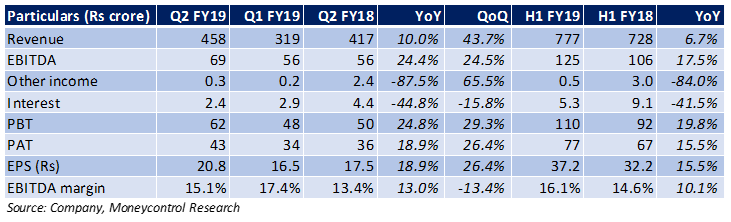

In a quarter hit by rising input costs and a weaker rupee, Insecticides India (IIL) was able to deliver a decent performance. It reported a strong growth in Q2 FY19 with a 10 percent year-on-year (YoY) uptick in revenue owing to healthy volume growth. Earnings before interest, tax, depreciation and amortisation (EBITDA) saw a 24 percent uptick with a 170 basis point (100 bps = 1 percentage point) margin expansion due to a favourable product mix, with lower share of generic products, better utilisation at the Dahej plant and improved B2C sales. The management was able to substantially reduce interest cost, which resulted in an 18.9 percent YoY growth in net profit.

Result snapshot

The company has strategically started exiting low margin products and is now looking to capture higher market share in superior margin products. The management aims to improvise its product mix by reducing concentration of generic products to around 5 percent. This should aid margin in coming quarters.

Rising input costs and backward integration Disruptions in Chinese supply and a weaker rupee have led to a surge in raw material prices, thus pressurising margins across the industry. Since 25 percent of its raw material needs are sourced from China, IIL saw a rise in input costs. However, it sees scope for an uptick in product prices, which would help protect margin.

The management is planning a backward integration plant, which is scheduled to be completed by FY19-end. While the same augurs well for its own raw material sourcing, the company is also planning to capture the void in the market created due to missing Chinese supply.

Banning of products In August, the government banned 18 pesticides, of which four are produced by IIL and are to be phased out by December 2020. With a substantial 15 percent revenue accruing from these products, the company’s FY20 earnings is expected to be impacted. Also, accumulation of inventory for these products in coming quarters might inflate working capital requirements.

However, the company has a pipeline of new products, which are scheduled to be launched in the next two years. Sales from these new products should help offset a portion of the impact on revenue.

Product line-up The six new products launched in the H1 FY19 are now gaining traction. It has a strong line-up in technical grade agrochemicals and formulation products. These are expected to drive volumes in coming quarters. The company has a strong R&D focus and intends to launch 6-7 new products every year. It is focussing on its branded B2B business and plans to spend on a branding exercise.

Tapping export opportunities The management has started focusing on the export segment and is planning to export branded formulations and technical grade agrochemicals to high growth emerging markets like Middle East, Africa and South East Asian regions. With rigorous registration rules, exports to the US and European nations are relatively more difficult and hence emerging markets seem like a thoughtful approach.

Planned capital expenditure The management is planning a brownfield expansion of its technical grade agrochemicals facility at Dahej. It is planning to fund the capital expenditure from internal accruals. With substantial capacity expansion on cards, we see improved volumes and benefits of operating leverage in the future.

Outlook

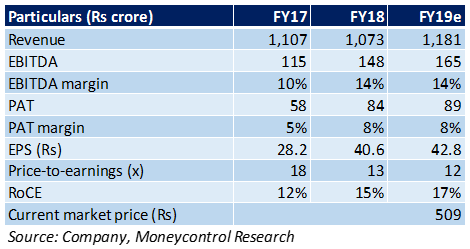

The stock has corrected 25 percent in the last three month and is currently trading 41 percent below its 52-week high. Post-correction, the stock is now trading at FY19 estimated price-to-earnings of 12 times. With its growth story remaining intact, the counter appears attractive. We expect consistency in earnings as the company is: 1) Moving to a healthier product mix; 2) Focusing on high margin products; 3) Low penetration of herbicides and fungicides in India; 4) Expectation of a near normal monsoon; and 5) Favourable macro and policy environment for agricultural companies.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.