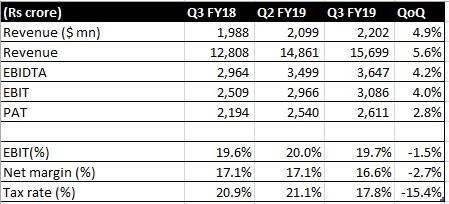

HCL Technologies reported robust execution in Q3 FY19. With a strong business outlook, the company has set the stage for a strong FY20.

Key positives- The company reported healthy revenue growth – quarter-on-quarter (QoQ) constant currency revenue growth of 5.6 percent and 13 percent year-on-year (YoY)

Source: Company

- The management’s key focus areas namely Mode 2 (largely digital) has performed well, with sequential growth of 13 percent

- The combined share of Mode 2 and Mode 3 (largely products) services is now 29.1 percent and has grown 9 percent sequentially

- In terms of geographies, growth was stellar in Europe, followed by the Rest of the World and Americas

- From industry verticals, retail consumer packaged goods (CPG), telecom, technology and life sciences performed well

- The company called out record deal wins in Q3. This is for the third time in the last five quarters that the company has reported record wins. The total deal wins in 9M FY19 is 40 percent higher than the year-ago period. This provides strong revenue visibility in the coming fiscal

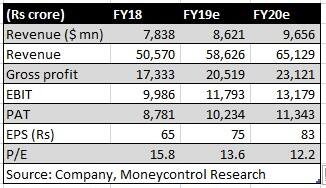

- While the management has maintained its FY19 constant currency revenue growth guidance in the 9.5-11.5 percent range, it expects to end the fiscal at the upper end of this range. Close to 5 percent of this growth will accrue from inorganic action and the rest would be from organic growth

- The company has seen strong net employee additions in the first three quarters of the current fiscal, which also shows the management's confidence in achieving accelerated growth going forward

Source: Company

Key negatives- Operating margin, although remaining within the guided band, experienced a sequential decline to 19.7 percent. While currency and productivity improvement impacted margin positively, a scheduled and planned wage hike eroded margin

- Financial services vertical, impacted by issues with two large clients, remained weak and the company expects it to recover in FY20

- Manufacturing too was largely weak, except showing some nascent signs of a revival in Q3 and is expected to do well in the coming fiscal

- Attrition remains high at 17.8 percent

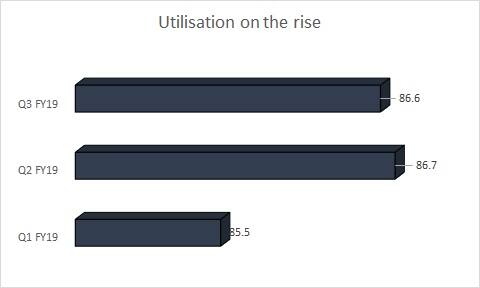

- Utilisation too remained high at 86.6 percent and could limit margin upside on this count

Source: Company

Other observations- The company is not worried much about macro weakness-related concerns and feel that companies are unlikely to cut down on their digital transformation spend

- Outsourcing penetration is still less than 50 percent. If economic conditions turn challenging, companies might resort to a more cost effective method like outsourcing

- HCL Tech had acquired select software products of IBM for $1.8 billion and the deal is expected to conclude by mid- 2019

OutlookThe improved order inflow and pipeline sets the stage for a strong FY20. While we are not excited with every inorganic move of the company, the strategic intent, earning visibility and undemanding valuation makes it a worthy buy in volatile markets.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.