Bhavana Acharya

Think 12-19 per cent returns and you would assume only equity funds could deliver that much in bull markets. But, in the last one year, gilt funds have delivered such solid returns. Even the worst one-year performer in the gilt category has posted returns in the double-digits, at 10.5 per cent.

In the face of the credit risks, write-offs, redemptions and poor returns in other debt funds, the combination of attractive returns and zero credit risk in gilt funds seems unbeatable. But before being tempted into investing in gilt funds, there are three key characteristics you need to know about this category of schemes.

Returns depend on interest rate cycle

First, what drives returns in a gilt fund? Primarily, returns come from a rally in gilt prices. And that rally comes based on interest rates; more specifically, on interest rate cuts or market expectations of a cut in the future. Gilt instruments are the most liquid among debt instruments, and the impact of rate changes is felt the most here.

While debt markets have been chaotic in the past 3-4 months, the 10-year g-sec’s yield has generally trended lower, standing at a tad lower than 6 per cent now against 7.03 last May. Depending on the stage of the rate cycle, the returns from gilt instruments of different maturities vary.

The average one-year returns for gilt funds have been above 10 per cent since June 2019. For a brief period in late 2019, funds such as IDFC G-Sec Constant Maturity returned above 20 per cent on a one-year basis while those such as ICICI Pru Constant Maturity came close to delivering such returns.

A gilt fund juggles around with maturities to maximise returns, but, effectively, a lot of the return depends on capital appreciation in the underlying bonds. They have to do this as most of the gilts that funds hold may not have attractive coupon rates. Though gilt funds too have accrual income through coupon payments on the securities, other debt fund categories score better on this count as they invest in higher-yield corporate and bank debt papers.

Returns normalise over time

High one-year returns, however, do not last. Given that returns move with rate cycles, a rising cycle would lead to falling bond prices and in turn gilt fund returns. Just as returns can leap higher, they can fall just as precipitously.

Consider all one-year returns since 2012 (in order to cover multiple rate cycles). The maximum average return gilt funds delivered in this period was 19.4 per cent. The lowest average 1-year return was a loss of 1.03 per cent. Over the above time frame, 5 per cent of the time, the funds delivered losses over the one-year period. Bond price falls on interest rate moving up, can wipe out a good part of the gain previously made.

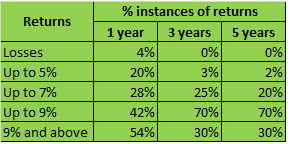

Dynamic bond funds, which also go for gilts during rate cut cycles, try to preserve gains by moving into accrual during flat to rising rate cycles. As gilt funds do not have this luxury, their returns tend to normalise. Holding over the years and interest rate cycles, therefore, evens out returns. The table below shows different return buckets and the instances of returns since 2012.

Essentially, while one-year returns came in above 9 per cent more than half the time, three-year and five-year returns tended to be much lower, in the 7-9 per cent range. One-year returns averaged 9.03 per cent, five-year returns were at 8.2 per cent and seven-year returns averaged around 7.8 per cent. Therefore, the attractive returns right now are very unlikely to persist.

Returns are volatile

Gilt funds have no credit risk. That doesn’t mean zero risk in returns. As explained above, gilt instruments see price volatility. Bond prices do not need an actual interest rate change to move – prices react to a variety of factors such as foreign institutional flows, inflation direction, government borrowings, liquidity, and so on.

And that means a gilt fund’s NAV can fall – i.e., the fund generates losses. Shorter the period, higher the risk of losses. Considering the same period as in the earlier points, the gilt category dipped into losses 25 per cent of the time based on one-month returns. Even over a six-month period, funds generated losses 11 per cent of the time. The graph plots the one-month and six-month returns for the gilt category average since 2012.

Therefore, while a gilt fund may be very safe in terms of credit quality, it does not translate into nil chances of losses.

How to approach gilt funds

Gilt funds are especially attractive right now given the turmoil in debt funds investing in corporate and bank bonds. But in order to invest in gilt funds, understanding the funds’ characteristics as explained above is important. This apart, the following points can guide you.

Be prepared for losses. As funds are volatile, there will be instances where returns move into the negative over periods such as one month, three months or even one year. This loss and volatility will even out over longer timeframes; three and five-year periods, or longer horizons have no instances of losses.

Have a longer timeframe. Ideally, gilt funds are great to book high returns in debt using a timed entry and exit – i.e., investments made early in a rate cut regime and exits done before interest rates are hiked. But this requires understanding of debt markets and rate cycles. In the absence of this understanding, holding a gilt fund for at least 5-7 years will give the benefit of no credit risk plus reasonable returns.

Don’t use gilt funds for short-term goals. Given the possibility of losses in short-term periods, using these funds to meet such goals is best avoided. Though an understanding of markets and rate cycles can mitigate the risk, debt markets can throw up surprises. Short-term goals do not provide room for such risks.

Keep return expectations right. In other words, do not base return expectations on recent one-year or even three-year performance. Avoid going for gilt funds only because current returns look promising as these returns will eventually dip back into more normal ranges.

(The writer is Co-founder, PrimeInvestor)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.