COVID-19 has highlighted the significance of owning a residential property. Humongous unsold inventory and a pandemic-induced loss of confidence has ensured that Indian real estate remains a buyer’s market. With decadal lows in home loan interest rates and an on-demand availability of ready-to-move-in projects, the dynamics of buying a house are currently most attractive.

To complement your quest for purchase of real estate, here is a list of six essential ratios and pointers.

Loan-to-value ratio

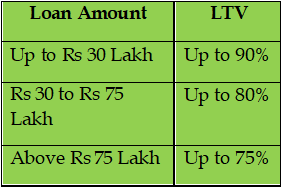

The Loan-to-value (LTV) ratio is one of the key parameters used by lenders to determine the home loan amount and eligibility. It is that percentage of the property cost, which a lender agrees to fund. Lenders use the LTV ratio to assess the risk weightage of the loan application. Presently, the maximum LTV for home loans ranges from 75-90 percent of the property value. The balance amount (down payment) needs to be funded by the applicant.

As a thumb rule, Banks and HFCs (housing finance companies) will use the following LTV percentage for assessing home loan eligibility.

Debt to income ratio

The debt-to-income (DTI) ratio is a figure used to assess the credit risk of a borrower. The lender will calculate the DTI ratio as the sum total of all EMIs and credit bills as a proportion of the borrower’s monthly income.

For example, if you pay Rs 8000 a month for Car Loan, Rs 12000 a month for a Personal Loan and Rs 5000 a month for Credit Card bills, your gross monthly debt payments will be Rs 25,000. If your gross monthly income is Rs 100,000 then your debt-to-income ratio is 25 percent.

It is generally recommended that the DTI be kept at 40-50 percent, so that you can conveniently meet your day-to-day expenses.

Also read: Applying for a home loan? Make sure you have these property documents

Family net worth

To assess the overall credit risk, the lender will determine the total income of all co-applicants and family members. Apart from your monthly business income or salary, the lender will also look into the income of other co-applicants, declaration of assets and family’s net worth certificate to compute the home loan eligibility. Thus, by incorporating your stocks, mutual funds, retirement accounts- PPF, NPS etc, life insurance, cars, real estate, rental income, additional incomes etc., you can verily enhance the home loan amount.

Gross and net income multipliers

A lender multiplies an applicant’s declared income with the “Income Multiplier” to arrive at the maximum amount that can be loaned. However, it should not be seen as the final loan eligibility criteria. For, the “multiplier” will vary from lender to lender, and other factors such as income, FOIR, and employment stability also affect the decision of the bank.

Rental yield

It is an important metric if you buy a property for investment and eye a rental income. You can compare rental yields of distinct properties and zero in on to the most favourable investment. To calculate gross rental yield, divide annual rental income by the property value.

Capitalization rate

Another important ratio for comparing properties is the capitalization rate. To compute it, you will first deduct all operating expenses from the annual rent and then divide it by the total property value. The expenses may include repair costs, taxes, agent fees etc. With the help of the capitalization rate, you can compare the return on investment of properties more efficiently.

In today’s climate of uncertainty, it would be advisable to purchase a property only for self use and to refrain from speculative activity, especially with borrowed funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!