Nitin Agrawal Moneycontrol Research

Despite facing high levels of competition, India’s aviation industry is in a sweet spot thanks to a favourable operating environment led by increase in passenger traffic, improving utilisation and government’s accommodative policy. Though rising air turbine fuel (ATF) prices are posing a lot of challenges to the airline carriers, players having an excellent geographic coverage, cost management and performance, along with sound financials health are well placed.

Recent weakness in the stock prices of Indian airlines on the back overall market volatility and rising ATF prices is providing an opportunity to board fundamentally strong business for the long term. We prefer IndiGo and SpiceJet from this space.

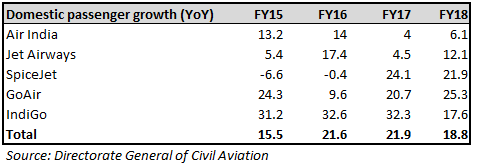

Opportunities for the industry In the last 4 years, domestic traffic registered a 20 percent compounded growth, gaining market from railways. The government’s regional air connectivity scheme – UDAN - is another avenue for airline carriers to capture growth originating from non-trunk routes. It has already cleared many routes under this scheme.

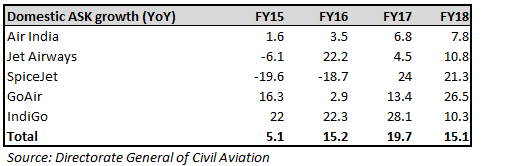

The Centre is focusing on improving required infrastructure and has earmarked Rs 25,000 crore for airport infrastructure to increase capacity with a focus towards smaller towns/cities. The industry is building additional capacity and has placed orders for close to 978 aircraft (current fleet size: 550). As per a report from Elara Capital, around 465 additional aircrafts will be added by FY22, translating in a capacity increase, as measured by available seat km (ASKM), of 21.5 percent compounded over FY18-22e. This additional capacity is expected to serve increased passenger traffic, which is projected to register a compounded growth of 22 percent over the same period.

Overall, air travel would continue to be robust on the back of rising disposable income, government’s accommodative policies and poor railway infrastructure.

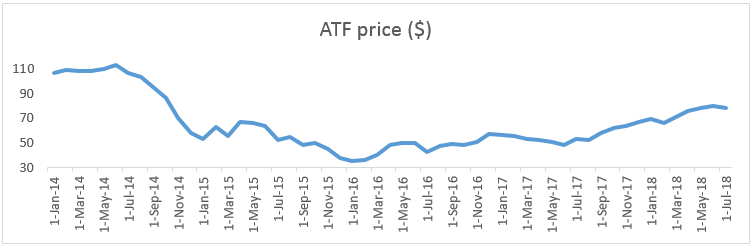

The biggest challenge The paradigm shift in the industry accrued from decline in fuel prices close to $45 per barrel from above $100 per barrel. As fuel alone contributes around 30-35 percent of total cost of airline operations, declining prices have led many airlines to turn profitable after recording losses for years.

However, ATF prices have started rising, putting profitability of Indian airlines under pressure. We believe crude oil prices will stabilise in the $70-75 per barrel range. Companies with efficient cost structure would be able to help offset the rise in ATF prices and would continue to rise higher.

Legendary investor Warren Buffett while explaining the rationale for his optimism on the industry said airlines would have some more pricing sensibility in next 10 years. He believes airlines would operate at higher capacity in future. Diversification of revenue streams beyond airline tickets is also a trend worth watching out for.

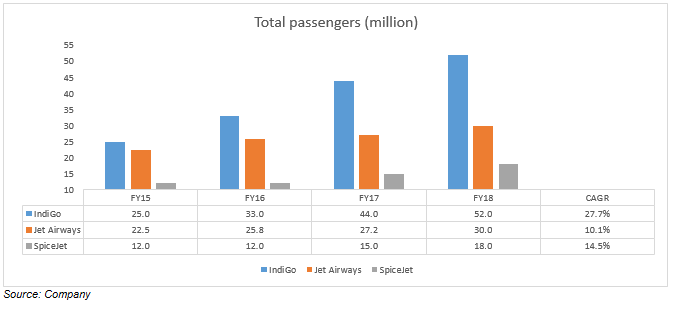

We prefer IndiGo on the back of: IndiGo dominates the Indian skies with over 40 percent domestic market share. Passenger traffic saw a compounded growth of 27.7 percent over FY15-18, as against industry growth of 20 percent, on the back of its competitive priced no-frill products, reach and on-time performance.

