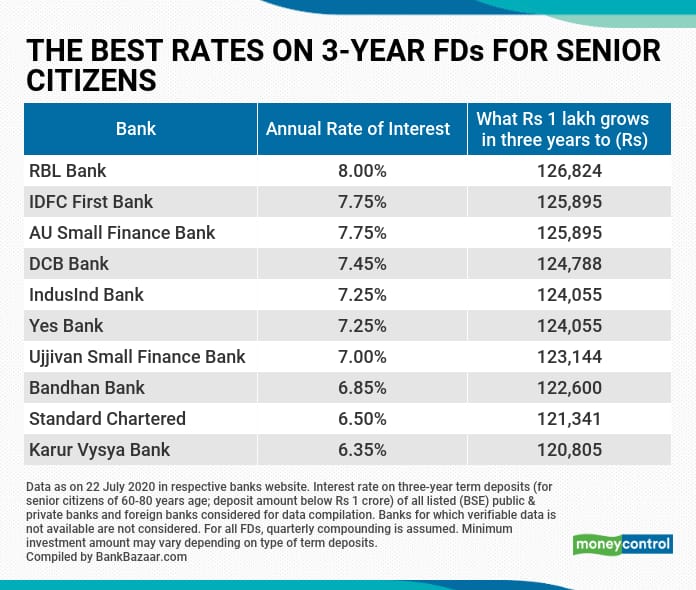

Higher rates offered by smaller private banksAs many as five private sector banks and two small finance banks offer FDs with rates in excess of 7 per cent for a three-year tenure. RBL Bank, IDFC First Bank, DCB Bank, IndusInd Bank and YES Bank offer 7.25-8 per cent interest on their three-year FDs, according to data compiled by BankBazaar shows.

Investments in fixed deposits of up to Rs 5 lakh are guaranteed by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the RBI.

Axis Bank, ICICI Bank and HDFC Bank offer 6 percent, 5.85 per cent and 5.70 per cent respectively on three-year FDs for senior citizens, while the State Bank of India (SBI) and Bank of Baroda (BOB) pay 5.80 per cent and 5.60 per cent, respectively.

The minimum investment amount varies from Rs 100 to Rs 20,000 for three-year fixed deposits across banks.

Senior citizens can park a small portion of their debt portfolio in such FDs for better returns.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.