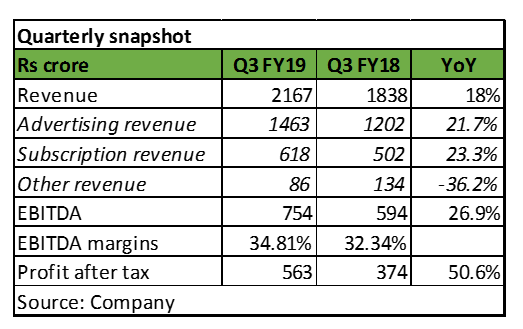

Zee Entertainment Enterprises (Zee) reported a robust Q3 FY19 earnings, with net profit increasing 51 percent year-on year (YoY) to Rs 563 crore. Its revenue, EBITDA and profit surpassed street expectations.

Revenue increased 18 percent YoY driven by healthy growth in advertising revenue (21.7 percent YoY) and spike in subscription revenue (23.3 percent YoY). Domestic subscription revenue increased 28 percent on the back of low base and monetisation of phase III subscribers. International subscription revenue remained flat . EBITDA increased 27 percent YoY as EBITDA margin improved to 34.8 percent in Q3 as compared to 32.34 percent in the same period last year.

While reported earnings look good, all eyes will be on any announcement relating to impending promoter stake sale. In an interesting development in November, Zee Entertainment's promoter (Essel Group) announced their intention to sell up to 50 percent of their around 42 percent stake to a strategic partner by March-April, most likely a global player.

Multiple reasons are speculated for stake sale, including the high share (around 59 percent) of pledged promoter shares and increasing competition from global over-the-top (OTT) platforms like Netflix and Amazon Prime. Read: Is promoter stake sale in Zee for survival or growth?

The uncertainty about the stake sale which may or may not trigger an open offer for minority shareholders will continue to weigh on stock performance.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.