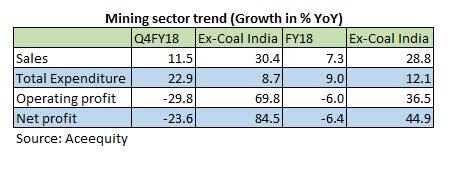

Except Coal India, whose earnings were under pressure because of wage revision, mining companies have been performing well, with most players reporting strong set of earnings growth in the past few quarters. In nutshell, excluding CIL, 6 companies covered below have delivered close to 31 percent revenue growth and strong 85 percent spurt in profits in Q4 FY18. It is not just quarterly performance, during the fiscal 2018, the same set of companies have delivered strong 29 percent growth in revenues and 45 percent increase in net profits.

Both strong realisations as well as a pick up in volumes led by strong demand from user industries such as metals have been helping these companies to earn higher profits. During Q4 FY18, companies like MOIL saw a 50 percent year-on-year increase in offtake and 6 percent growth in realisation to Rs 12,047 a tonne.

NMDC reported similar performance. During the quarter gone by, its revenues grew 35 percent YoY, led by 7 percent and 26 percent increase in domestic volumes and realisation, respectively. Both companies are benefitting because of a favourable pricing environment and strong demand from the steel sector. We have a buy rating on MOIL and NMDC, which are trading at 9 times and 7 times FY19 estimated earnings, respectively.

In the case of Coal India, despite 9 percent revenue growth and better volumes and realisation, the profitability was impacted because of one-time employee expense as a result of wage revision. In FY19, the company is eying 9 percent volume growth. Additionally, most of these one-time expenses are fully provided, which means that profitability would look better in the coming quarters. The full benefit of the recent price hike and additional coal transport levy would help in better profitability. It is trading at 11 times FY19 earnings, which is quite cheap considering the recovery in the business and cash in the books.

The power sector has seen increased demand for raw material with a recovery in all India generation. This is also a reason why companies like Gujarat Mineral Development Corporation, which is into lignite mining, continues to report a strong set of numbers. During FY18, the company reported a 31 percent growth in sales led by a strong 38.5 percent growth in production. While realisations were slightly lower at Rs 1,645 per tonne in FY18 as against Rs 1,671 a tonne in FY17, a significant reduction in other income led to a mere 9 percent growth in net profits. Nevertheless, it is expected to do well with strong growth in volumes led by production from new mines. At 6 times FY19 estimated earnings, GMDC remains one of our attractive picks in the mining space.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!