The gas sector reported mixed performance in the March quarter. We saw encouraging results from Gujarat Gas (GG) and Indraprastha Gas (IGL) while Mahanagar Gas (MGL) took a slight hit on margins. GAIL reported a subdued set of numbers with impact on profitability in petrochemical and transmission segments.

While there was some impact on profitability for some companies, we remain overall positive on the growth story for the sector.

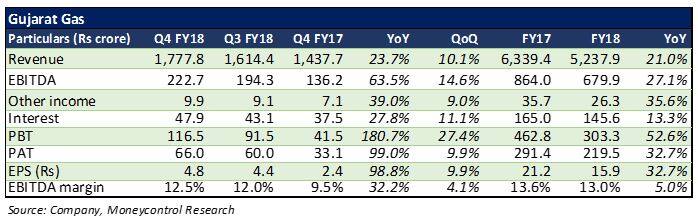

Gujarat Gas:

Gujarat Gas saw a healthy topline growth of around 24 percent year-on-year (YoY) on the back of an overall volume uptick of 11 percent YoY. Volume growth was driven by strong growth in industrial volumes at 4.7 million metric standard cubic meters per day (mmscmd) along with an uptick in PNG (piped natural gas) volumes at 0.72 mmscmd. Owing to high crude prices, there was a significant switch from fuel oil to gas in the industrial segments which led to high volumes. High demand from the ceramic segment provided an additional boost. On account of a price hike which the company took In December 2017, operating margins saw a noticeable improvement. Despite a higher than usual tax rate, net profit nearly doubled YoY.

The company is eyeing rapid growth in the CNG (compressed natural gas) and the PNG (piped natural gas) segments and plans to add more stations to its CNG network in the coming year which would drive further volumes and help capture the increased shift towards CNG vehicles.

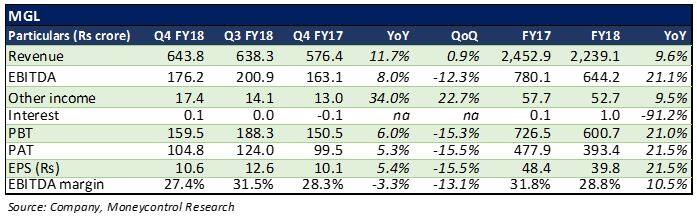

MGL:

MGL reported nearly 12 percent YoY topline growth driven by a healthy 7 percent volume growth which came in with the expansion into Raigad. The higher cost of procuring gas which could not be fully passed on to commercial users, coupled with high operating expenses ate away from the margins. Operating expenses increased due to high maintenance costs and provision made during the quarter.

The company has almost 86 percent of its sales coming in from non-cyclical and relatively more defensive segment of transportation and domestic demand, which is expected to grow rapidly in the coming years. With plans to expand into this segment, the company has bid aggressively in the recent round for CGD auction. Expansion to more territories should support volume uptick. However, with rupee depreciation and increase in the international prices of natural gas, the margins might stay under pressure in the short run.

Improved realisations coupled with a robust 13 percent YoY volume uptick led to a healthy 23 percent growth in the revenue. Reversal of provisions amounting to Rs 16 crore with respect to trade margins payable to OMCs (oil marketing companies) led to the 37 percent uptick in earnings before interest tax depreciation and amortization (EBITDA) and almost a 230 basis points EBITDA margin expansion.

Rising conversion to CNG with policy incentives in Delhi aided the volume growth for the company and bodes well for future volume growth. Given some pricing power, margins are expected to remain stable. The company is eyeing aggressive expansion across regions in India which is expected to drive volumes.

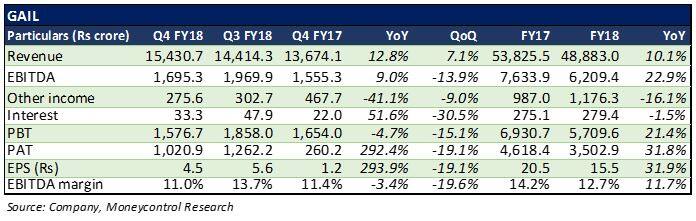

GAIL:

Performance at GAIL remained subdued largely due to a higher gas cost which led to disappointment in transmission and petrochemical businesses. Gas trading margins fell sharply as spot LNG prices went up substantially in January. LPG (liquefied petroleum gas) business had a strong quarter.

GAIL is contemplating an IPO for GAIL Gas, which could be better for overall business valuations. The rising trend in crude prices bodes well with the company’s growth story as it makes the US LNG contracts profitable. A unified tariff system could boost gas transmission realisations for the company in the coming term. CGD (city gas distribution business) is positioned for growth across regions and could drive profitability for the company.

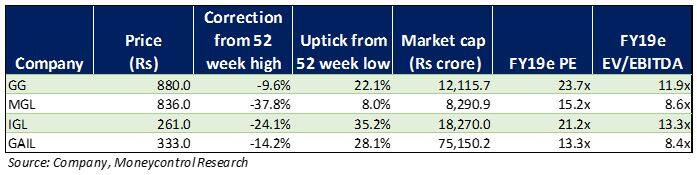

OutlookThe sector overall is currently positioned for numerous macro tailwinds which we expect would facilitate rapid growth in the future. The swift uptick in the crude prices has made gas an attractive, cheaper alternative which brings in more conversions in both commercial and domestic segments and brings in higher volumes. Increased environmental concerns and policy support around it have promoted CNG (being a cleaner fuel) and we expect this trend to continue. With more and more cities being brought under the CGD network and companies bidding aggressively to win contracts across cities, we believe the sectors growth story remains intact. Mandatory inclusion of gas pipelines in new building constructions ensures longer-term volumes in PNG segment. Compared to most major developed nations, gas still remains deeply underpenetrated in India both in the domestic as well as the commercial segments. Due to this, we see immense scope for volume growth in the long run.

The stock prices have corrected from 10 to 38 percent from their 52-week highs and are trading at multiples which ease down valuations and provide comfort. With overall growth story in place, we see current price levels as a good entry point.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!