Highlights - RBI responds to lessen the impact of COVID-19 - Accelerated rate cut and liquidity boosting measures - Importantly, transmission of policy action is directed - Big benefit to corporate bond and money market participants - Liquidity stress of NBFCs and MFs will be relieved - Equity markets will remain volatile -------------------------------------------------

The Reserve Bank (RBI) has stepped in to support the economy and help it tide through the disruption caused by the outbreak of COVID-19. The central bank announced a slew of measures to ease financial conditions and boost liquidity for the corporate sector.

Reduction in interest ratesAmong the major policy actions, the RBI reduced the repo rate by 75 basis points (bps) and reverse repo by 90 bps to 4.4 percent and 4 percent respectively. A rate cut is a necessary step because pandemic hurts growth in the near term and raises the risks to the long term economic outlook.

Earlier today, rating agency Moody’s slashed India’s GDP growth to 2.5 percent for CY20 (CY19 - 5 percent) from an earlier estimate of 5.3 per cent on account of the rising economic cost of the coronavirus pandemic.

The RBI has lowered policy repo rates cumulatively by 185 bps (including 75 bps announced today) in FY20 following weakness in the domestic economy and given the stable inflation outlook.

To ensure the efficacy of monetary policy and speed up the transmission of policy rate reduction, the RBI had made it mandatory for banks to link all new floating rate loans to external interest rate benchmarks from 1 October 2019.

But despite these efforts, credit growth in the economy in the current fiscal year, i.e. FY20, is likely to be below 7 percent, the lowest in past six decades. The pace of credit expansion has been impacted by a consumption slowdown which will further aggravate with the locking down of the country. The reduction in reverse repo by a higher margin is to discourage banks to park money with the RBI.

Massive liquidity infusionThe RBI announced a series of measures to infuse liquidity into the financial system which included announcing targeted long-term repo operations (TLTRO) to the tune of Rs 1 lakh crore, a reduction in CRR by 100 bps and raising the MSF (marginal standing facility) window to 3 percent of NDTL from 2 percent earlier allowing banks with liquidity issues to get more funds if needed. These three measures relating to TLTRO, CRR and MSF will inject a total liquidity of Rs 3.74 lakh crore to the system.

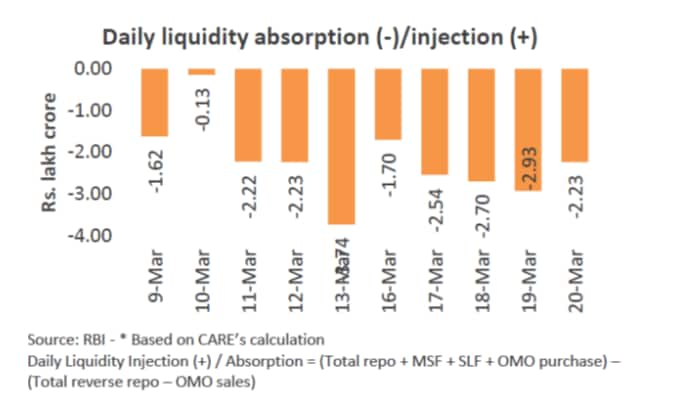

The liquidity in the banking system remained in a surplus position and has been hovering around Rs 2.5 - 3 lakh crore in March 2020. With sustained liquidity surplus seen in the banking system, the RBI has been undertaking reverse repo auctions to drain out liquidity from the banking system. During the week ended March 20, 2020, the daily net absorption by the RBI from the banking system stood at Rs 2.23 lakh crore as on 20 March, 2020.

