PI industries (PI) reported a strong quarter with healthy growth in topline and profits. Margin expansion was healthy at both the operating and net levels.

-Q3 revenue was up 31 percent on strong 40 percent year-on-year (YoY) exports growth with healthy demand for the existing products. There has been an increased momentum in the international demand which the company expects to continue in the coming quarters.

-Despite a soft overall demand during a weak Rabi and poor rainfall, the company managed a 9 percent YoY domestic revenue growth.

-Improved product mix coupled with increased realisations resulted in 84 basis points YoY uptick in earnings before interest, tax, depreciation and amortisation margins

-New products commercialised in the last 2-03 quarters have started gaining traction and contribute around 12 percent of the total revenue.

-The quarter reported a net forex gain to the tune of Rs 8-10 crore.

-With consistent build-up in reserves, the company now has almost zero net debt position, which is healthy for future expansion

-The domestic business has seen headwinds in this quarter from erratic rainfall in key agrarian states and poor price realisation in the key crops.

-This has impacted demand and industry is seeing higher than average inventory levels but with a range of differentiated offering, PI has reported commendable results.

Other observations-The company has commissioned a new multiproduct plant during the quarter, which is planned to be tied up for a single molecule with a long term contract. Another plant is expected to be commissioned in the current quarter which is largely a backward integration effort to bring about supply consistency amidst global supply disruptions.

-In additional PI is planning 2 multiproduct plants at its existing Jambusar unit. The total capex is estimated to be around Rs 300-350 crore each year.

-The management indicated the inventories in China are now going down, and there has been a healthy demand momentum due to this leading to better offtake.

-Rs 74 crore was not recognised in revenue in Q4 last year due to a shift in accounting standards. Due to this Q4 of the current year is expected to show a boost which a low base.

OutlookWith a strong product line up and supportive policy environment, the domestic performance is expected to improve. Further, pick up of recent product launches along with new molecules lined up for a launch, volumes are expected to go up.

The export business has seen a strong upsurge and reported healthy traction with inflows coming in from the order book. We expect this to continue. With increased inquiries and higher translation into firm orders, we expect the growth in exports to sustain. The company has an aggressive line up of new molecules with which it aims to expand volumes in this segment.

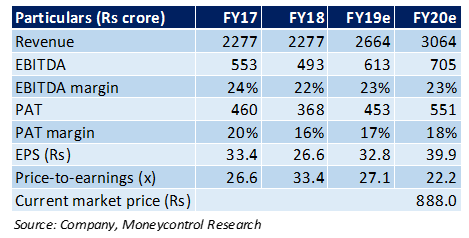

After the strong results the stock has seen a sharp uptick intraday, however, it is still 5 percent below its 52-week high, at a 2020e PE of 22x. With a strong order book line up, improved exports and backward integration we expect the current performance to sustain.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.