Highlights:

- Strong premium growth ahead of industry growth

- Combined ratio improved, investment yields moderate

- No hike in third-party motor insurance premium by IRDAI is a key negative

- Premium valuation offers limited upside

-------------------------------------------

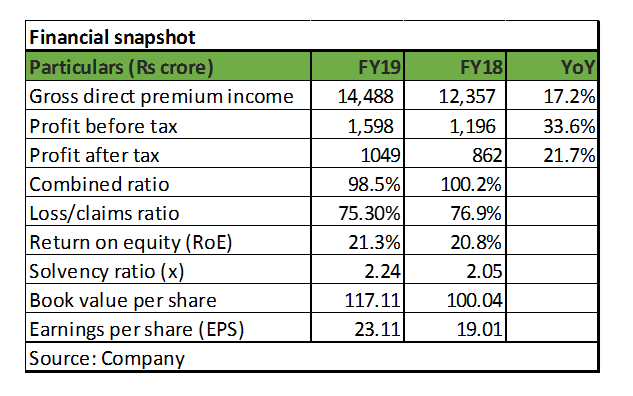

ICICI Lombard General Insurance, the largest private sector non-life insurer in India, reported a net profit of Rs 1,049 crore for FY19, up 22 percent year-on-year (YoY). The underlying performance of the insurer was much stronger than that reflected by the headline number.

Reported FY19 profits were suppressed because of two reasons. First, the change in income tax regulations resulted in higher effective tax rate as long-term gains came under the tax ambit, which adversely impacted net profit. So, if we consider pre-tax profit, the growth was much stronger at 34 percent. Second, profits were pulled down by the upfront expensing of the acquisition cost incurred to achieve higher business growth. It is worth noting that, as per accounting rules, commissions paid to agents are recognised upfront while premium income is amortised over four quarters.

While there is inherent volatility in its core risk-underwriting business, ICICI Lombard is better positioned in the sector with a market share of around eight percent among all non-life insurance companies, making it a stock worth looking at.

Strong growth in premium

The company reported healthy growth (17.2 percent) in Gross Direct Premium Income (GDPI) in FY19 as against the industry growth rate of 12.9 percent, driven by motor insurance. Consequently, it further consolidated its market share, which currently stands around 8.5 percent. GDPI growth was even better at 20.5 percent, if we exclude the crop segment, which isn’t a focus growth area for the insurer.

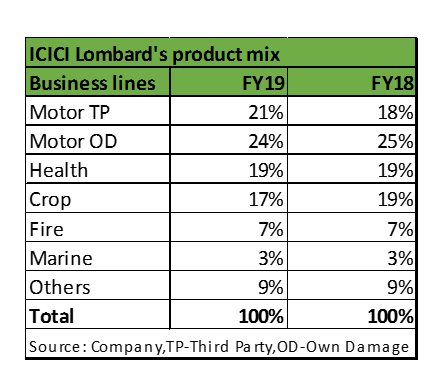

While the insurer maintains a diversified portfolio, the mandated longer-tenure third-party (TP) motor insurance by the Supreme Court benefitted ICICI Lombard disproportionately as its presence in the segment is well above the industry average. As a result, the share of TP motor insurance in product mix increased to 21 percent at the end of March as compared to 18 percent YoY.

The management is consciously pulling back growth from the crop segment after having experienced higher losses, which is reflected in reducing the share of crop insurance in the product mix.

Improvement in operating metrics

The combined ratio, the measure of an insurance company’s profitability, improved to 98.5 percent in FY19 from 100.2 percent last year, leading to underwriting profit. This implies that the business growth was not only strong but also profitable. The overall underwriting performance was dragged down by higher losses in the crop insurance, with the claims ratio at 106.5 percent for FY19. All other segments reported a claim ratio below 100 percent.

The overall underwriting performance was dragged down by higher losses in the crop insurance, with the claims ratio at 106.5 percent for FY19. All other segments reported a claim ratio below 100 percent.

Investment income supplemented underwriting profit. Despite the insurer’s yield on investment assets declining to 9.4 percent in FY19 versus 9.7 percent in FY18, investment income grew 18 percent on the back of a nine percent growth in investment assets and increase in leverage.

Capitalisation is adequate for ICICI Lombard as reflected in its solvency ratio at 224 percent, which is comfortably above the regulatory requirement of 150 percent.

No hike in TP motor insurance premium – a key negative

The Insurance Regulatory and Development Authority of India (IRDAI) has put on hold its annual premium rate increase for TP motor insurance policies for FY20 as of now. This will adversely impact the claims-loss ratio for the industry as a whole.

Unlike own- damage motor insurance, every motor vehicle owner in India is required to purchase TP insurance. At the same time, pricing of TP motor insurance is regulated. The premium rates for TP motor insurance are set by the IRDAI. It is reviewed and adjusted every year using a prescribed formula.

Hence, the profitability in the TP motor insurance segment is contingent to a large extent on the premium/tariff hike announced by IRDAI. In the past, the TP motor insurance segment had a combined ratio higher than 100 percent, indicating that they were paying more in claims and operating expenses than what it was earning from premiums.

Since there is no premium hike this fiscal, insurance companies may suffer losses in the TP motor segment if the price at which the business is written falls short of claim inflation.

Competitive advantage aids premium valuationsICICI Lombard is well-poised for earnings growth with an increase in insurance penetration, focus on profitable segments and improvement in operating efficiency.

The stock is up 42 percent in the last one year and has significantly outperformed the Nifty. At the current market price of Rs 1,080, it is trading at a premium valuation of nine times its trailing price-to-book. The current valuation is rich even after considering a high RoE (return on equity) of around 21 percent.

We have seen that leading companies in the secular growth sector tend to trade at higher multiples for a long period in time. In the absence of suitable and comparable listed peer, ICICI Lombard trades as a proxy for the sector, commanding a higher valuation. While the premium valuation will sustain, near-term upside in the stock is limited. Nevertheless, investors who have a long-term horizon and want to participate in the growth in non-life insurance sector can consider buying the stock on dips.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!