RBI measures to ensure wider distribution of liquidity If liquidity is already in excess, what prompted the RBI to infuse a huge amount into the system? That is because, distribution of this liquidity is highly asymmetrical across the financial system. For instance, large private banks can easily access funds, but NBFCs have been facing liquidity issues for quite some time now. With the outbreak of COVID-19, volatile markets and increased uncertainty, mutual funds (MFs) have been facing increased redemption pressure. As a result, despite surplus liquidity in system, liquidity premia on instruments such as corporate bonds, commercial paper (CPs) and non-convertible debentures (NCDs) have surged. The problem so far was that banks were not meaningfully channeling the abundant liquidity being provided to them by the central bank via its LTROs even into near-term quality money market instruments. The RBI has today categorically specified how banks can deploy liquidity availed from the central bank. Banks can use the liquidity to buy corporate bonds, CPs, NCDs in secondary market from MFs and NBFCs and classify them as held to maturity (HTM). With no mark-to- market risk and a dispensation on exposure limits, banks will now hopefully start participating actively in the secondary market and in turn improve liquidity position of other market participants like mutual funds and NBFCs. The RBI’s measures will set right the dislocation in the corporate bond and CP market and will go a long way in ensuring financial stability. The current scenario seems to be mini flashback of 2008-09 global financial crisis. The MF industry faced liquidity challenge in 2008-09 following the Lehman bankruptcy and saw significant outflows over a short period. Back then, the Reserve Bank had facilitated a short-term liquidity window for mutual funds to help ease liquidity pressures. The current regulatory action will help avert any liquidity-induced credit contagion. That said, NBFCs and MFs will end up ceding their market share in favor of banks. Large private banks will continue to gain market share and grow their balance sheet. On a broader perspective, real economy will be struggling due to lock down. Ample liquidity will be critical to avert a spiraling of the crisis from the real economy into a financial crisis. Regulatory forbearance In other measures, various sorts of moratoria and dispensations on loans have been provided. Banks can allow customers to defer payments or interest costs on loans and will not have to re-classify/downgrade the asset to non-performing. The RBI has permitted working capital-related loans to be rolled over and defer interest payment on working capital facilities, without having to mark them as defaults in case of non-payment for three months. At the same time, capital conservation buffers and implementation of some regulatory changes for banks have been pushed back. These moratoria will lessen some financial stress of borrowers and relaxations on asset classification and capital adequacy will help banks void financial pain. Overall, the RBI made it clear that it will do “whatever it takes” to avoid a deeper fall in growth and maintain financial stability. While the policy action is at the next level, markets will remain volatile till there is a clear signal of containment of the virus or the discovery of a medical treatment. Till then, a coordinated fiscal and monetary push will act as temporary catalyst for the equity markets. Investors should tread carefully. Follow @nehadave01For more research articles, visit our Moneycontrol Research page

RBI measures to ensure wider distribution of liquidity If liquidity is already in excess, what prompted the RBI to infuse a huge amount into the system? That is because, distribution of this liquidity is highly asymmetrical across the financial system. For instance, large private banks can easily access funds, but NBFCs have been facing liquidity issues for quite some time now. With the outbreak of COVID-19, volatile markets and increased uncertainty, mutual funds (MFs) have been facing increased redemption pressure. As a result, despite surplus liquidity in system, liquidity premia on instruments such as corporate bonds, commercial paper (CPs) and non-convertible debentures (NCDs) have surged. The problem so far was that banks were not meaningfully channeling the abundant liquidity being provided to them by the central bank via its LTROs even into near-term quality money market instruments. The RBI has today categorically specified how banks can deploy liquidity availed from the central bank. Banks can use the liquidity to buy corporate bonds, CPs, NCDs in secondary market from MFs and NBFCs and classify them as held to maturity (HTM). With no mark-to- market risk and a dispensation on exposure limits, banks will now hopefully start participating actively in the secondary market and in turn improve liquidity position of other market participants like mutual funds and NBFCs. The RBI’s measures will set right the dislocation in the corporate bond and CP market and will go a long way in ensuring financial stability. The current scenario seems to be mini flashback of 2008-09 global financial crisis. The MF industry faced liquidity challenge in 2008-09 following the Lehman bankruptcy and saw significant outflows over a short period. Back then, the Reserve Bank had facilitated a short-term liquidity window for mutual funds to help ease liquidity pressures. The current regulatory action will help avert any liquidity-induced credit contagion. That said, NBFCs and MFs will end up ceding their market share in favor of banks. Large private banks will continue to gain market share and grow their balance sheet. On a broader perspective, real economy will be struggling due to lock down. Ample liquidity will be critical to avert a spiraling of the crisis from the real economy into a financial crisis. Regulatory forbearance In other measures, various sorts of moratoria and dispensations on loans have been provided. Banks can allow customers to defer payments or interest costs on loans and will not have to re-classify/downgrade the asset to non-performing. The RBI has permitted working capital-related loans to be rolled over and defer interest payment on working capital facilities, without having to mark them as defaults in case of non-payment for three months. At the same time, capital conservation buffers and implementation of some regulatory changes for banks have been pushed back. These moratoria will lessen some financial stress of borrowers and relaxations on asset classification and capital adequacy will help banks void financial pain. Overall, the RBI made it clear that it will do “whatever it takes” to avoid a deeper fall in growth and maintain financial stability. While the policy action is at the next level, markets will remain volatile till there is a clear signal of containment of the virus or the discovery of a medical treatment. Till then, a coordinated fiscal and monetary push will act as temporary catalyst for the equity markets. Investors should tread carefully. Follow @nehadave01For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.