The quarterly results of FMCG companies indicate revival in consumption in rural areas, albeit on a soft base that was marked by destocking on account of the Goods & Services Tax. Among the recent results, Dabur and Emami are no exception to this trend. Both firms witnessed double-digit volume growth and are outliers in terms of momentum. Dabur’s exceptionally better earnings was due to a recovery in the beverage segment while Emami’s performance came in below our expectation as its summer portfolio lacked shine on account of a weak season.

Amid this, Tata Global Beverages' earnings was another disappointment, impacted by weak non-branded business.

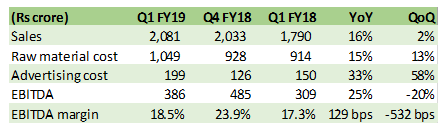

Dabur: Strong volume led growth

Source: Moneycontrol Research

Dabur posted consolidated year-on-year (YoY) sales growth of 16 percent, aided by 21 percent volume growth in the domestic business (68 percent of sales). International operations grew 11 percent on a constant currency basis, underlining recovery in the Middle East North Africa (MENA) market. Domestic business growth broadened last quarter as there was a revival in beverage and homecare segments.

Broadening of volume growth Of late, the beverage segment (foods category constitute 22 percent of sales) has been impacted by high competition, which the management countered by trade promotions, advertising campaigns and new launches. About 27 percent sales growth was aided by a soft base (-8.3 percent sales growth in Q1 FY18). Homecare segment (Odonil, Sanifresh) in the last few quarters witnessed industry-wide weakness. It now seems to be recovering with 17 percent sales growth.

In other categories, the company posted robust numbers aided by the red toothpaste franchise. However, the low-priced category (Babool in case of Dabur) was impacted by promotional offerings from competitors, including the market leader.

In the case of haircare, it posted another quarter of growth (19 percent YoY) but on a soft base (-11 percent). Given the management's volume-driven low-price strategy and competitive intensity, this category remains a key space to watch out for.

Containment of competition is positive We are particularly enthused by the improvement in Dabur's competitive landscape. The management expects high single-digit volume growth for rest of the fiscal and is confident of maintaining margins. In the quarter gone by, rural and urban growth have been similar (beverages segment has an urban skew). In coming quarters, rural growth is expected to be the main driver for growth as the distribution strategy is in place.

The stock is currently trading at 39 times FY20e earnings, which is at a steep discount to the market leader and sector average. We expect a further re-rating in the stock on improving growth outlook led by rural demand, falling competitive intensity and the improvement in international businesses.

Emami: Sequential earnings decline impacted by seasonality

Source: Moneycontrol Research

Emami’s sequential sales growth has been flattish on account of lower-than-expected sales of summer portfolio (Navratna range) due to erratic season. Optically, while the domestic volume growth of 18 percent YoY looks impressive, the same comes on an extremely weak base (-18 percent volume growth in Q1 FY18). Margin contracted sequentially due to seasonality and is in line with the historical trend.

Greater revival in product sales In spite of the setback in topline growth, there are few incremental positives which adds to our conviction. 1) Higher contribution from wholesale channel which now caters to 40 percent of sales. 2) The Q4 FY18 revival in Kesh King was sustained last quarter despite relaunch-related trade channel disruption. 3) Recovery in sales of Pancharishta (40 percent of healthcare range) was a positive surprise.

Launch of Zandu Diabrishta for diabetes patients is interesting. The product is expected to benefit from company’s medical store reach of 125,000, which was scaled up in the last two years.

A combination of stabilising distribution strategy, improving innovation pipeline and product launches, and broadening categories of products with higher sales has improved its growth outlook. The stock is trading at 37 times FY20e earnings after the recent underperformance. The management’s guidance of stable margin and double-digit volume growth in FY19 provides an opportunity in our view.

Tata Global Beverages: Impacted by non-branded business In case of Tata Global Beverages, the result was below our expectation because of weak non-branded business (lower sale in the coffee extraction business). Value growth in the India branded business was lower than volume growth, suggesting impact of higher commodity tea prices and heightened competition.

Market share gains in green tea business in India, improving international operations like Eight O’Clock and key product sales traction such as Keurig K-cups in North America and Kombucha in Australia are key positives. The joint-ventures of Nourishco and Tata Starbucks are performing steady.

The investment thesis is mainly governed by the management's restructuring initiatives. A large part of it has played out in the last one year, yet few options remain in terms of hiving off of non-branded business and/or merging consumer food business at the Tata group level.

Read: Tata Global Beverages: Restructuring story is still alive

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!