The mutual fund (MF) industry has built a monthly SIP book of close to Rs 10,000 crore. Systematic investment plans (SIPs) have become quite popular among MF investors wanting to build a large investment corpus by following a gradual and disciplined process.

But how has investor behaviour towards SIPs changed?

Here are some interesting findings of a survey done by Aditya Birla Sun Life Mutual Fund (ABSL MF) with its own investors. This survey was done in July 2021 and covered 657 investors.

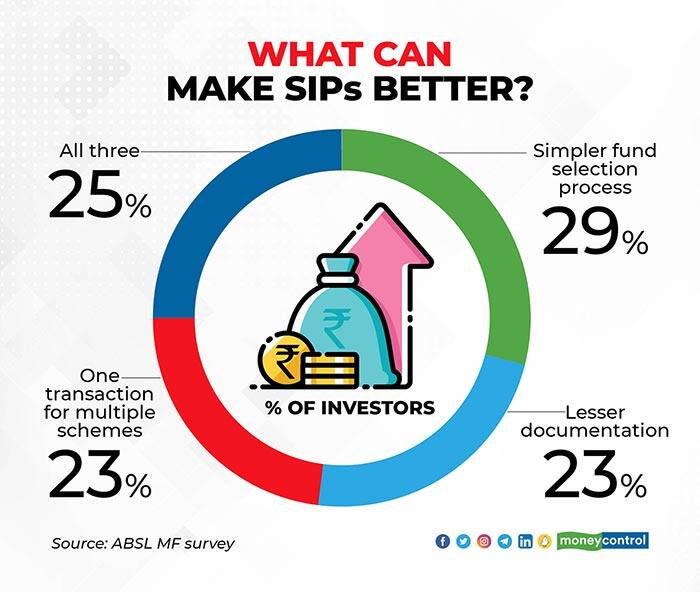

Need for simple options when starting outOf the investors surveyed, about 29 percent said they wanted fund selection to be a simpler process when starting a SIP.

“It is important to explain to new investors how equity markets can behave and then give them simpler products such as index funds to those just starting out,” says Vinayak Savanur, founder and chief investment officer, Sukanidhi Investment Advisors. Most investors use the SIP route to investing in equity funds so that they can reduce the impact of market volatility and benefit from cost averaging by buying across market levels.

With cost averaging, SIPs can bring down your average investment costs, by buying more units when markets fall and fewer units when indices rise.

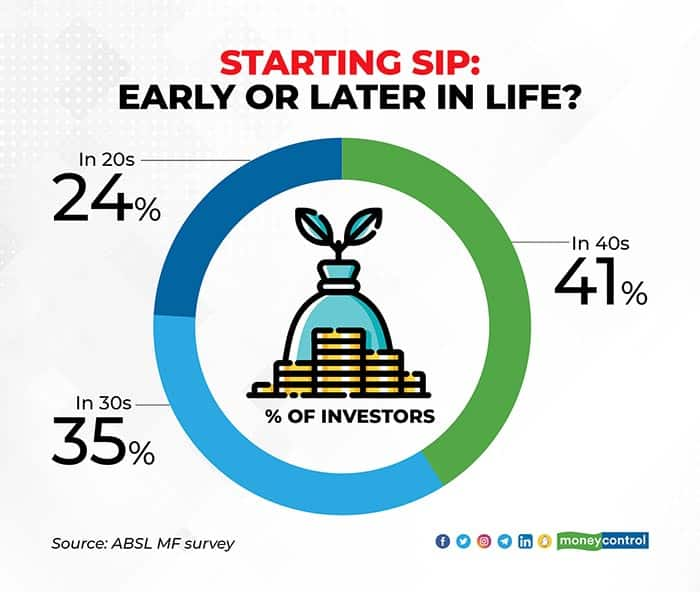

Over 40 percent of the investors that were surveyed started their first SIP in their 40s, 35 percent in their 30s, and 24 percent in their 20s. This was despite the age band of 20-25 showing greater awareness of SIPs.

Women investors were more willing to start SIPs in their 20s (33 percent of the women respondents) than men (22 percent of the male respondents). This phenomenon could also be due to fewer women respondents (99) versus male respondents (556).

But Nisreen Mamaji, a certified financial planner and Founder of MoneyWorks FS, says she has noticed working women being keener about taking charge of their finances early on.

“Earlier, fathers would take over the investment portfolio of girls, but now girls are taking charge of their portfolios. Also, several young women now start their careers away from home. After they get their salary accounts, they get calls from bank relationship managers offering certain investment options. This makes them ask questions and become curious about other options out there,” Mamaji points out.

Taking the long-term approachAccording to the survey, investors were largely willing to hold their SIPs for more than 10 years.

About 57 percent of those surveyed, recommended holding SIPs for over 10 years. Half of those surveyed were of the view that letting investments compound over time through SIPs, can help in building a long-term investment corpus.

This change can also been seen in the MF industry data. When it comes to regular plans, a bulk of the SIP assets are more than five years old.

As of August 31, 2021, they stood at Rs 95,536 crore, accounting for one-fifth of the SIP assets in regular plans. SIPs have also become a popular choice for goal-based investing.

The ABSL MF survey shows that 52 percent of the investors started their first SIP for a specific goal. About 75 percent of the respondents believed in the idea of having different SIPs for different financial goals.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.