![Advance tax is the process of paying taxes in line with income earned. [Representative image: Shutterstock]](https://images.moneycontrol.com/static-mcnews/2021/06/income-tax-770x433.jpg?impolicy=website&width=770&height=431)

If you are a salaried individual, but also have incomes other than salary, this is for you. Employers are mandatorily required to deduct tax on employee’s salary as per the income tax slab applicable to them, but if employee has other sources of income like interest, dividend, rent or capital gain and so on, he or she may have to pay advance tax on these incomes.

What is advance tax?Advance tax is the process of paying taxes in line with income earned. It effectively means pay as you earn to ensure steady flow of taxes to the exchequer. According to Section 208 of the Income-tax Act, 1961, every individual tax assessee whose estimated tax liability for a financial year (FY) is more than Rs 10,000 has to pay advance tax.

Who needs to pay advance tax?Usually businessmen and professionals need to pay advance tax as they receive income from sources where tax is not deducted at source in accordance with the income tax slab applicable to the receiver of the income. However, a salaried individual may also have to pay advance tax, if he or she earns incomes other than salary. Generally, many salaried individuals also have incomes from sources like interest from deposits in banks and post offices, dividends and capital gains from shares or mutual funds. Few also have rental incomes or business income.

So, if you are a salaried individual, estimate total income from other sources, and if total tax liability on such income exceeds Rs 10,000 after adjusting tax deducted at source (TDS) then you need to pay advance tax.

Who all are exempt from advance tax liabilities?As per Section 207 of the Act, a resident senior citizen (an individual who is 60 years or above), not having income from business or profession, is exempted from paying advance tax.

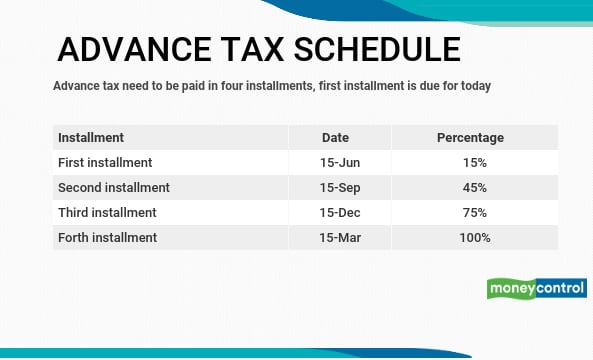

As per the Act, the taxpayers are required to pay advance tax in four installments—15 percent, 45 percent, 75 percent and 100 percent, on or before June 15, September 15, December 15 and March 15 respectively. Those who file their income under the Presumptive Taxation Scheme (PTS) need to pay the entire advance tax in a single instalment on or before 15 March. Under section 44AD of the Act, PTS allow a businessman or a professional to file their returns based on an assumed income. Any amount paid by way of advance tax on or before 31 March is also treated as advance tax paid during the financial year.

Consequence of not paying advance tax installments on timeIf you fail to pay the advance tax liability before the mentioned due dates or there is a shortfall in payment, the due amount will attract penal interest as per section 234 of the Act.

You can pay the advance tax offline as well as online. To pay it offline visit bank branches authorised by the income tax department and use tax payment challans (challan number 280) to pay the advance tax.

On the other hand, to pay advance tax online logon to the income tax department’s website www.incometaxindia.gov.in and click on e-Pay taxes tab. You will be directed to the National Securities Depository Ltd (NSDL) website. Click on challan no./ITNS 280, fill the required details and make the payment. You can pay it through net banking or debit card.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.