Sachin Pal

Moneycontrol Research

Highlights:

- Topline growth was aided by higher volumes and realisations

- Cost control measures supported margin improvement

- Demand continues to remain strong in the central region

- Valuations reasonable at 7.4 times estimated FY19 EV/EBITDA

-------------------------------------------------

Heidelberg Cement India delivered yet another quarter of strong financial performance in Q3 FY19. Steady volume growth, coupled with higher realisations and focus on cost efficiencies, aided operational performance of the company in the quarter gone by. The company continues to display superior business execution and appears to be in a sweet spot owing to its strategic location in the central region.

Key Q3 positives

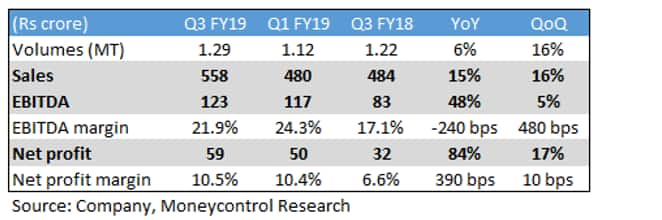

- The company reported sales growth of 15 percent and earnings before interest, tax, depreciation and amortisation (EBITDA) increase of 48 percent year-on-year (YoY). Strong demand in the central region drove volumes (up 6 percent) as well as realisations (up 9 percent) higher in the quarter gone by

- Operating leverage from higher capacity utilisation, along with cost benefits from its recently set-up Waste Heat Recovery System plant and change in fuel mix, offset the increased cost pressures and resulted in operating profit rising to Rs 123 crore in Q3 FY19. The company also benefitted from reduction in transportation expenses on account of one-time railway freight rebates

- Despite the sharp increase in raw material cost and fuel expenses, the management sustained its profitability metrics on a sequential basis through strict cost control measures. Heidelberg reported an EBITDA per tonne of Rs 947 in Q3, largely in line with the EBITDA per tonne of Rs 1,047 in the preceding quarter

- The company is operating at 90-95 percent capacity and therefore incurred capital expenditure of Rs 7 crore to debottleneck its existing capacity by 0.1 million tonne. It plans to further expand its capacity by 0.3-0.4 million tonne through subsequent debottlenecking exercises

- Cement prices in the central region continue to remain firm and the trend is being supported by higher volumes. Capacity utilisation in the region stands at 75-80 percent

Key Q3 negatives

- Heidelberg uses a combination of petcoke (60-65 percent) and coal (30-35 percent) for its power and fuel requirements. Coal availability continues to remain limited, amid supply constraints. Therefore, the company has shifted to the e-auction route for ensuring proper supply, but this is likely to increase costs as e-auction prices are higher than normal rates

- The demand environment continues to remain uncertain in the near term as corporates are in wait and watch mode in light of the upcoming elections. Also, the liquidity squeeze in the non-banking financial company (NBFC) could result in some weakening of cement demand from the infrastructure and housing segments

Outlook and recommendation

- Large scale infrastructure development activities (freight corridor, metro network, industrial parks) continue to aid demand for cement in the central region. Given the current capacity utilisation levels, cement realisations in the central region remains fairly attractive vis-à-vis other regions

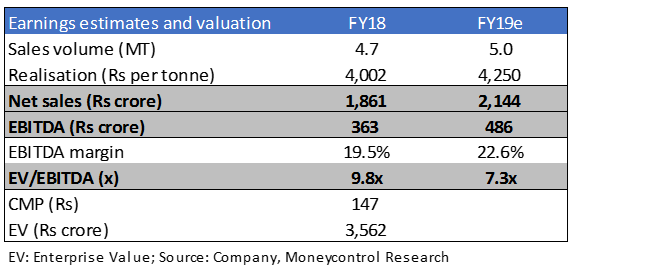

- Heidelberg expects demand momentum to continue and anticipates a volume growth of 7-8 percent for 2019. The counter is among our preferred picks from the midcap cement pack, given its strong positioning in the central market and superior margin profile compared to peers. Firm cement prices in the central region and strong operating leverage will continue to aid earnings. In terms of valuation, the company trades at valuation of 7.4 times FY19 estimated enterprise value-to-EBITDA. We therefore advise investors to accumulate this stock on corrections

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!