Cost optimisation; efficient sweating of assets The company has focused on reducing every component that appears in its cost structure. IndiGo’s per unit cost is lower compared to other players in the industry. Even when oil prices were soaring, it was consistently able to report profit.

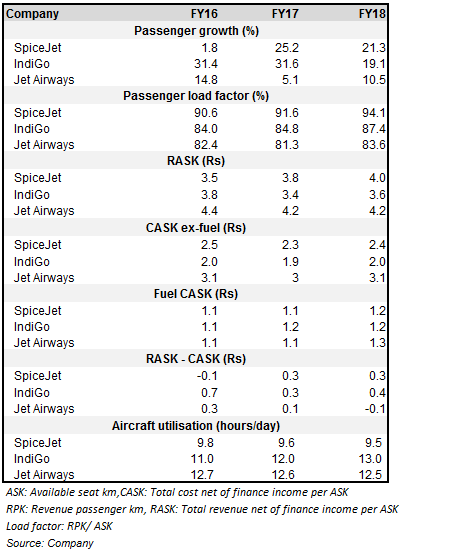

IndiGo has been able to utilise its assets much better than its peers. Its aircraft utilisation stood at 13 hours per day (SpiceJet: 9.5 hpd, Jet Airways: 12.5 hpd) in FY18. The company has started adding fuel-efficient A320neo aircraft in its fleet, which would help it reduce fuel cost by close to 15 percent.

Well-timed aircraft ownership The management plans to use its existence cash flow to finance purchase of aircrafts. It believes this strategy would usher in additional operational cost savings. The primary reason for it owning aircrafts is because new technology has just been introduced in the market and the management sees lesser chance of the technology going obsolete soon. This technology will usher in additional cost savings if the aircrafts are flown for a longer duration.

Significant capacity addition to capture rising demand The company has placed a huge order for aircrafts, the delivery of which will help IndiGo retain its leadership position in the Indian market. Most additions would be of fuel-efficient A320neo aircrafts. The management sees its capacity growing 18 percent year-on-year in the first quarter and 25 percent YoY in FY19.

The uncertainty pertaining to stake purchase in debt-laden Air India is now out of the way and the company is making concrete plans to venture aggressively into the international air space.

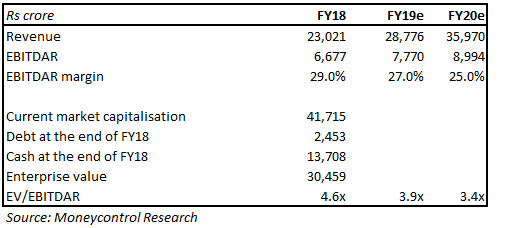

In spite of industry challenges, IndiGo has performed well in the past. Recent weakness in the stock price offers comfort on valuations. Our estimates indicate that the stock is currently trading at 3.9 times and 3.4 times projected FY19 and FY20 enterprise value to earnings before interest, tax, depreciation, amortisation and rental multiple.

We prefer SpiceJet due to:

Emerging from the brink of bankruptcy, SpiceJet has been navigating well over the last few quarters. It is the second best cost efficient player in the industry as is evident from its cost structure.

Focus on non-competitive routes As a part of its business strategy, the management continues to focus on routes that are less crowded. The company deploys around 23 percent capacity to these kinds of routes. Operating on these routes also helps it incur lower charges related to airport duty or maintenance

Low cost structure SpiceJet has been undertaking cost reduction efforts. Its cost structure now is the second best in the industry.

Focus on capacity expansion Most of the company’s flights are running at over 90 percent load factor. To continue to maintain/expand its market share it needs to expand capacity. In light of this, the management has placed orders for new aircraft and now has an order book of 243 aircraft: the second highest after IndiGo.

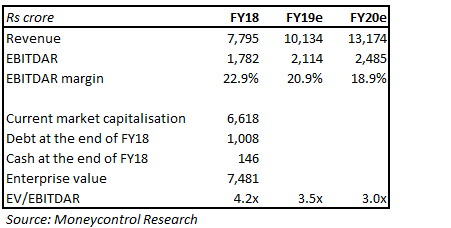

Valuations reasonable The company is currently trading at reasonable valuations. Our estimates indicate that the stock currently trades around 3.5 times and 3 times projected FY19 and FY20 EV/ EBITDAR multiple, which is reasonable.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!