Fintech major PhonePe, which is backed by e-commerce giant Flipkart, has become latest entity to apply for mutual fund (MF) license from market regulator Securities and Exchange Board of India (SEBI).

Navi MF, which is backed by Sachin Bansal's fintech group, has already got the MF license and has filed for several new fund launches. Bansal, interestingly had co-founded Flipkart.

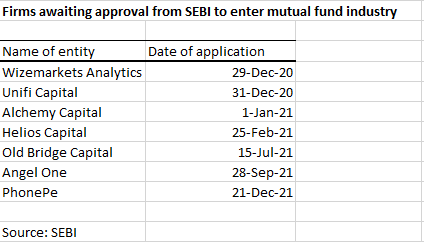

In last year-and-a-half, several entities have applied for MF license and shown interest in entering the Rs 37 lakh crore MF industry.

White Oak Capital group recently got the approval from SEBI to complete its acquisition of YES MF, which was renamed as White Oak Capital Asset Management.

Several portfolio management service (PMS) providers have also applied for MF license.

Rakesh Jhunjhunwala-backed Alchemy Capital and Samir Arora-backed Helios Capital have also applied for MF license. Interestingly, Arora has been part of the MF industry when he was the chief investment officer of Alliance Capital MF.

Also read: Why do PMS firms want to become mutual funds?Similarly, Kenneth Andrade's PMS firm Old Bridge Capital has also applied for MF license. Andrade's last job was as chief investment officer of IDFC MF.

MF distributors and even discount brokers have shown interest in starting their own mutual fund.

NJ India, the country's largest MF distributor by way of commissions, got SEBI's approval recently and launched its MF business.

The discount broker Samco Securities also started its MF business recently and has started to launch its new funds.

Nithin Kamath-founded Zerodha, which is the country's largest discount broker in terms of active clients, has also received the in-principle approval from SEBI to set up its MF business.

The financial services giant Baja Finserv has also got in-principle approval from SEBI for its mutual fund foray.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.