Fiberweb (India) (market cap: Rs 508.75 crore) is a technical textile manufacturer (100 percent export oriented unit) with distinctive product offerings. The company’s products are used by businesses across sectors such as personal hygiene, industrial filteration, agriculture (including crop protection), and textile.

In the quarter gone by, execution of new orders led to a good top-line performance. However, rising crude prices caused the raw material (polypropylene) prices to go up too, thus impacting the operating and bottom-line margins.

Fiberweb’s melt blown nonwoven fabric (MBNF) manufacturing facility became operational in Q3FY18, whereas the polypropylene flatbound nonwoven fabric (PFNF) unit is likely to be commissioned by March 2019. Both these products command high realisations, which, in turn, should aid sales growth.

CapexStarting FY19, Fiberweb’s MBNF projects can add nearly Rs 60 crore annually to the company’s turnover (at full utilisation rate of 90 percent). Furthermore, Rs 125 crore will be expended on setting up a PFNF factory in FY19, the funding for which will be as follows:-

At peak utilisation level (85-90 percent), the PFNF facility will be capable of contributing approximately Rs 200 crore to the company’s revenues from Q1FY20.

MBNF and PFNF command high margins compared to PSNF owing to high demand and limited supply, as seen below:-

Being highly technical products in nature, Fiberweb can pass on crude price variations to its customers without denting margins.

Value-added products (VAPs)Non-VAPs represent synthetic fabric sheets sold to clients as it is, whereas VAPs involve conversion to the finished product. Going forward, Fiberweb expects the share of VAPs to the company’s annual revenue to increase in the coming two years, which will improve the overall margin profile.

Currency/crude volatility (especially to the extent of the non-VAPs/commoditised products) and a high exposure to the US market (80 percent of total operating income) continue to remain the major investment risks.

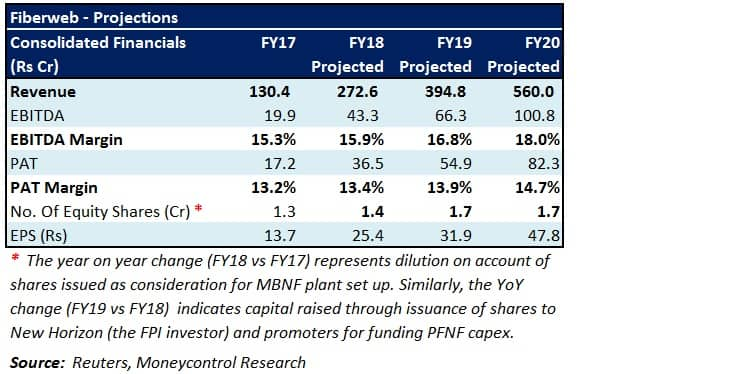

Nevertheless, in our view, Fiberweb is well-poised to witness earnings traction on the back of capacity expansion and a change in the product mix. The valuation, at 5x FY20 projected earnings, remains undemanding and merits attention.

For more research articles, visit our Moneycontrol Research Page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.