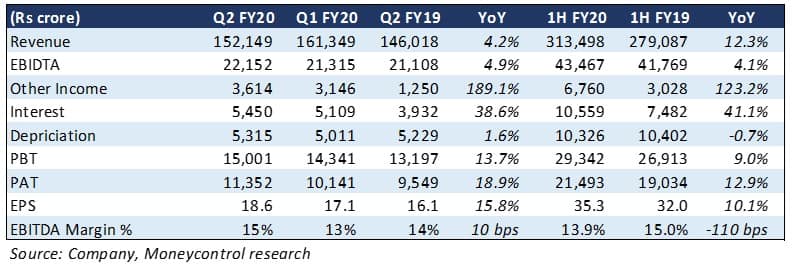

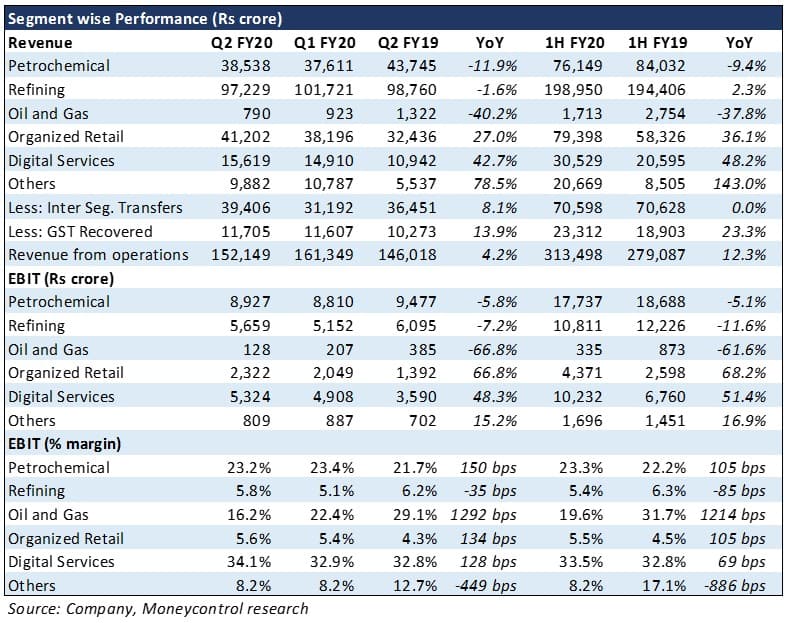

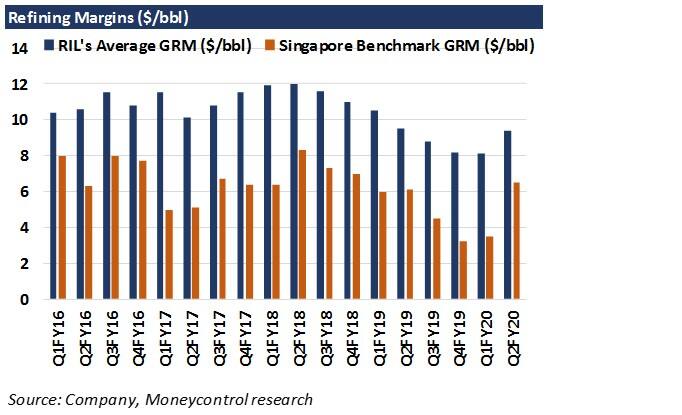

Reliance Industries’ (RIL) numbers in the September quarter for traditional businesses were weaker, in line with global trends and low crude prices. Gross refining margin (GRM) at $9.4 per barrel was a miss from Street expectations. Nevertheless, the petchem business saw an improvement in margins.

Jio continues to meet quarterly performance expectations. Despite falling ARPU (average revenue per user), topline growth was strong and there was significant margin expansion in Q2 FY20. Launch of JioGigaFiber services would aid the next leg of growth for the company.

Also read: RIL Q2 profit beats estimates; 10 key takeaways from quarterly result

RIL’s thrust towards consumer facing businesses was evident in yet another stellar performance by its retail division. Reliance Retail remains among the biggest and fastest growing retail players in the world.

- Despite last year’s high base, Reliance Retail reported a 27 percent growth YoY (year-on-year) in its top-line, led by new stores and healthy same-store sales. Retail revenue for Q2 FY20 stood at Rs 41,202 crore, an all-time quarterly high. Operational efficiencies led to margins improving noticeably YoY as well.

Also read | RIL Q2 result: Consumer business now contributes one-third of quarterly EBITDA, says CFO

-Jio saw a strong 33.7 percent year-on-year (YoY) growth in its net revenue which came in at Rs12,354 crore. The growth came on the back of net addition of 24 million subscribers in the quarter. Jio’s subscriber base stood at 355.2 million.

Also read | Reliance Jio earnings: Q2 net profit rises 45.4% to Rs 990 crore

-Jio continues to positively surprise in terms of its operating margin. Its earnings before interest, tax, depreciation and amortisation (EBITDA)margin expanded by 314.8 bps in the quarter gone by. The management highlighted that it was driven by operational efficiencies.

Key Negatives-Weakness in global crude prices was reflected in lower realization for the refining segment. While the GRM (gross refining margin) was up sequentially, they remained below expectations at $9.4 per barrel. Lower differential between light and heavy crude and higher costs for heavy crude led to around a 7 percent year-on-year decline in EBIT (earnings before interest tax depreciation and amortization). Issues in Iran and Venezuela also hit refining margins to certain extent.

-The petchem segment saw a sharp growth in volumes. However, with weakness in prices of petrochemical products there was a 12 percent YoY dip in segment revenue. Demand revival in both polymer and polyester in the domestic market contributed to the volume growth. Addition of new capacity resulted in inventory overhang. Together with subdued global demand, this resulted in weak margins for most petchem products.

- While Jio’s subscriber base continued to expand, the pace of growth moderated primarily due to base effects and increased competition. Strong competition and offers by Jio led to an ARPU decline of 8.9 percent on YoY basis. ARPU came in at Rs120 per month.

The results were broadly in line with our expectations. The weakness in the traditional businesses was in line with global trends. However, we take a cue from the CFO's comments about strength in product demand and improving volumes which should aid performance in the current quarter. It is important to remember that major capex in the businesses is now at an end and benefits should accordingly start flowing in.

We believe Jio would continue to do well, going forward, on the back of its strategy of offering services at a reasonable price. Its focus on deeper and wider market penetration has made it the largest telecom operator in India in terms of subscriber base, within a very short time.

There are two factors which could aid earnings momentum for the telecom business. The first is the launch of JioGigaFiber services during the quarter, which is getting good traction from its customers. Secondly, the company’s decision to start charging its customers 6 paisa per minute on the outgoing calls made to other networks to recover the Interconnect Usage Charges (IUC) which the company pays to other network providers. This would improve operating margins, at least for the next quarter.

For the retail business, going forward, revenue growth would be driven by aggressive brick-and-mortar store expansion, integration of online and offline retailing, measures to grow the customer loyalty base and exclusive agreements with more foreign lifestyle brands.

In a bid to improve margins, we expect greater emphasis will be laid on promoting private labels across segments, improving the product mix, undertaking store productivity initiatives to boost like-to-like sales and leveraging benefits of scale.

However, weak consumer demand, particularly in rural India, would be a challenge in the near future and will be something investors need to watch out for.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.