Anubhav Sahu Moneycontrol research

Seya Industries (Market cap: Rs 1791 crore) is a vertically integrated benzene based specialty chemicals company which is undergoing an expansion plan of global scale. Company’s earnings trajectory, range of products offered and the chemical reaction capabilities highlight the increasing non-commoditised nature of the business, ensuring higher margin profile. Further, it also positions the company as a key beneficiary of the global specialty chemical sector trend of sourcing chemical intermediates from the environmentally compliant hubs in Asia.

Expertise in Nitro chloro benzene/Chloro benzene value chain

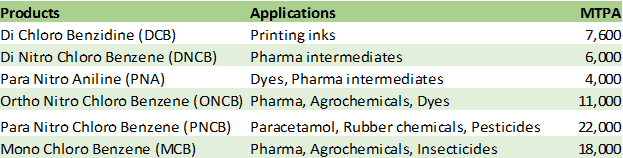

Seya was incorporated in 1990 as Sriman Organic Chemical Industries Ltd (SOCIL) with the initial capacity of about 14,400 MT for benzene based chemical intermediates. Its Tarapur plant has the capacity to manufacture 68,600 MT of chemicals in the Nitro chloro benzene (NCB) and Chloro benzene value chain catering to end markets like pigments, pharma, agro-chemicals, rubber chemicals, textiles and personal care.

It caters to marque clients like Bayer, BASF, Atul, Clariant, Sudarshan, Mitsubishi Chemcials, Cappelle, Hindustan Insecticides ltd, Huber group, Chemie and exports to 25 countries.

Seya participates in some categories of NCB/CB value chain

Table: Installed capacity

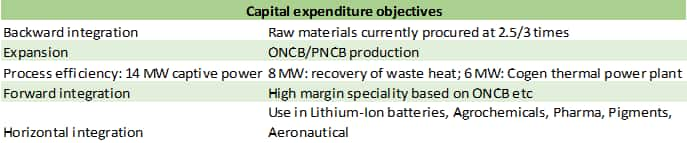

Ambitious capex plans

Seya Industries is undergoing capacity expansion of 443,950 MT (Rs 735 crore) and is expected to commission it in H2 2019. Massive capacity expansion in a similar scale has bee done by Aarti Industries (Rs 900 crore in 2-3 years) speaks about the company’s objective to reach global scale.

Among the upcoming products, diversification into Sulphur trioxide based specialty chemicals, Thionyl Chloride, Di Methyl Sulphate are noticeable which would have applications in pharma, preservatives in food industry, fabric softners, agrochemicals etc.

Positive industry trends

As pointed by industry leaders, “easternisation” has been a key trend which benefitted chemical intermediate companies of China and India. Easternisation refers to industry wide trend where in chemical majors of developed markets discontinued intermediate process in the chemical value chain and transferred capacities eastwards. It therefore benefitted from resultant asset light structures as well as skilled labour in Asian countries.

In recent years, trend towards environment compliance, need for diversification of country sourcing and favorable competitiveness have benefitted India disproportionally.

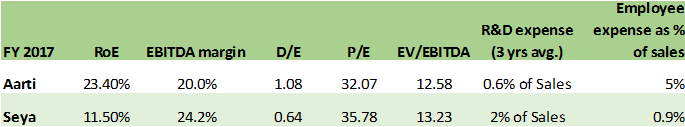

Focus on R&D

Seya, with an aim towards scaling the value chain, has maintained a higher run rate for R&D expense compared to the industry leader. Employee cost has surprisingly been kept in check contained. Here, however, there is a possibility for increased allocation as the company undergoes more complex chemistry processes and competes with the global leaders.

Vertical integration remains the key

In an export oriented sub-sector like this, currency remains the key risk. Raw materials are indigenously procured but export competitiveness can be impacted in the scenario of sharp appreciation in local currency. Sourcing risk of raw materials is increasingly covered with the backward integration plans.

Having said that competition from domestic manufacturers and renewal of threat from the Chinese players remain a major risk. Given that possibility, major players in this category like Seya and Aarti are expected to continue to invest in increasing scale and forward integration to value added products.

Financial projections

In the last three years, company witnessed huge margin expansion (+1294 bps) aided by lower raw material cost (74 percent of sales in FY17 vs. 89 percent of sale in FY 14) and increased contribution of value added products. High margin specialty chemicals constitute 99 percent of sales in FY17 vs. 71 percent in FY14. In the current fiscal operating margins have further improved to about 28 percent. We expect margins to hover at similar level in medium term on account of company’s effort toward vertical integration. Thus, operating profit are expected to witness CAGR of 42 percent during 2017-21E driven by sales CAGR of 37 percent and company’s foray into value added products.

Based on this, the stock is currently trading 13.5x 2020 estimated earnings, which is inexpensive compared to specialty chemical sector average. Further, given the sector wide tailwinds, global scale of operations and foray into value added products, investors can consider Seya industries for accumulation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!